EGLD price bullish breakout in danger as Elrond announces new NFT and P2E platform

- EGLD price faces increasing resistance at $60.00 amid the formation of a rising wedge pattern.

- Elron has released Cantina Royale, an NFTs and P2E platform, on its mainnet.

- A daily close above $60.00 will ensure that the bullish outlook on Elrond price extends the leg to $68.00.

EGLD price is at a crucial juncture that could decide the direction it will take in coming sessions or a few days. A sharp bullish move from support at $45.50 paved the way for an extended leg to $60.00. However, a daily close above this level is essential for its next recovery phase eyeing $68.00.

Introducing Cantina Royale – an NFTs and P2E platform on Elrond

Elrond announced the release of its new gaming and NFTs (non-fungible tokens) platform referred to as Cantina Royale on Monday. According to a post published on Twitter, Cantina Royale promises an “incredible blockchain-based gaming experience for all.”

Although Cantina Royale is in its beta stage of development, Elrond is already conducting an invite-only program to allow early access to the game. NFT holders and Open Beta players are automatically invited to participate.

Elrond will follow this development by releasing game versions for PC, Android and iOS users. Traders will have an opportunity to earn rewards in addition to accessing an NFT lending pool. Features such as an in-game trading system and character progression are already in place.

The release of the Cantina Royale gaming and NFTs platform could positively impact the Elrond price, especially as players take up EGLD tokens to make in-game purchases. The protocol’s use cases are also getting a boost, opening Elrond to a larger audience. EGLD has much to gain with this entrance into the NFTs and P2E (play-to-earn) arenas.

What’s next for EGLD price?

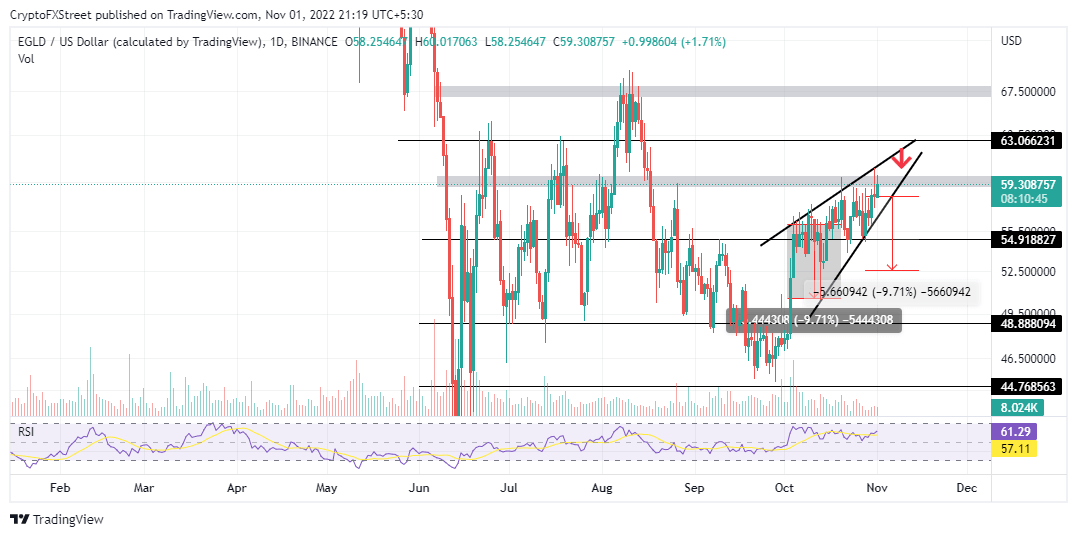

EGLD price faces acute seller congestion at $60.00 and a potentially bearish outlook presented after forming a short-term rising wedge pattern. The RSI (Relative Strength Index) reveals that buyers firmly hold the fort while seeking a reprieve above $60.00.

A rising wedge is a highly bearish pattern that indicates that a prevailing uptrend may soon flip bearish. In the case of Elrond price, selling pressure at $60.00 could exacerbate the risk of a retracement in price.

EGLD/USD daily chart

Short-term sell opportunities could emerge as EGLD breaks below the lower trend line of the wedge. A 9.71% profit target extrapolated from the breakout point could see Elrond price retest support at $52.00 before regaining ground to $60.00.

For traders who remain stubbornly bullish, short-term long positions are recommended above $60.00, with the first take-profit at $63.00. If the trend proves to be extremely bullish, the second take-profit target is the massive seller congestion at $68.00.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren