DYDX slashes trading rewards in half, triggers massive rally ahead of token unlock

- DYDX, native token of the DEX, climbed 12.5% on Monday, in response to a governance vote to slash trading rewards by 45%.

- The proposal received over 25 million votes in favor, as voters aimed to increase the amount of tokens in the protocol’s rewards treasury.

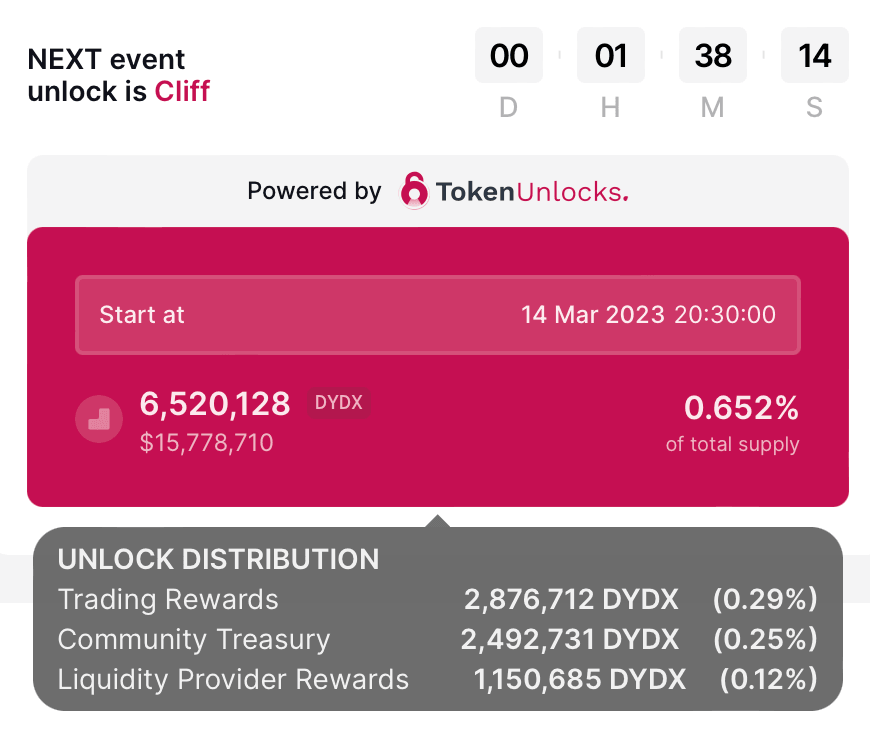

- DYDX is changing hands at $2.42, less than two hours away from a massive token unlock event of $15.7 million worth of tokens.

DYDX, the native token of the decentralized exchange of the same name, witnessed a massive recovery in its price on Monday. A governance proposal slashing trading rewards by 45% was passed by a majority of voters, fueling a bullish sentiment among holders.

The token is set to witness a mass unlock of 6,520,128 DYDX tokens on March 14.

Also read: Big whales movements in altcoins Loopring, AAVE, DYDX, CRV alarm crypto investors

DYDX cuts trading rewards by 45%, fuels rally in token price

DYDX voters passed a governance proposal slashing trading rewards by 45%. This fueled a recovery in the token’s price. The native token of the decentralized exchange of the same name, has surged by 12.5% since Monday.

The proposal to cut trading rewards in half won massive support from the voter community, it received over 25 million votes in favor compared to five million votes against. The move is aimed at increasing the amount of tokens in the protocol's rewards treasury. The decision was made by the community’s support, in favor of long-term growth of the treasury and DYDX.

The DEX token is currently trading at $2.44 after surging from a 24-hour low of $1.87. While the crypto market witnesses a massive boost following bank liquidations and crises, the token has outperformed most DeFi assets.

DYDX token unlock on March 14

According to data from crypto intelligence tracker Token Unlocks, $15.7 million worth of DYDX will be unlocked on March 14. The event is less than two hours away and the token distribution is as seen in the image below.

DYDX token unlock

It remains to be seen whether the unlock of tokens negatively influences DYDX prices and wipes out the DeFi tokens recent gains.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.