DYDX price takes the lead in Crypto market recovery

- DYDX price, trading at $2.15, is riding on the broader market's bullish cues, approaching a key resistance level.

- The derivatives platform recently launched its second public testnet for the dYdX Chain, which could be a factor in recvoery.

- DYDX Whales have been holding back from conducting transactions on the network, and their involvement could further the altcoin’s value.

DYDX price is up, joining the league of the highest gainers of the day as the rest of the market bounces back after the recent crash. Motivated by Bitcoin price rising to $26,500, the altcoin shot up to test a critical resistance level, flipping which could initiate a rally for the DeFi token.

DYDX price makes a quick recovery

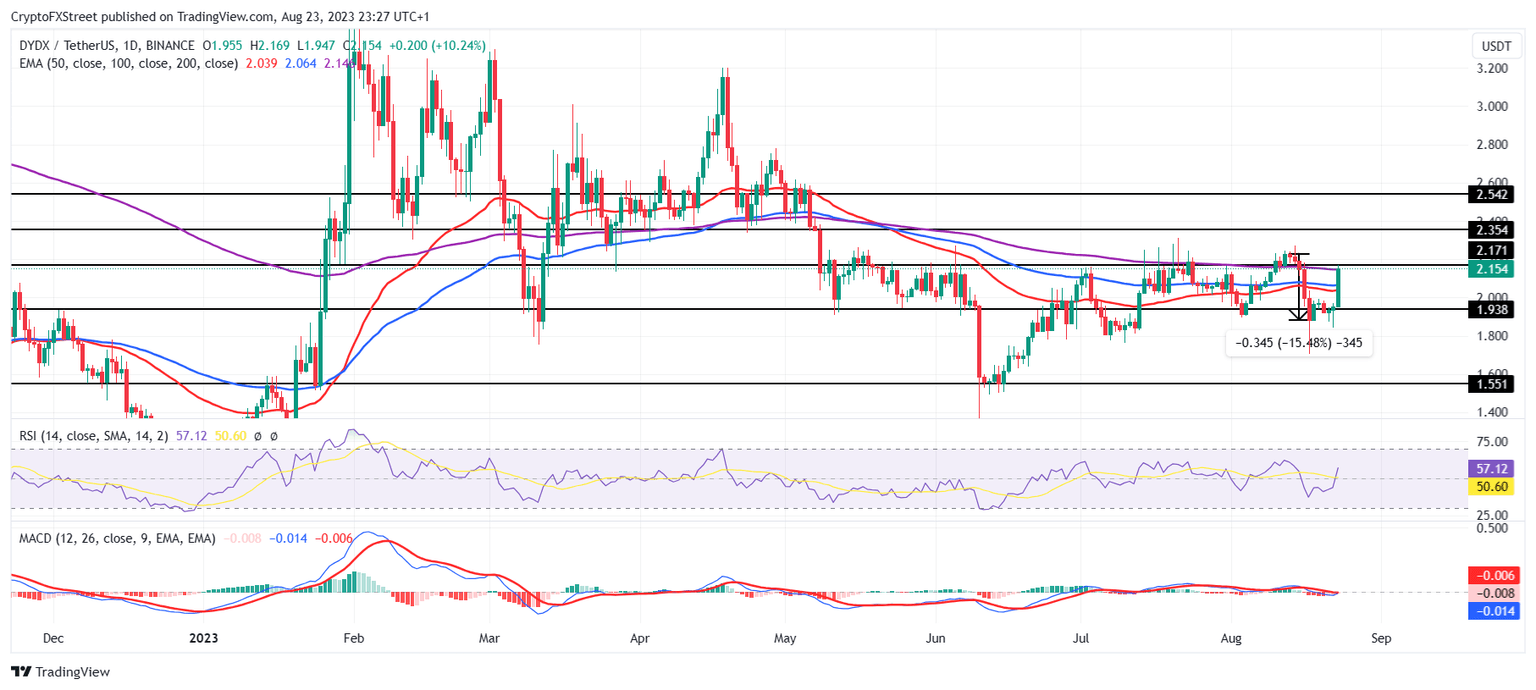

DYDX price was down by more than 15% over the last week as the crypto market crashed. While other altcoins are taking it slow in making back their losses, the DeFi token seems to be in a hurry. Already up by a little over 10% in the past 24 hours, DYDX is set to breach the 200-day Exponential Moving Average (EMA) as it sets eyes at $2.35.

For now, the cryptocurrency would need to breach and flip the resistance level at $2.17 into a support floor. Trading at $2.15, DYDX price would be able to create a bullish momentum if it manages to do so to rally towards $2.35.

DYDX 1-day chart

The altcoin is certainly absorbing the bullishness from its investors emerging from the launch of its second public testnet for the dYdX Chain, which was drowned out by the broader market crash initially.

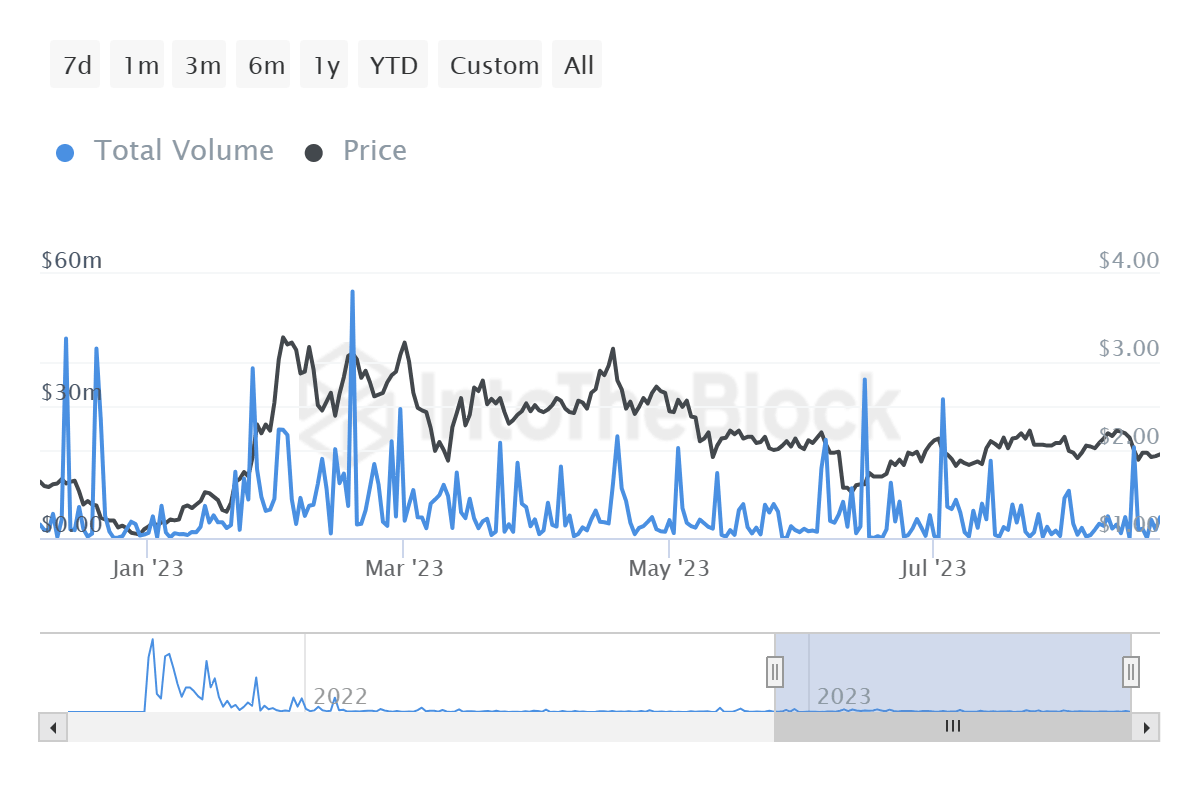

Whales need to make a move

However, in order to sustain this rise, DYDX would need the support of a key cohort - its Whales. These large wallet holders currently control about 68% of the entire circulating supply, making their activity crucial to a successful rally. Not so surprisingly, these whales have been holding back, registering volume averaging under $5 million, with the exception of a spike on August 18, when the price declined.

DYDX whale transactions

The derivatives platform token has been struggling to make it back to $2.35 for nearly three months now. One of the biggest contributing factors to this difficulty has been the declining interest in the Decentralized Finance (DeFi) market and protocols. The total value locked (TVL) in the market has been falling since mid-April, currently holding just under $63 billion.

DeFi market TVL

The rocky market conditions are adding to this skepticism, and if this sentiment does not change, coins like DYDX, along with other DeFi tokens, could note significant drawdowns in the long run.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.