DYDX price rallies 10% ahead of 13.95M token unlocks; Community urges 25% emission cut

- dYdX token rises 10% in the last 24 hours; trading volume up almost 110% in the same timeframe.

- The rally came hours before the next token unlocks schedule, where 13.95 million tokens will be unleash to its circulating supply.

- Meanwhile, community members deliberate whether to slash rewards to liquidity providers, a move that could pump DYDX price.

DYDX, the ticker for perpetual contracts decentralized exchange dYdX, remains bullish for almost two straight months despite the overall dormancy in the market and the lack of directional bias from Bitcoin (BTC).

Also Read: Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Soggy BTC to move soon

DYDX bullish fundamentals could fuel 10% gains

DYDX price has been on an uptrend since June 10, consolidating upwards along an ascending trendline. On July 31, the token surged by close to 10% within a 24-hour timeframe, bolstered by a 110% increase in trading volume.

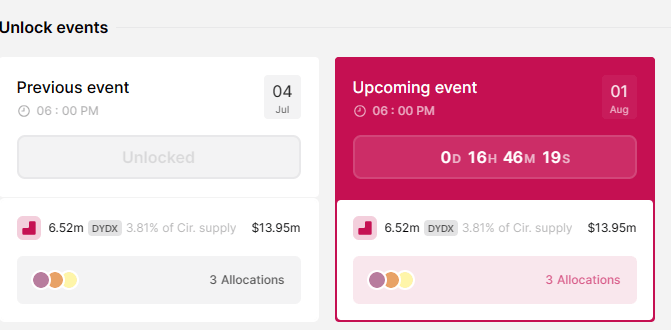

The bullishness comes ahead of the network’s token unlocks program, scheduled for August 1 at around 6:00 PM GMT.

As indicated, the event will see 13.95 million DYDX tokens added to the network’s circulating supply and will make up for 3.81% of its total supply. As the countdown continues, the perpetual contracts DEX token could elevate further.

Asset prices tend to rally ahead of such events, with investors looking to capitalize on the “buy the rumor, sell the news” narrative. Also, as the event increases supply, economic dynamics forecast a drop in value, which long-term investors capitalize on to grow their portfolios. The ensuing demand pressure could catalyze an uptrend.

dYdX community members want token emissions slashed by 50%

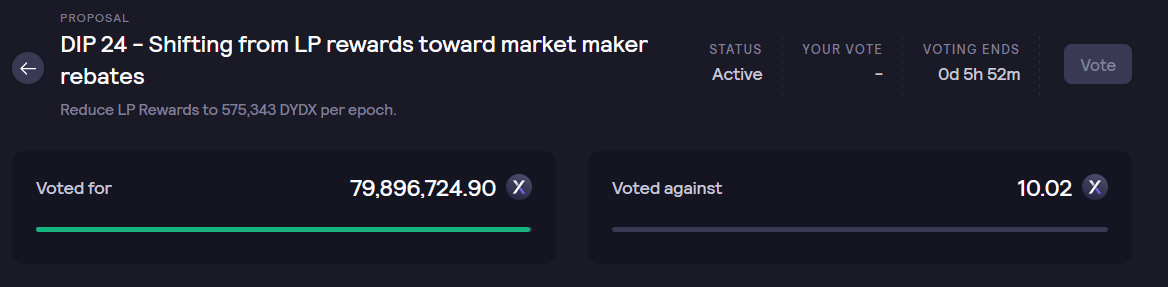

Meanwhile, the dYdX community is in the middle of a voting process, expected to end on August 1. It follows an earlier proposal to reduce the amount of rewards offered to liquidity providers (LP) by half. Such a move would be bullish for DYDX, if passed, as it cut down on token issuance, hence reducing supply against a constant or growing demand. Further, the change would also see the ecosystem save monthly spending of $1 million.

With less than six hours before the voting window closes, the odds are clearly in favor of the proposal, with only 10.02 negatives against almost 8 million supporters.

As the yeses have their way, DYDX token holders could see more gains in the coming days as approval would see the amount of tokens offered to LPs reduce from 1,150,684 to 575,342, a 50% cut. Based on current rates ($2.146), this represents approximately $1.235 million. It is also worth mentioning that the move would represent a 25% reduction of token emissions, according to network founder, Antonio Juliano.

This would further reduce overall $DYDX token emissions by ~25% https://t.co/R7vySaVjWb

— Antonio | dYdX (@AntonioMJuliano) July 22, 2023

DYDX price forecast as bullish fundamentals play on

As the bullish fundamentals play on, DYDX price could continue along the uptrend, breaching the immediate hurdle presented by the 200-day Exponential Moving Average (EMA) at $2.171. A breach of this barrier would clear the path to the $2.347 resistance level. In a highly bullish case, the token could break above to pursue the April highs of around $2.731. Such a move would denote a 25% climb.

The Relative Strength Index (RSI) has tipped north while the histograms of the Awesome Oscillators are turning green within the positive territory. This points to rising momentum, which is bullish for DYDX.

DYDX/USDT 1-Day Chart

On the other hand, there is a chance traders could give in to their profit appetite, cashing in on July 31 gains or sell the news after the unlocks and voting processes. The ensuing selling pressure could see DYDX price slide below the confluence support offered by the uptrend line and the 50-day EMA at $2.025.

Such a move would threaten the uptrend, but invalidation would occur upon a decisive daily candlestick close below the $1.795 support level.

Like this article? Help us with some feedback by answering this survey:

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.