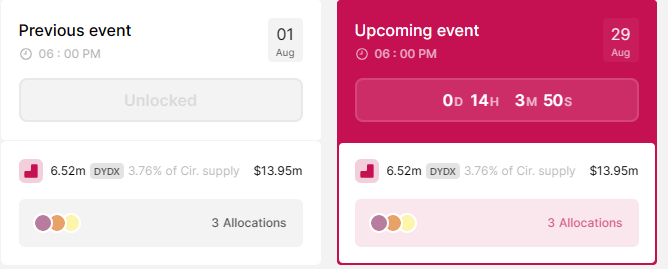

- dYdX ecosystem will add 6.52 million tokens worth $13.95 million to its circulating supply in under 24 hours from now.

- Like the previous cliff unlocks event, DYDX could fall 10% to $1.882 as traders avoid being caught in exit liquidity.

- Invalidation of the bearish outlook will occur if the altcoin records a decisive daily candlestick close above $2.347.

dYdX price shows signs of an impending downtrend, and for good reason, considering the network will unleash millions of DYDX tokens to the markets in cliff unlocks. While part of the tokens will go to the community treasury, a huge chunk will go toward liquidity provider and trading rewards.

The possibility of investors offloading the reward allocations for immediate selling sets dYdX price up for imminent selling pressure.

Also Read: Optimism, Sui, Hedera prices brace for over $138 million worth in token unlocks

dYdX price readies for a 10% downswing

dYdX price could fall 10% after the network pours an additional 6.52 million DYDX tokens worth approximately $13.95 million into its circulating supply. In the previous unlocks on August 1, the network unlocked the same amount of tokens, which sent the price down the same gap to find support at $1.882.

DYDX token unlocks

With history repeating, bolstered by bearish fundamentals, dYdX price eyes the same fate that could trap traders among exit liquidity.

Increased seller momentum could send dYdX price below the immediate support level at $2.005 to potentially dip into the demand zone (blue) around the psychological $2.000. Strong buyer momentum often defines demand zones, meaning DYDX could bounce from this zone.

However, if selling momentum from bears outweighs aggressive buying from bulls in the blue order block, dYdX price could slip through to tag the August 1 lows at around $1.882. Such a move would constitute a 10% downswing.

In the dire case, dYdX price could extend a leg south to find support at around $1.779, levels last seen around July 10.

Already, momentum indicators suggest an impending slump, with the Relative Strength Index (RSI) headed south and the Awesome Oscillator showing histogram bars turning red, indicative of falling momentum.

DYDX/USDT 1/day chart

On the opposite side, invalidation of the bearish outlook would occur if dYdX price extends north, breaking past the supply zone (red order block) and making it a bullish breaker by decisively closing above it. A daily candlestick close above $2.347 would be ideal, constituting a 10% ascent from current levels.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP gains as traders gear up for futures ETFs debut this week

XRP climbs over 3% on Monday, hovering around $2.33 at the time of writing. The rally is likely catalyzed by key market movers like XRP futures Exchange Traded Funds (ETFs) approval by the US financial regulator, the Securities and Exchange Commission (SEC), and a bullish outlook.

Bitcoin Price Forecast: BTC eyes $97,000 as institutional inflow surges $3.06 billion in a week

Bitcoin (BTC) price is stabilizing above $94,000 at the time of writing on Monday, following a 10% rally the previous week. The institutional demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.