DOT price resumes its uptrend as Polkadot native staking participation skyrockets

- Polkadot native staking skyrockets in response to the launch of the new dashboard, increasing accessibility for users who start with as little as 1 DOT.

- The improved user experience expands the user’s control and ownership over their assets without relying on third-party centralized staking services.

- DOT price is in an uptrend and yielded 8% gains for holders since February 10.

Polkadot, an Ethereum competitor, introduced on-chain pooling of staked DOT, promoting native staking over centralized third-party platforms. This method increases the user’s control and accessibility allowing for as little as 1 DOT to be staked.

Also read: MATIC price gears up for rally despite concerns around Ethereum Virtual Machine scalability

Polkadot improves native staking for DOT holders

Polkadot, an Ethereum competitor, recently upgraded its native staking experience for users. The platform highlights caters to users looking for decentralized native staking, allowing for as little as 1 DOT token to be staked for earning rewards.

The latest update allows users to maintain control and ownership over their assets. The improvements include a real countdown timer showing the time remaining in the current era, indicating when rewards will be paid out.

The staking process has been simplified and it now accommodates global users with app-wide localization and translation into English and Chinese, and more languages on the way.

Other updates include services like finding the most trustworthy validators, that verify transactions in the Polkadot network. Stakers can make informed decisions in their selection process and take main actions.

Updated experience for Polkadot native staking

The team has planned future improvements including support for fast unstaking, waiting for 28 days. This is already available on Kusama and projected for Polkadot. Users now have an option for pool-switching and changing nomination pools without a wait.

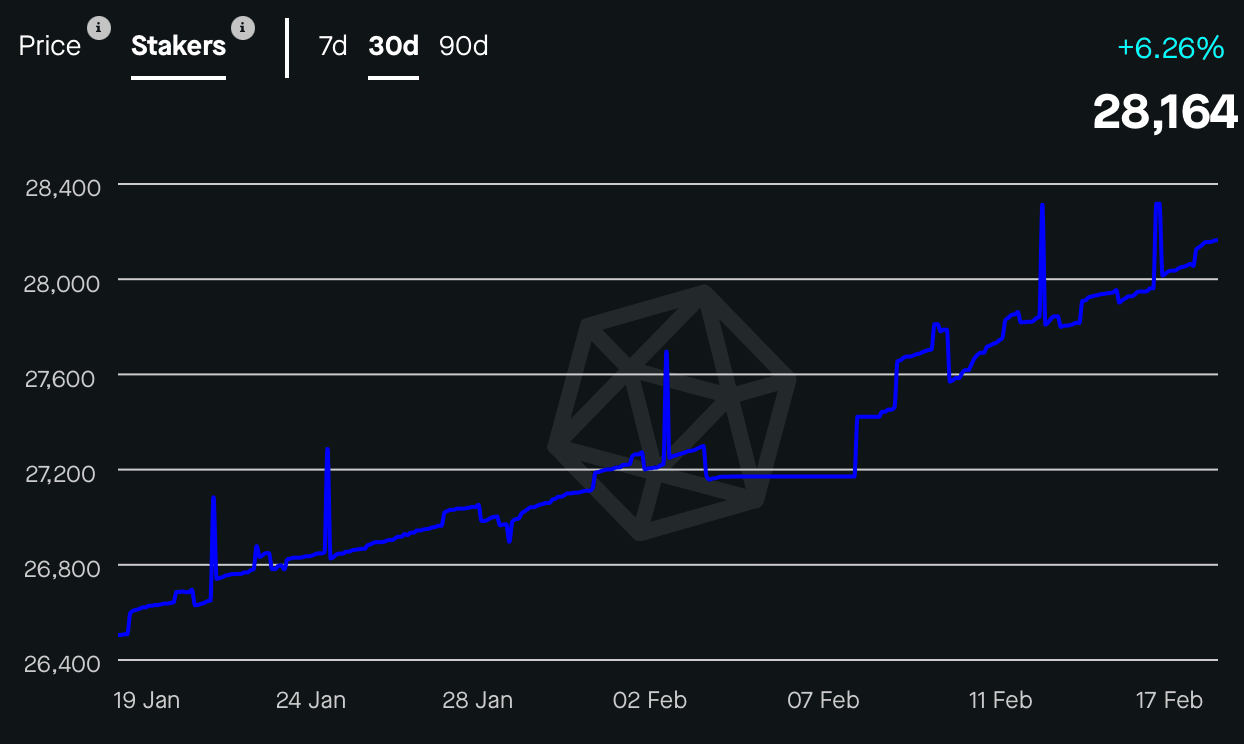

Polkadot Staking Metrics

As seen in the chart above, there is a consistent spike in the number of stakers on Polkadot, fueling a bullish narrative for DOT. The asset has yielded nearly 8% gains over the past week and continued its uptrend, hitting a weekly high of $6.79 on February 17.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.