Don’t stake Dogecoin on Binance: Developers warn DOGE holders

- Dogecoin developers took to Twitter to express this disapproval of Binance’s DOGE staking program.

- Binance recently announced a new program for Litecoin and Dogecoin “Locked Staking” without detailed risk exposure.

- Analysts predicted a quick run up to $0.082 as Dogecoin breaks out of its downtrend.

Developers on the Dogecoin network criticized Binance’s new staking program. Binance added DOGE and Litecoin to its “Locked Staking” program, offering investors 3.1% APR for a 120 day period.

Also read: No more Dogecoin, Shiba Inu and Tezos rewards says Crypto.com

Three reasons why Binance’s staking program is a risky venture

In a series of tweets, Dogecoin developers and the DogeArmy slammed the world's largest exchange, Binance. Mishaboar, a crypto analyst voiced his dissent on Binance’s new locked staking program and recommended that Dogecoin holders stay away from the crypto exchange.

Oh boy. @Binance announced another "holding" program. This one is referred to as "Locked Staking", and it allows you to "stake" LTC and Dogecoin.

— Mishaboar (@mishaboar) July 19, 2022

How is that even possible, when #LTC and #Dogecoin are PoW cryptos? Are you "staking" Binance-pegged tokens?

Stay away! pic.twitter.com/SnAT7KSJoa

Mishaboar argued that “locked staking” of DOGE and LTC is not possible as these are Proof-of-Work cryptocurrencies. The analyst asked Binance whether the exchange powers staking of Binance-pegged tokens. It is difficult to ascertain how the program works and the description is not clear.

The website describes “Locked Staking” as,

the process of holding funds in a cryptocurrency wallet to support the operations of a blockchain network.

It remains unclear which network Binance is referring to and risk disclosure remains equally unclear. Dogecoin network’s developers argue that there are several disasters plaguing the cryptocurrency ecosystem and murky terms are the root of the same. Therefore the launch of a “locked staking” program by Binance is not the right way forward. It holds the potential of exposing investors and their Dogecoin holdings to risks without the necessary disclosures.

Mishaboar therefore warned investors and asked them to steer clear of the exchange’s new program.

Binance Staking pledges to increase user income, but for real?

The exchange’s website reads: “Binance Staking, dedicated to increasing user staking income.”

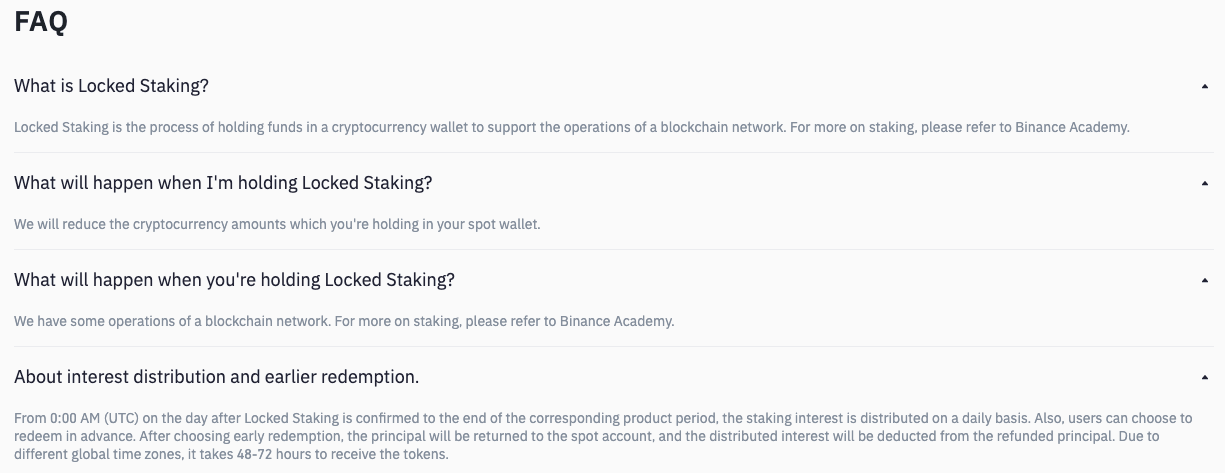

However, the lack of clarity and details has garnered criticism from the Dogecoin community. The website’s FAQ section offers incomplete information. Binance’s exchange platform strives for transparency and safety of user funds, a message reiterated by CEO Changpeng Zhao in his tweets and his consistent efforts to keep the crypto community safe. There is a disparity when it comes to the staking platform and the “locked staking” program.

FAQ section of Binance’s locked staking program

Dogecoin price prepares for a bull run

Analysts at FXStreet evaluated the Dogecoin price trend and predicted a rally to $0.082. The meme coin recently recouped its losses and started a new leg up. For more information and key price levels, check this video:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.