Bitcoin (BTC $22,379) investors reeling from the shock of recent cryptocurrency company failures and banking issues may face another potential problem: a recovering United States dollar.

US Dollar strength reemerges

Notably, the U.S. Dollar Index (DXY), which tracks the greenback’s performance against a basket of top foreign currencies, has risen 4% from its Feb. 3 low of 100.82, amid anticipations that the U.S. Federal Reserve will continue raising benchmark rates to cool inflation.

Inflation persists

An air of caution remains as fresh U.S. data shows a recession is not yet imminent.

That includes the latest jobless claims, which fell 2,000 to a seasonally adjusted 190,000 in the week ending Feb. 25, and stronger consumer spending in January.

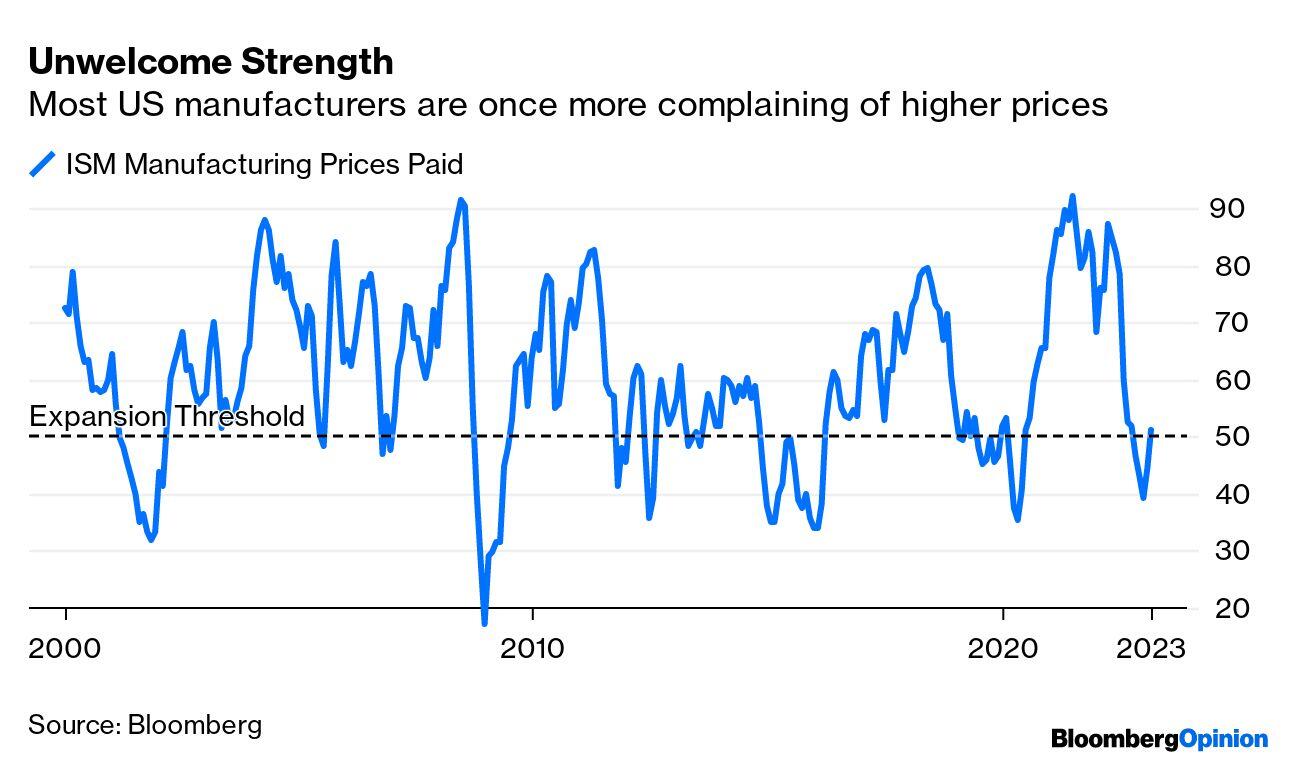

Meanwhile, 90% of the U.S. manufacturers surveyed by Bloomberg complained about rising input prices despite the easing supply-chain problems.

ISM manufacturing prices paid. Source: Bloomberg

While the problem is not as severe as during the pandemic, the survey shows inflationary pressure has not gone away despite the Fed’s aggressive rate hikes.

“Recent data suggest that consumer spending isn’t slowing that much, that the labor market continues to run unsustainably hot, and that inflation is not coming down as fast as I thought,” noted Fed Governor Christopher Waller, adding:

If those data reports continue to come in too hot, the policy target range will have to be raised this year even more.

Bank of America Global Research anticipates the Fed to raise the interest rate to almost 6% from the current 4.5–4.75% range. Theoretically, it should renew investors’ demand for the dollar by putting downside pressure on “riskier” assets like Bitcoin.

DXY chart paints inverse head-and-shoulders

From a technical perspective, the U.S. Dollar Index looks poised to rise by more than 4.5% in the coming months due to the formation of a classic bullish reversal pattern.

Dubbed inverse-head-and-shoulders, the pattern develops when the price forms three troughs below a common resistance line (neckline), with the middle trough (head) deeper than the other two (left and right shoulders).

DXY daily price chart. Source: TradingView

An inverse-head-and-shoulders pattern resolves after the price breaks above the neckline and rises by as much as the maximum height between the pattern’s lowest level and the neckline.

If the DXY successfully breaks above its neckline of 105.25, the likelihood of an extended recovery toward 109.75 in 2023 will be higher.

Bitcoin price to retest $20K?

The stronger dollar prospects come as Bitcoin bulls fail to sustain the price rally in breaking the $25,000 technical resistance level. BTC’s price has tumbled by around 13% since, with macro headwinds being one of the primary reasons.

What’s more, concerns over Silvergate and potential ramifications for the industry have also kept the price in check in the past few days.

“Any liquidity concerns will have a direct impact on market conditions and may affect the access and availability of some client funds,” warned John Toro, head of trading at digital-asset exchange Independent Reserve.

Technically, Bitcoin has maintained its short-term bullish bias by holding strongly above its two key exponential moving averages (EMA): the 50-day EMA (red) near $22,500, and the 200-day EMA (blue) near $21,770.

However, traders should watch for a potential break below the EMAs, which, coupled with rising rates and additional negative news, could see the BTC price retesting the key $20,000 support level in the coming weeks.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

EOS 22% pump steals the show unveiling Vaulta’s web3 banking ecosystem

EOS, the token behind the recently rebranded Vaulta network, has increased by a staggering 22% in the last 24 hours.

Curve DAO Price Forecast: CRV bulls could aim for double-digit gains above key resistance

Curve DAO (CRV) price is in the green, up 8%, trading above $0.53 on Thursday after rallying nearly 15% so far this week.

Bitcoin price reacts as Gold sets fresh record highs after Trump’s reciprocal tariffs announcement

Bitcoin price plunges towards $82,000 as Gold soars past $3,150 after US President Donald Trump imposed new tariffs on Israel and UK, triggering global markets turbulence.

Bitcoin and top altcoins slide as Trump kicks off reciprocal tariffs

Bitcoin (BTC) and the entire crypto market saw a quick correction on Wednesday following President Donald Trump's reciprocal tariff announcements based on half of each country's respective rates.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.