Dogecoin’s on-chain data foreshadows 155% rally for DOGE holders

- Dogecoin holders have changed fundamentally since mid-June, showcasing massive accumulation.

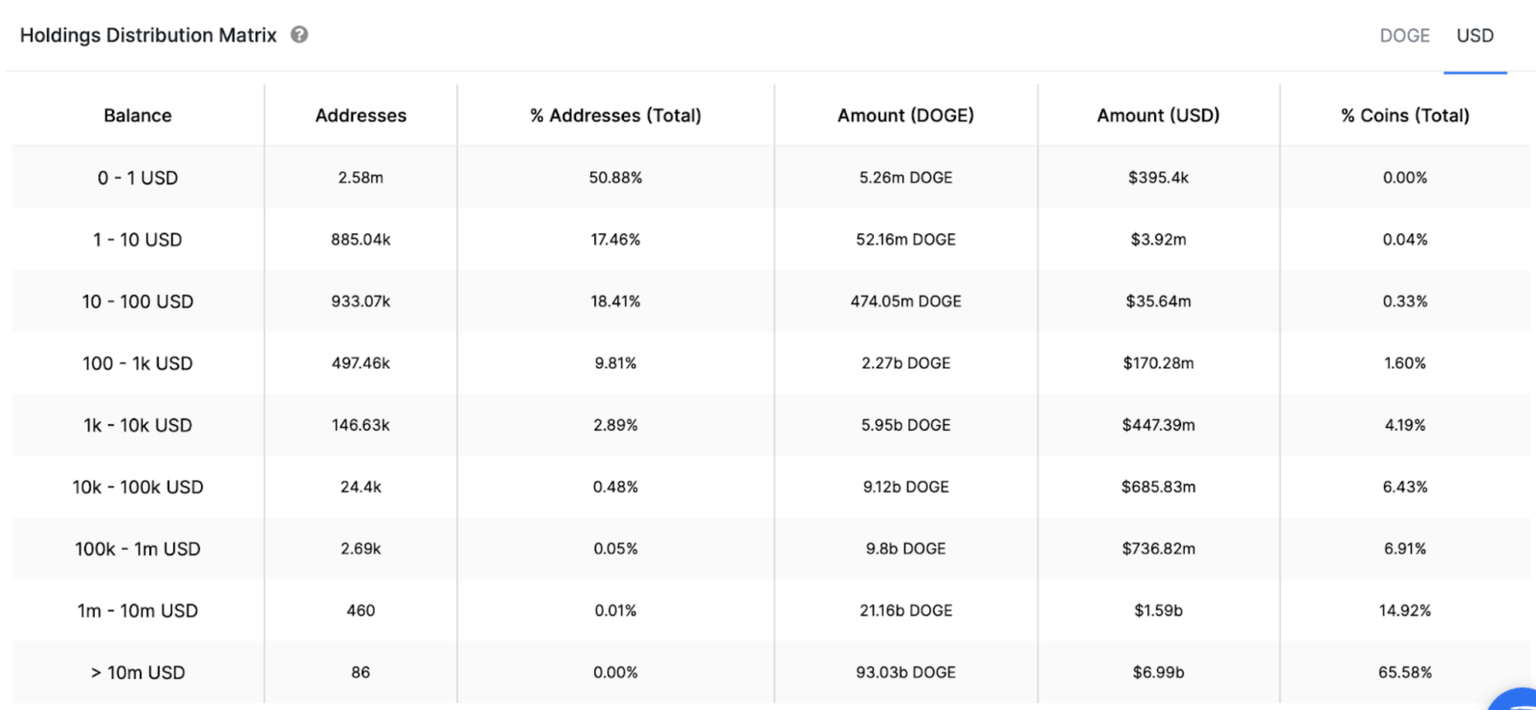

- The meme coin’s distribution matrix shows that nearly 80% of DOGE is controlled by wallets with balances ranging from $1 million to greater than $10 million.

- Short-term holders have given up, while mid-term holders have renewed enthusiasm, suggesting a shift in investor sentiment.

- Technicals suggest that DOGE could appreciate anywhere from a mere 50% to a whopping 155%.

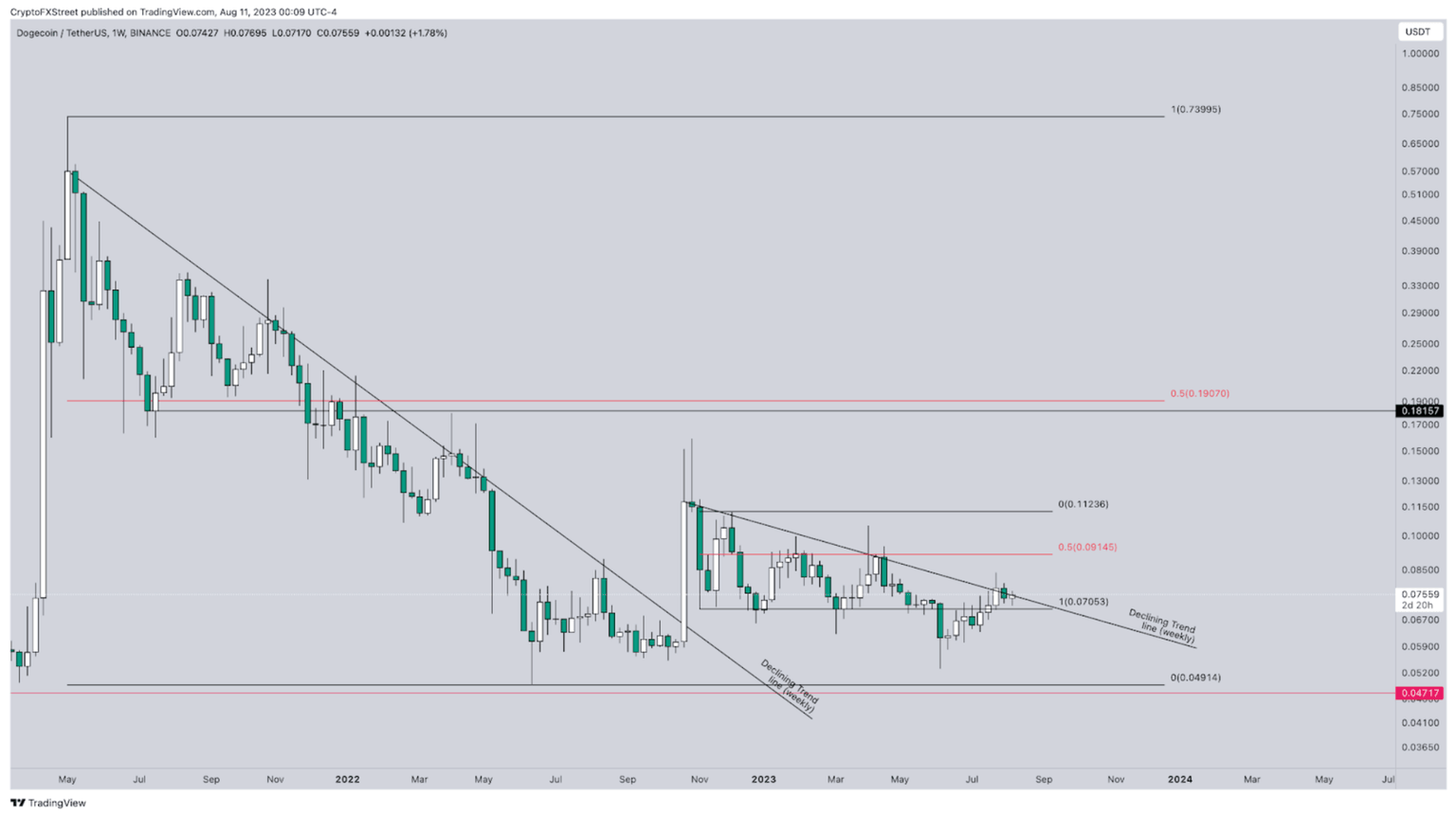

Dogecoin price continues to trade below a declining trendline that serves as resistance for more than nine months. As DOGE slithers close to this hurdle and knocks on it, it is a clear sign of an attempted breakout. But lack of liquidity, buying pressure or bearish market conditions have prevented the dog-themed cryptocurrency from rising higher. A closer look under the hood reveals a shifting sentiment and investor attitude toward Dogecoin that might be foreshadowing an explosive rally.

Dogecoin holders undergo a change

Dogecoin holders can be split into three categories - holders, cruisers and traders. The first category contains addresses holding DOGE for more than a year, while the second cohort’s holding period ranges from a month to a year. The last category of DOGE holders is uncertain investors that hold their tokens for less than a month.

As seen in the chart, June 23 marked a fundamental shift in the attitude of DOGE investors. While the balance of cruisers fell by 68.8% in 48 hours, cruisers increased their balance by 30% from roughly 65.54 billion to 85.30 billion DOGE.

This shift in holders’ sentiment could suggest that traders that accumulated from May 15 gave up on their bullish outlook while cruisers doubled down on their thesis.

DOGE balance by time held

Taking a look at the holdings distribution matrix for DOGE shows that cohorts holding DOGE tokens worth $1 million to $10 million and greater than $10 million are the ones that control a majority of the circulating supply.

These cohorts together control nearly 80% of the DOGE supply.

DOGE holdings distribution matrix

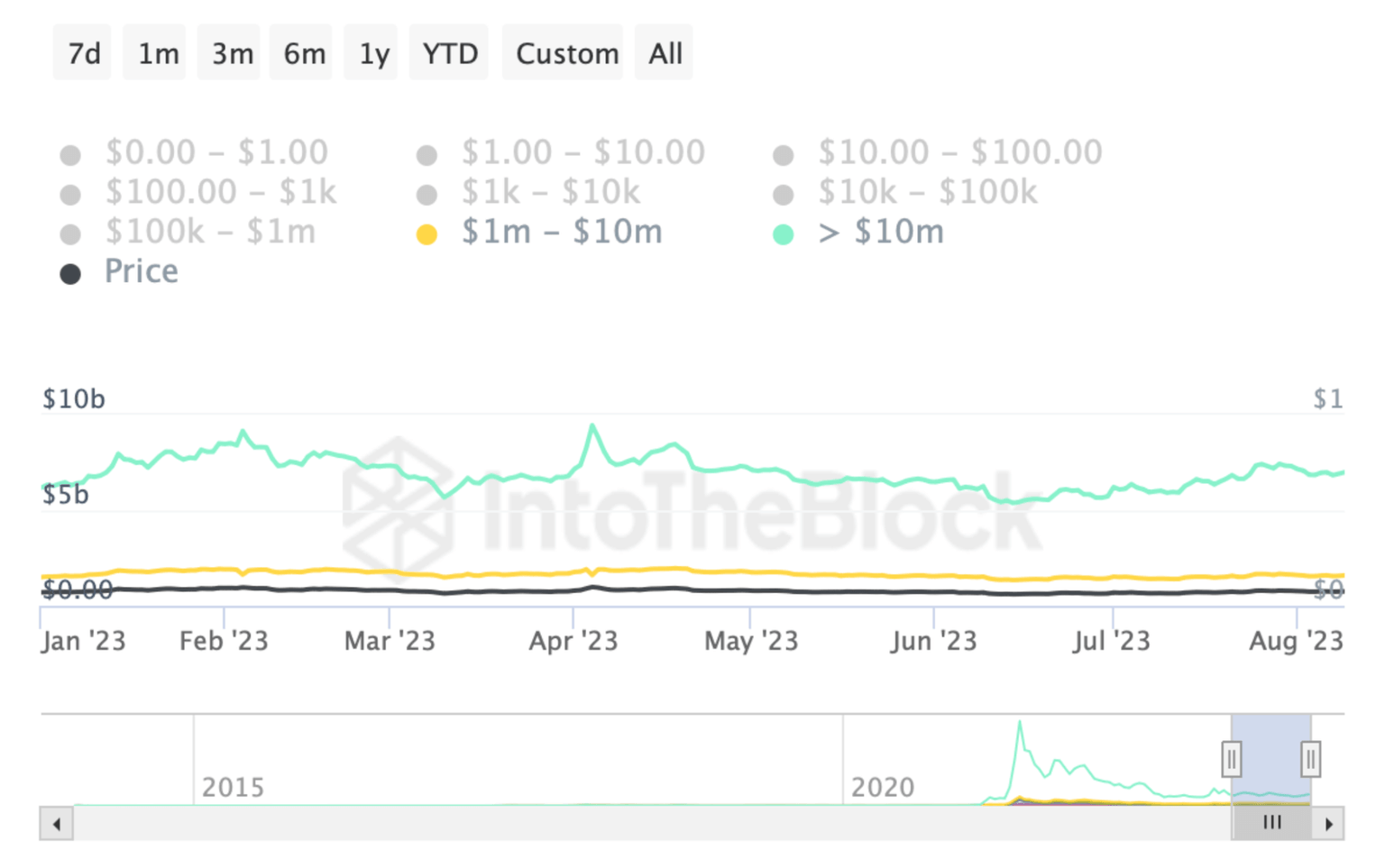

Furthermore, the balance by holdings chart shows that the aforementioned cohorts, i.e., $1 million to $10 million and greater than $10 million, respectively, increased their holdings from $1.36 billion and $5.43 billion to $1.59 billion and $6.00 billion.

DOGE balance by holdings in USD

Dogecoin price rally and Bitcoin ETF’s role in it

All in all, Dogecoin holders are showing a significant change in sentiment since mid-June. This outlook could be driven by Blackrock’s ETF application, which was announced on June 15. From a technical standpoint, Dogecoin price currently sits under a declining trendline, which serves as resistance. DOGE has attempted to breach this hurdle for the past nine months but has failed each time.

With Bitcoin moving sideways and investors’ attention drawn to on-chain altcoins, tokens on centralized exchanges have failed to move higher. But as profits from on-chain gambling rotate, altcoins on crypto exchanges are likely to trigger a massive rally.

Dogecoin price is primed for a breakout, which could easily catalyze a 50% run-up to tag $0.1123. In a highly bullish case, DOGE could retest the $0.190 hurdle, which is the midpoint of the 93% bear market crash witnessed between May 2021 and June 2022. The move to $0.190 would constitute a 155% gain.

DOGE/USDT 1-week chart

While things are looking up for Dogecoin price, a breakdown of the $0.049 level on the weekly timeframe will signal a weakness among buyers. Such a development could lead to a steep 45% correction to $0.0267 and $0.0140.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Like this article? Help us with some feedback by answering this survey:

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.