- Dogecoin price has outperformed the Shiba Inu price by 172% since August.

- DOGE rose by 52% during the final days of November, while Shiba Inu price lost 17% of its market value.

- A pullback on the DOGE/SHIB chart would likely result in a Shiba Inu rally.

Dogecoin price has been outperforming the Shiba Inu price, but circumstances are subject to change. If market conditions persist, SHIB could gain market control and rally while DOGE heads for lower targets.

Dogecoin price outperformed Shiba Inu

Dogecoin price pulled off an astonishing uptrend rally during the fall, replenishing 180% of lost market value to the hands of investors. Shina Inu's price, on the contrary, remained stagnant. November's auction settled with a 25% decline for SHIB investors. While there is no doubt that DOGE has been the better asset to hold. Now On December 7, utilizing the help of comparative technical analysis tools, the tables may be due for a turn for the two notorious meme coins. Shiba Inu price may become the outperformer in the weeks to come.

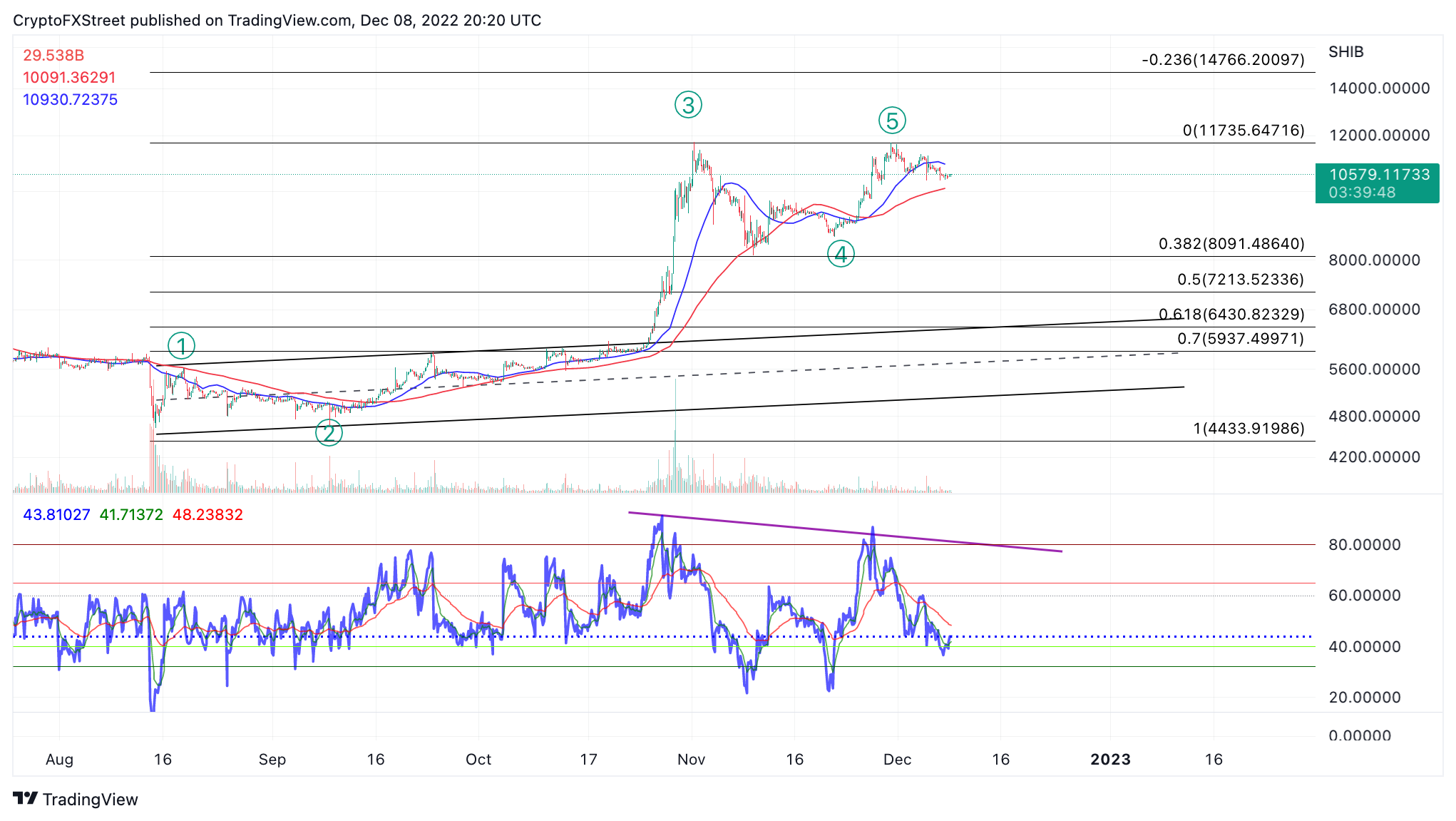

Using Tradingview.com, investors can determine which asset will perform another by implementing a simple division equation between both assets. In this case, the Dogecoin price divided by the Shiba Inu price shows Dogecoin as a clear outperformer between the two assets. Since August 2022, DOGE has outperformed SHIB by 172%. Furthermore, investors can check the efficacy of the equation by reviewing each asset individually. Since August, DOGE has risen by 163%, while DHIB only saw a 50% uptrend spike within the same time period.

Using Elliott Wave Theory, a clear five-wave impulse is shown on the DOGE/SHIB chart. The technicals also bounced from the 38.2% Fiib level on November 10, and printed a double top formation on November 31. The Fibonacci retracement level is extracted from measuring the swing low in August to the recent swing high in November. The rally shown was a result of DOGE's last-minute 52% recovery rally between November 14 through November 31. The Shiba Inu price lost 17% of its market value during this same time period.

If the DOGE/SHIB chart has indeed topped, a decline into the lower targets could result inversely as a Shiba Inu rally. In other words, a plummet into the "Golden Pocket" 61.8% Fibonacci Retracement level would result in a 40% increase for the Shiba Inu price. It is worth noting that the DOGE price could also decline by 80% while Shib remained entirely still to manifest the aforementioned scenario's outcome on the DOGE/SHIB chart. Due to both assets' correlation with Bitcoin, the primary scenario is the more likely outcome.

The Relative Strength Index supports the idea that Shiba Inu will soon outperform the Dogecoin price as a divergence between wave three and wave five is shown on the daily chart. The divergence signal may be the catalyst for the pullback to induce the rotational powershift investors are looking for.

DOGE/USDT/SHIB/USDT 1-Day Chart

To recap, Investors may want to keep their eyes on the DOGE/SHIB chart to gauge the strength of both dog coins going into 2023. Doge's outperformance of SHIB has gone on for nearly half a year, and a rotational shift would be more than reasonable. Traders may be able to use classical technical analysis techniques on the DOGE/SHIB chart in anticipation of a profitable opportunity.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Cardano stabilizes near $0.62 after Trump’s 90-day tariff pause-led surge

Cardano stabilizes around $0.62 on Thursday after a sharp recovery the previous day, triggered by US Donald Trump’s decision to pause tariffs for 90 days except for China and other countries that had retaliated against the reciprocal tariffs announced on April 2.

Solana signals bullish breakout as Huma Finance 2.0 launches on the network

Solana retests falling wedge pattern resistance as a 30% breakout looms. Huma Finance 2.0 joins the Solana DeFi ecosystem, allowing access to stable, real yield. A neutral RSI and macroeconomic uncertainty due to US President Donald Trump’s tariff policy could limit SOL’s rebound.

Bitcoin stabilizes around $82,000, Dead-Cat bounce or trendline breakout

Bitcoin (BTC) price stabilizes at around $82,000 on Thursday after recovering 8.25% the previous day. US President Donald Trump's announcement of a 90-day tariff pause on Wednesday triggered a sharp recovery in the crypto market.

Top 3 gainers Flare, Ondo and Bittensor: Will altcoins outperform Bitcoin after Trump's tariff pause?

Altcoins led by Flare, Ondo and Bittensor surge on Thursday as markets welcome President Trump's tariff pause. Bitcoin rally falters as traders quickly book profits amid Trump's constantly changing tariff policy.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.