- Crypto memecoin sector dips 5% on Monday as investors appear to be sidestepping low-liquidity assets amid intense market volatility.

- Fartcoin emerged the standout performer on the day, posting 15% gains despite the sector wide downturn.

- Technical indicators highlight key levels that DOGE, SHIB, and FARTCOIN traders must watch if Bitcoin price approaches $100,000.

Meme coins slid 4.8% Monday amid rising volatility, with investors fleeing low-liquidity tokens in favor of Bitcoin stability.

Memecoin market tumbles as capital rotates to Bitcoin dominance

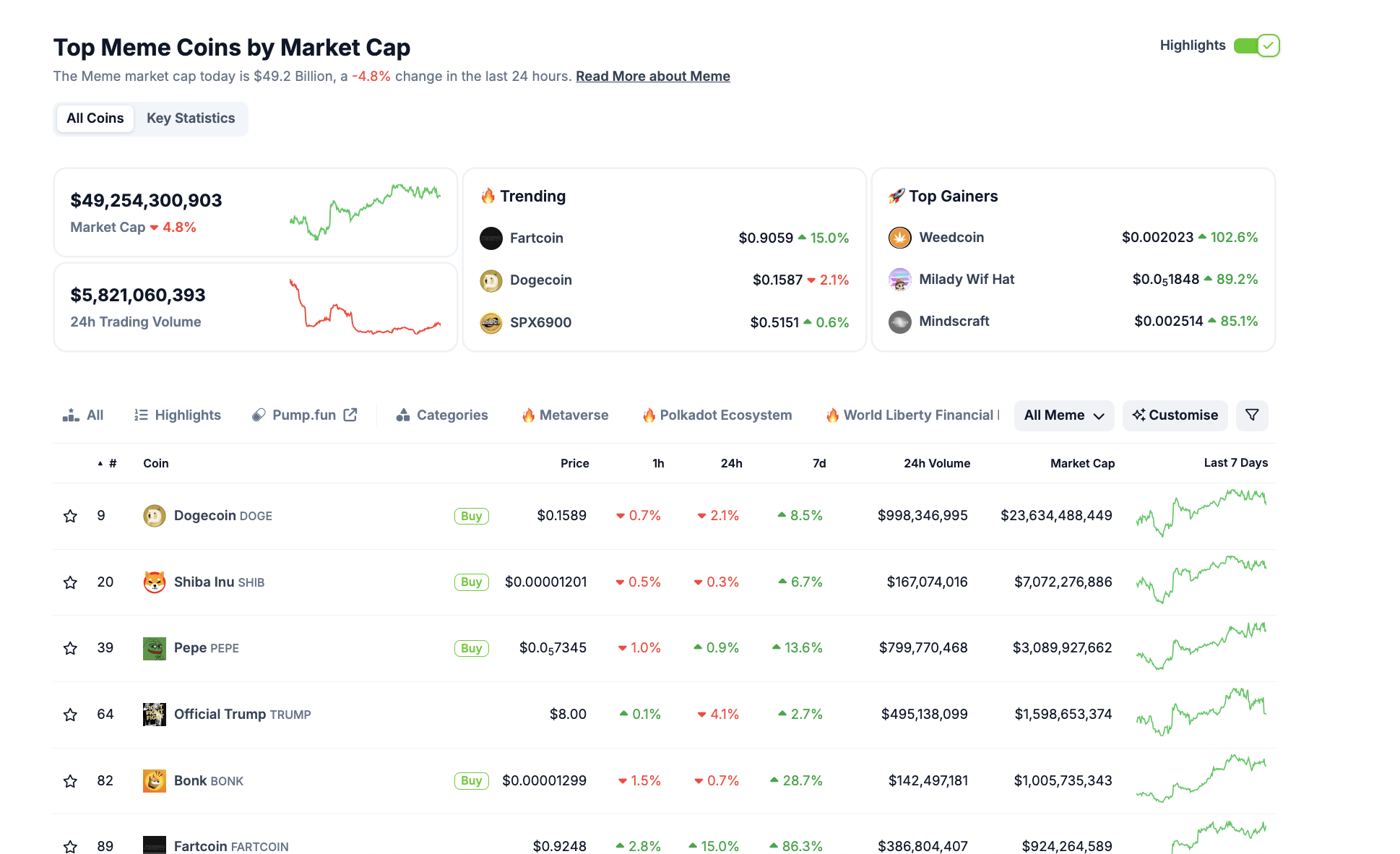

The meme coin market fell sharply on Monday, shedding 4.8% in market capitalization to settle at $49.25 billion, according to data compiled from CoinGecko. The sell-off coincided with increased volatility across broader crypto markets while investors rotated funds into Bitcoin briefly tested the $85,000, as positive sentiment triggers from the US inflation report subsided.

The decline in meme coins reflects a flight from low-liquidity tokens as investors positioned themselves defensively as markets await the next upward catalyst, as the trade war between US and China rages on.

Memecoin market performance | Source: Coingecko

As seen in the chart above, Dogecoin (DOGE), the sector's flagship asset with a $23.6 billion market cap, fell 2.1% over the past 24 hours to $0.1589 despite recording an 8.5% gain over the last seven days.

Shiba Inu (SHIB) was comparatively stable, losing just 0.3% in the same timeframe. Pepe (PEPE), the 3rd largest meme token by market capitalization, dipped 0.9%, although it remains up 13.6% over the past week.

The trading volumes, however, suggest that interest remains concentrated around the top three assets, with Dogecoin posting nearly $1 billion in 24h volume. Still, risk appetite has clearly rotated toward Bitcoin dominance, leaving meme tokens temporarily sidelined.

DOGE, SHIB and FARTCOIN technical price forecast if BTC advances to $100K

While the current defensive market has seen top memecoin lose traction on Monday, this trend may reverse sharply as investor sentiment improves. If Bitcoin price convincingly advances towards the $100,000 it could reignite memecoin rallies on speculative demand.

Fartcoin emerges standout performer as search interest surges

In stark contrast to its larger peers, Fartcoin (FARTCOIN) surged 15% on the day, making it the top-trending meme asset by search volume and one of the most actively watched altcoins.

Trading at $0.93 with a market cap of $924 million, Fartcoin’s spike appears to be driven by speculative interest and growing retail attention.

Despite the market’s risk-off tone, Fartcoin outperformed all major tokens in the category and entered the top 100 by market cap. The project’s sudden virality and rapid price appreciation mirror early stages of previous meme coin cycles, where low market cap coins with strong retail engagement quickly attract liquidity once Bitcoin solidifies a breakout.

In terms of short-term price prediction, technical indicators on the Fartcoin 12-hour chart highlight the $0.15 resistance as the key level to watch for potential breakout signals

Fartcoin price prediction: $1.06 breakout ahead if search interest persists

Fartcoin price remains buoyant above the $0.91 level, with the 12-hour chart showing a sustained uptrend supported by rising VWAP and mid-band Bollinger support at $0.9188. Price action is hugging the upper Bollinger Band at $1.0618, suggesting strong momentum without overextension.

Notably, the Parabolic SAR dots sit comfortably beneath the current price range, indicating bullish trend continuation and that the rally has not yet reached overbought exhaustion.

Fartcoin price prediction

A closer look at the Bollinger Band width suggests volatility expansion, typically a precursor to significant price discovery phases. The Volume Delta today is neutral at 28.33K, signaling consolidation rather than distribution. If Bitcoin breaks $100K and meme coin flows resume, the next resistance lies near $1.06 — the upper Bollinger Band.

On the bearish side, failure to hold the VWAP and a break below $0.89 could see Fartcoin revisit the mid-range at $0.71, where the lower Bollinger Band converges.

If Bitcoin price crosses the $100,000 market, Fartcoin could easily extend its rally past the $1.20 psychological mark, especially if new capital flows from sidelined retail investors looking for lower entry points.

Dogecoin Price Forecast: DOGE eyes $0.20 level if BTC breaks $100K

Dogecoin price continues to consolidate around the $0.1600 level, finding immediate support near the Volume Weighted Average Price (VWAP) at $0.15936. This stabilization is occurring within the Keltner Channel bands, suggesting a period of reduced volatility as traders skim prior gains.

The lower boundary of the Keltner Channel at $0.14369 remains a key support zone, while the upper bound near $0.17777 forms the next bullish target should momentum reaccelerate.

Dogecoin Price Forecast

If Bitcoin price breaches the psychological $100,000 level, Dogecoin is well-positioned to break above $0.1650 and test the upper resistance at $0.1750. A sustained close above that level would open the path toward $0.1950, driven by renewed meme coin enthusiasm.

However, failure to hold above VWAP could expose DOGE to a pullback toward $0.1500 and possibly the KC lower support at $0.14369. Until then, price action remains range-bound but biased higher, contingent on Bitcoin’s broader trend resolution.

Shiba Inu price prediction: $0.000015 resistance could cave if BTC nears six figures

Shiba Inu price is holding steady at $0.000012, consolidating just below the critical short-term resistance zone between $0.000011 and $0.000012, defined by the converging 5, 8, and 13-day SMAs on the 12-hourly SHIBUSDT chart.

The bullish crossover observed last Friday, confirmed by the green arrow, signals short-term upside momentum, though the flattening slope of these moving averages hints at hesitation.

Shiba Inu price prediction | SHIBUSDT

The MACD remains in positive territory, but its histogram is contracting, suggesting the bullish momentum may be stalling unless a catalyst—like Bitcoin breaking $100,000—reignites volume.

In this case, a decisive close above $0.000012 could validate the bullish structure, with upside targets set at the March high of $0.000016.

Conversely, failure to hold above the $0.00001150 floor risks a bearish reversal back toward $0.00001050.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP gains as traders gear up for futures ETFs debut this week

XRP climbs over 3% on Monday, hovering around $2.33 at the time of writing. The rally is likely catalyzed by key market movers like XRP futures Exchange Traded Funds (ETFs) approval by the US financial regulator, the Securities and Exchange Commission (SEC), and a bullish outlook.

Bitcoin Price Forecast: BTC eyes $97,000 as institutional inflow surges $3.06 billion in a week

Bitcoin (BTC) price is stabilizing above $94,000 at the time of writing on Monday, following a 10% rally the previous week. The institutional demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.