Dogecoin shatters $0.15 support as ‘Black Monday’ bloodbath fears surge

- Dogecoin tumbles over 10% on Monday, slashing $3.73 billion from its market capitalization to $19.78 billion.

- CNBC host Jim Cramer warns of global markets’ bloodbath if US President Donald Trump stays intrasigent.

- The MACD indicator sustains a sell signal, blowing up chances of an extended correction in DOGE.

- A falling wedge pattern hints at a possible rebound after global markets cool off from Trump’s tariffs.

Dogecoin (DOGE), like most cryptocurrencies, is in a deep dive on Monday. The leading meme coin crashed, losing 19.7% of its value in the last 24 hours to trade at $0.1354 at the time of writing. Additionally, DOGE is down 19.4% in the past seven days, while its market capitalization plunged to $19.78 billion from $24.67 billion on Sunday.

Dogecoin bleeds as Jim Cramer foresees ‘Black Monday’ sell-off

Dogecoin has not been spared by immense headwinds swirling across global markets as US President Donald Trump insists on keeping tariffs elevated to resolve his country’s trade deficit.

CNBC host Jim Cramer reckoned on Sunday that global markets could experience a ‘Black Monday’ sell-off resembling the 1987 collapse unless Trump rethinks his tariff plan, which impacts 100 countries.

“If the president doesn’t try to reach out and reward these countries and companies that play by the rules, then the 1987 scenario–the one where we went down three consecutive days and then down 22% on Monday, has the most cogency,” Cramer explained on Saturday.

How low can it go? Is another Black Monday beckoning? Join the Club the CNBC Investing Club and read my piece that just went live for the answers.

— Jim Cramer (@jimcramer) April 6, 2025

President Trump announced 10% reciprocal tariffs on April 2, which will come into effect on Wednesday. However, countries like China have already announced retaliatory tariffs, sending global markets into more disarray.

“We will not have to wait too long to know. We will know it by Monday,” Cramer added.

Bitcoin’s downside pressure is in full force, testing support at $75,000 during the European session on Monday. Ethereum, the prominent smart contracts token, is down 18% in the last 24 hours to $1,469, while XRP retests $1.70 support. Cumulatively, the crypto market capitalization has lost 12.5% of its value to hold at $2.46 trillion.

Can Dogecoin make a bullish comeback?

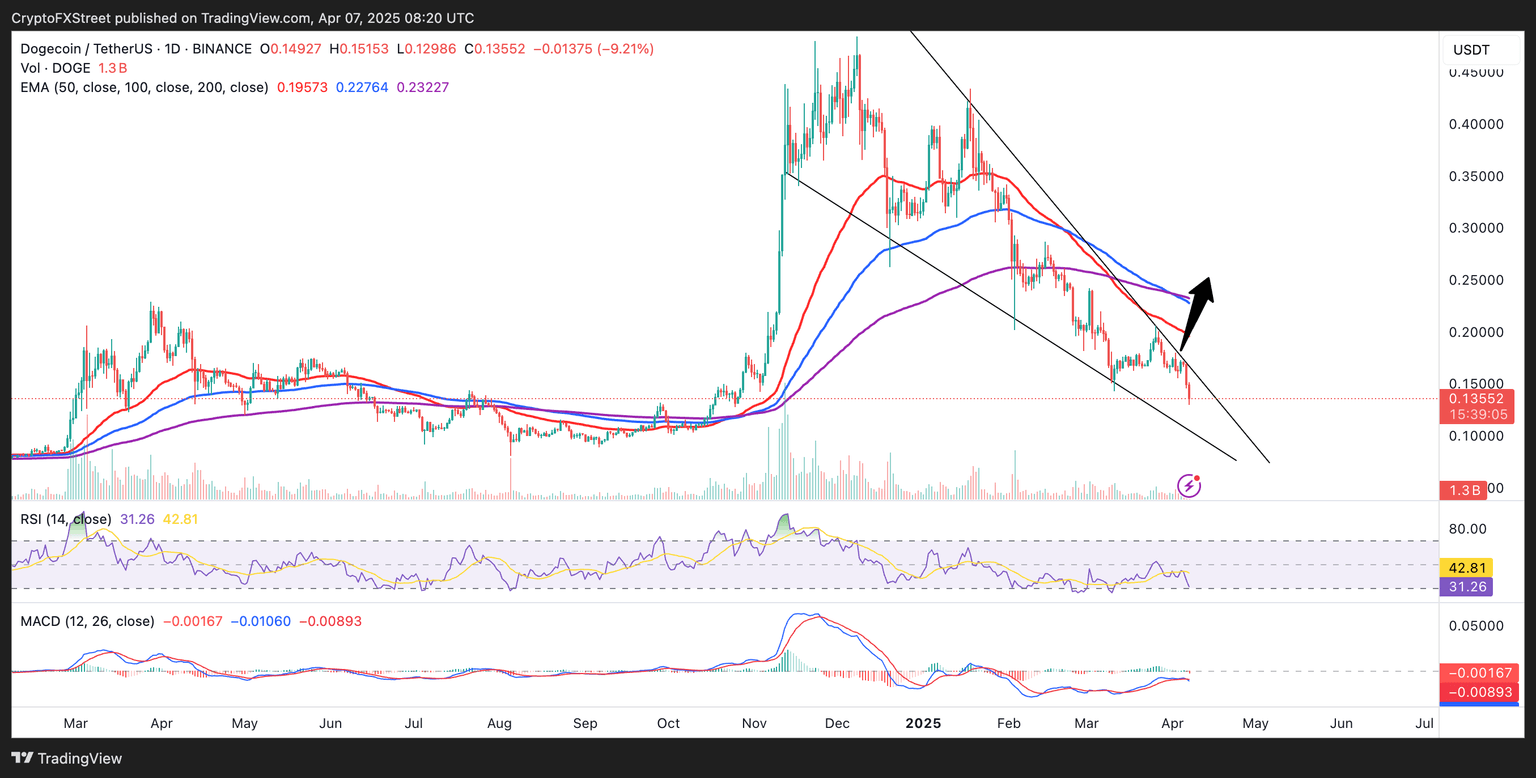

Dogecoin faces a grim technical picture after it lost the $0.15 support level. A death cross pattern, formed when the 50-day Exponential Moving Average (EMA) crossed below the 200-day EMA, further fuels the bearish momentum.

The Relative Strength Index (RSI) encourages traders to sell XRP as it approaches the oversold region in the daily chart, suggesting strong bearish momentum. At the same time, a sell signal from the Moving Average Convergence Divergence (MACD) validates the deteriorating technical structure. If Dogecoin fails to reclaim the $0.15 level in the short-term, there’s a high probability its lower leg will reach $0.10.

DOGE/USDT daily chart

However, a falling wedge pattern is forming in the same daily chart, implying that Dogecoin could soon find support, paving the way for a bullish recovery. An oversold RSI would also be another indicator to watch, as it could signal a rebound ahead. Traders interested in buying the dip may look out for a bounce back from the $0.12 support area.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren