- Dogecoin has been stuck in a sideways momentum for almost three months now.

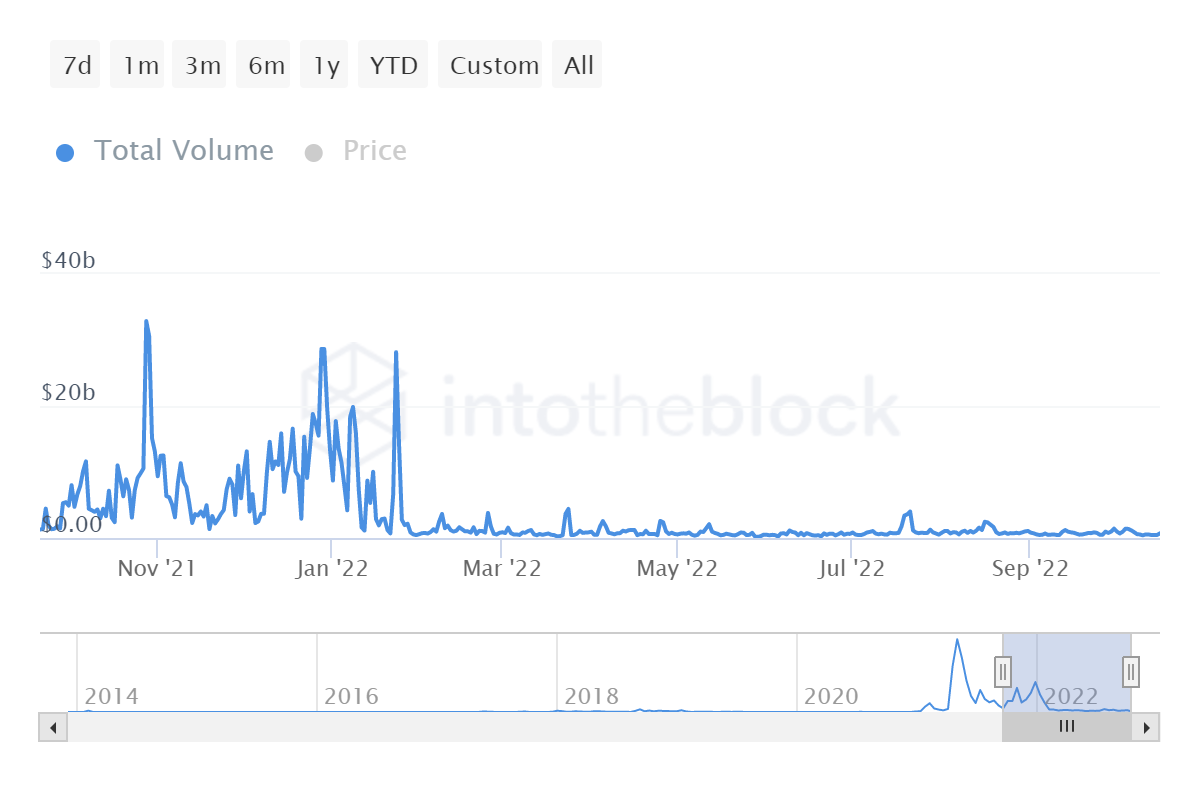

- DOGE whales’ transaction volume has reduced to less than $1 billion since January from an average of $10-$15 billion.

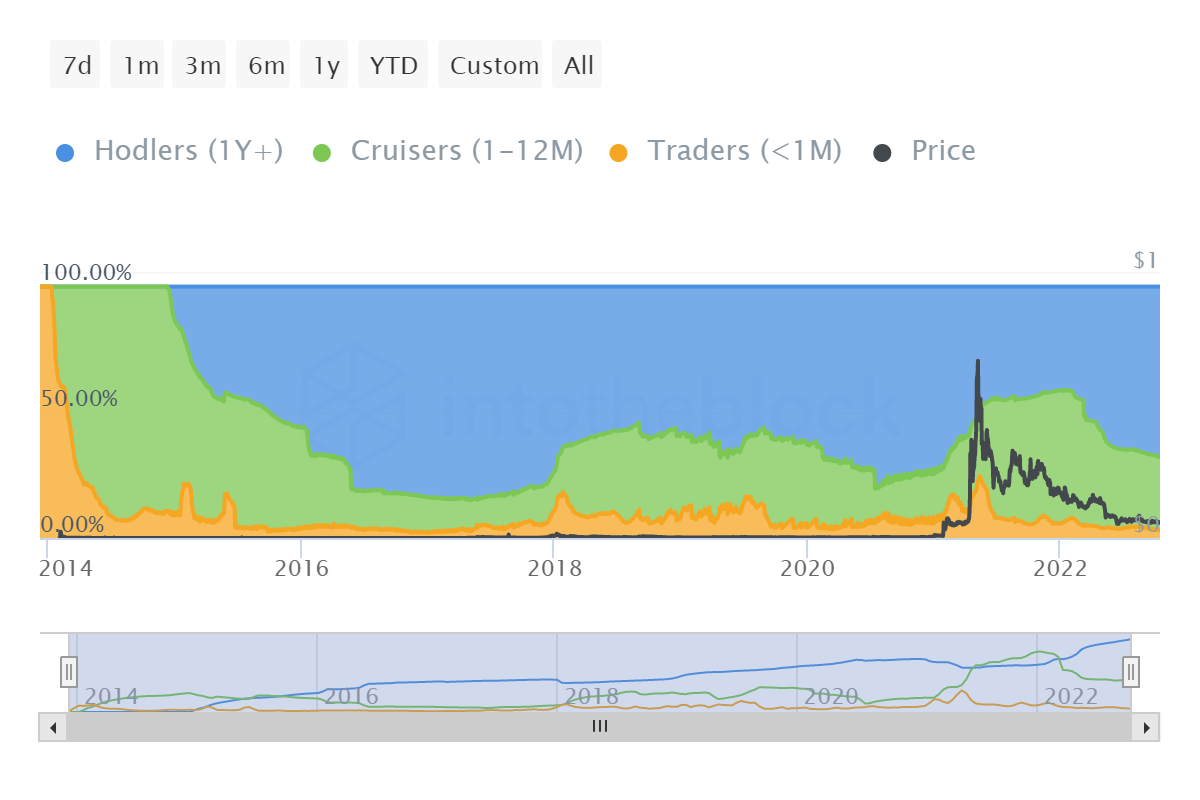

- Since January 2022, DOGE long-term holders’ concentration in the market has risen by over 26%.

Dogecoin is one of the most easily influenced cryptocurrencies in the market since it is dependent on social cues to push its price. But both Elon Musk and the broader market cues haven’t had a positive impact on the price. As a result, DOGE whales have decided to sit on their holdings for a little while longer than anticipated.

Dogecoin marches on

Dogecoin is marching on, however, to nowhere. Since mid-August this year, DOGE has been following a sideways momentum and is seemingly going to continue to do so. The Fibonacci retracement from its local top ($0.1729) to recent lows ($0.0491) established the 23.6% level at $0.0783.

This level was last tested in August, and the failure to flip it into support was followed by the fall in price that placed DOGE in consolidation. Trading at $0.0598, the meme coin king has minimal buying pressure, keeping it from retesting the 23.6% Fibonacci level.

DOGE/USD - 1-day chart

DOGE/USD - 1-day chart

As long as the Relative Strength Index (RSI) remains below the neutral line, selling pressure will dominate the market.

However, Dogecoin was once one of the most volatile assets in the market, the reason being its whale holders, who have been silent for a while.

Dogecoin whales make no splash

Whales play a significant role in an asset’s price movement, but particularly Dogecoin, these matter more since they dominate 48.88% of all supply. Thus the movement of 66.7 billion DOGE is in their hands.

This movement has been low since January when transaction volumes fell from $10-$15 billion to less than $1 billion on average. Co-incidentally in the same duration, the domination of HODLers grew.

Dogecoin whales’ transaction volume

Also known as the long-term holders, these HODLers’ presence has grown from 41% in January to 67.8% this month. This 26.8% growth could be the whales holding on to their assets since January.

Dogecoin HODLers

However, if they decide to be active again and move this DOGE around, the price could see an uptrend. If not, the bearishness of the market will get to it eventually and push the price toward its $0.0491 low.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Why is Bitcoin performing better than Ethereum? ETH lags as BTC smashes new all-time high records

Bitcoin has outperformed Ethereum in the past two years, setting new highs while the top altcoin struggles to catch up with speed. Several experts exclusively revealed to FXStreet that Ethereum needs global recognition, a stronger narrative and increased on-chain activity for the tide to shift in its favor.

Bitcoins hits new record high above $94K, signals continuation of larger uptrend

Bitcoin hit new record high on acceleration above 94K on Wednesday, lifted by growing expectations for more crypto-favorable conditions under incoming Trump’s administration. Break above the top of seven-day consolidation range generated initial signal of continuation of larger uptrend after bulls paused to consolidate recent strong post-US election gains.

Cardano surges to over two-year high as on-chain metrics show bullish bias

Cardano (ADA) price extends its bullish momentum, rallying more than 10% on Wednesday and reaching levels not seen since early May 2022. On-chain data further supports this rally as ADA’s whale transaction, trading volume, and open interest all rise, reaching record levels.

Dogecoin Price Forecast: Selling pressure drops 95% as DOGE traders target $0.50 breakout

The Dogecoin price breached the $0.40 resistance on Monday, rebounding from a 15% pullback. On-chain transaction flows observed this week suggest DOGE could be on the verge of another leg-up toward $0.50.

Bitcoin: New high of $100K or correction to $78K?

Bitcoin surged to a new all-time high of $93,265 in the first half of the week, followed by a slight decline in the latter half. Reports highlight that Bitcoin’s current level is still not overvalued and could target levels above $100,000 in the coming weeks.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.