Dogecoin rises to highest price since 2021 after spike in transaction volume

- The transaction volume of DOGE surged to $9.2 billion in over 48 hours.

- Dogecoin addresses cross 6 million after GigaWallet v1.0 unveiling.

- Dogecoin may be set for a further rally as Coinbase futures listing on April 1 approaches.

Dogecoin is looking set for another bull run on Thursday following recent developments related to the meme coin. With increasing transaction volume and user base, the April 1 launch of a DOGE futures product on Coinbase may see it soaring to new highs.

Read more: These four Dogecoin on-chain metrics point to an exponential growth in DOGE price

DOGE’s impressive March

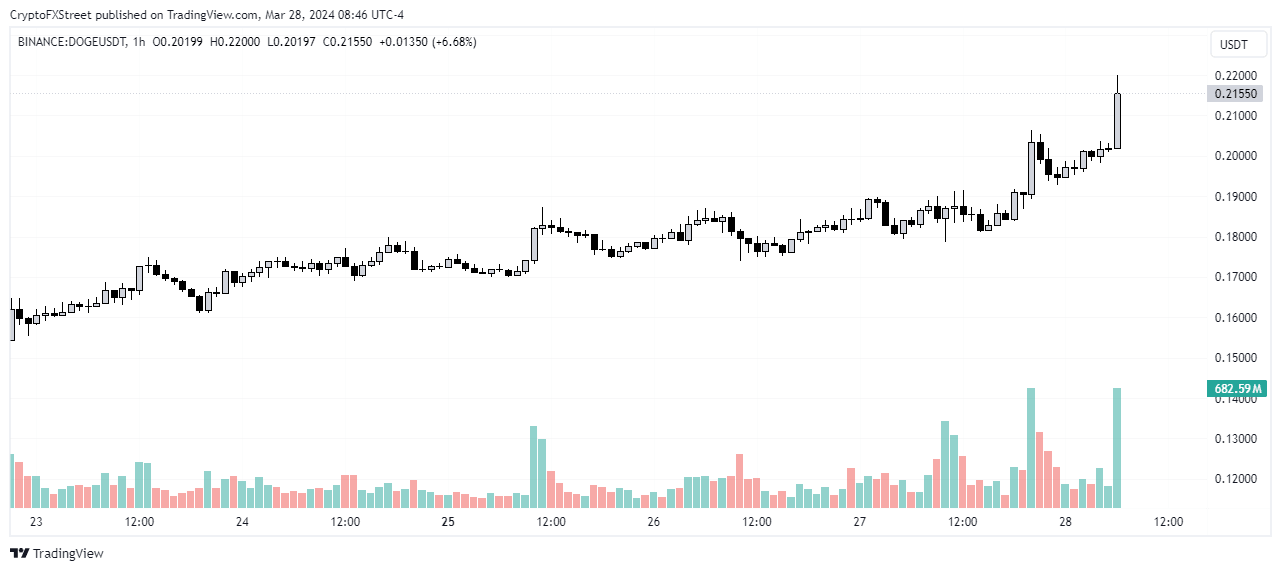

Dogecoin's resurgence in bullish momentum comes on the heels of a notable price spike, with the meme coin recording a more than 16% increase on the day.

This surge follows a month-long rally fueled by Bitcoin's ascent to new all-time highs, which saw Dogecoin climbing over 111% in the last 30 days. The close correlation between Dogecoin and Bitcoin's price movements is evident.

Elon Musk's endorsement further amplifies Dogecoin's appeal, particularly after hinting at the possibility of Tesla accepting Dogecoin payments for its cars in the future.

DOGE/USDT 1-hour chart

The recent rise of Dogecoin has not only attracted attention to the meme coin but has also ignited a broader frenzy in the meme token market. Tokens like dogwifhat (WIF), Book of Meme (BOME), Pepe (PEPE) and Slerf (SLERF) experienced surges in tandem with Dogecoin's ascent, leading some to dub Dogecoin as the "Bitcoin of meme coins."

However, the currency experienced a downturn following a correction in Bitcoin's price last week.

Also read: Can Shib, Doge, Floki and Book of Meme kick-start a rally after Avalanche's meme coin program?

Potential reasons for DOGE’s rise

DOGE's price growth also coincides with the rising number of wallet addresses on its blockchain, which has reached 6.27 million, according to its on-chain data. There may be a connection between this and the Dogecoin Foundation's rollout of GigaWallet v1.0, which would allow businesses to enable Dogecoin payments through API integration.

Consequently, data from Santiment indicated a substantial increase in its transaction volume, which surged approximately 7.5x from $1.22 billion to $9.22 billion within 48 hours. This indicates growing interest and activity surrounding Dogecoin.

Read more: Dogecoin soars nearly 20% after Coinbase announces listing of DOGE derivatives

Looking ahead, Dogecoin's bullish momentum may continue as Coinbase plans to list Dogecoin futures products starting April 1. This announcement has fueled anticipation within the crypto community, potentially leading to another price surge for Dogecoin.

Furthermore, the approval of Dogecoin's futures product by the Commodity Futures Trading Commission (CFTC) paves the way for potential investment opportunities, including the possibility of a Dogecoin ETF.

As different narratives surrounding the meme coin take shape in the coming days, its recent surge underscores its growing influence in the crypto market.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi