Dogecoin rallies, Bitcoin ETFs bleed ahead of US elections

-

DOGE's increase is largely attributed to a renewed endorsement from Elon Musk linked to his proposal for a "Department of Government Efficiency" (D.O.G.E.).

-

U.S.-listed spot bitcoin ETFs experienced net outflows, with significant withdrawals from major funds like Fidelity's FBTC and Ark Invest's ARKB, except for BlackRock’s IBIT which saw inflows.

-

The crypto market's reaction appears influenced by the narrowing lead of Donald Trump in election polls, traditionally seen as more favorable towards cryptocurrencies, some traders said.

Dogecoin (DOGE) was the only major token in green ahead of the widely-watched U.S. elections, with some expecting a marketwide surge in the coming weeks regardless of whichever candidate wins.

The memecoin has jumped over 10% in the past 24 hours even as bitcoin (BTC) lost nearly 3%, and all major tokens registered losses between 1%-5%. The broad-based CoinDesk 20 (CD20), a liquid index tracking the largest tokens by market capitalization, fell 3%.

DOGE has risen 50% in the past 30 days on a renewed endorsement by technology entrepreneur Elon Musk as part of the Republican campaign. Musk has been proposing a Department of Government Efficiency — which is abbreviated as D.O.G.E; a clear nod to the token — as an agency that will make government spending and monetary planning more effective.

Bitcoin fell as defunct exchange Mt.Gox sent $2.2 billion worth of tokens from its storage to new wallets. Such moves have historically preceded creditor repayments and caused prices to dip lower, and traders expect short-term selling pressure when the assets are further moved to exchanges.

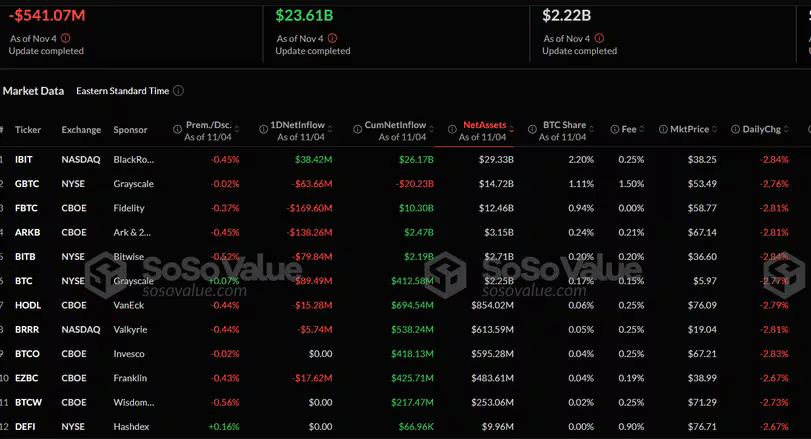

Elsewhere, U.S.-listed spot bitcoin exchange-traded funds (ETFs) recorded $541 million in net outflows on Monday - the highest since May - dashing hopes for increased institutional interest in the asset after a week that saw consecutive days of net inflows above $800 million.

BlackRock’s IBIT was the only product showing net inflows at $38 million. Fidelity’s FBTC led outflows at $169 million, its highest since going live, followed by Ark Invest’s ARKB at $138 million and Grayscale’s mini bitcoin trust (BTC) at $90 million.

(SoSoValue)

Meanwhile, traders say the correction comes amid shifting election polls that have neared coin-toss odds on some marketplaces.

“Markets are falling because traders are no longer confident that Trump will have an "easy" victory on Tuesday, and that doesn't bode well for crypto as he's been perceived as the more pro-crypto candidate,” Jeff Mei, COO at crypto exchange BTSE, told CoinDesk in a Telegram message.

“On betting platforms such as Polymarket and Kalshi, and polls across the country, his lead over Harris has deteriorated over the weekend and people think it's going to come down to a very close decision,” Mei said, adding that “the real kicker” could be a Fed rate cut decision on Thursday where the agency is expected to continue to cut rates in a move that could “boost markets in the short run.”

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.