Dogecoin rallies 28% as institutional investors grow bullish on DOGE utility

- Mark Cuban, billionaire investor, states that Dogecoin has a strong use case as a payment method.

- Analysts convinced by the surge in DOGE's on-chain activity and exchange trading volume, expect the memecoin to rally to $0.40.

- New investors have a bullish outlook, increasing their share of DOGE supply from 9% to 25% in over a year.

Analysts predict that Dogecoin, among other altcoins, is expected to lead the ongoing cryptocurrency rally.

Dogecoin's increasing adoption and surge in on-chain activity points to a long rally

The Shiba Inu-themed cryptocurrency, Dogecoin, is on a bullish streak, and the price is up nearly 28% in the past year. The project started as a meme in 2013, has interestingly gained traction and on-chain data suggests that DOGE trader sentiment is bullish.

Mark Cuban, American billionaire entrepreneur and owner of the Dallas Mavericks, recently said that Dogecoin is the 'strongest' cryptocurrency as a medium of exchange. He shared the two strengths of the memecoin in his recent tweet.

The point about DOGE that people miss is that DOGE's imperfections and simplicity are it's greatest strengths. You can only use it to do 2 things: Spend It or HODL It. Both are easy to understand. And it's cheap to buy. Which makes it a community anyone can join and enjoy.

— Mark Cuban (@mcuban) August 15, 2021

Cuban argued that over 5.2 billion Dogecoins are minted every year, putting it above Bitcoin in terms of utility, since Bitcoin supply is limited to 21 million.

On-chain analysts agree with Cuban's bullish outlook since DOGE trading volume on Coinbase noted a spike last week.

Cryptocurrency trader and analyst behind the Twitter handle @Pentosh1 tweeted:

Just saw the $DOGE volume on Coinbase the past week and my god

— Pentoshi Wont DM You (@Pentosh1) August 15, 2021

There have been some massive buyers 200m USD a day of Doge in volume on CB alone (DIrect fiat on ramp) starting a week ago

While I'm not trading it to $1+ I do think it will get there. My goal is .40-.45 pic.twitter.com/VBtdAWtdjk

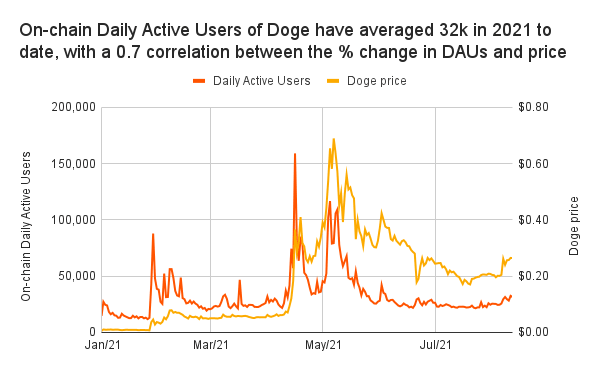

DOGE's current price action is attracting more traders, daily active users of Dogecoin are currently nearly 32,000. This number is moving with a price based on the following chart.

Daily active users of Dogecoin

Though correlation is not causation, the spike in active users coincides with the rise in Doge's social media dominance and indicates a more robust bullish response from users.

Interestingly, the increased active users are adopting Dogecoin faster than expected, at levels unseen since the 2017 bullrun. Philip Gradwell, the chief economist at Chainalysis, shared details of adoption by new users in his recent tweet.

On-chain, Doge is being adopted by new investors at a level not seen since the late-2017 bull market, with new investors increasing their share of supply from 9% in July 2020 to 25% in August 2021 pic.twitter.com/W782qNhyMW

— Philip Gradwell (@philip_gradwell) August 16, 2021

Analysts at FXStreet have set a price target of $0.40 for Dogecoin, and at the time of writing, the crypto is trading at the $0.32 level. A potential 26% gain is likely, and the downside is expected to be relatively limited.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.