- Dogecoin price, even on May 23, failed to note any recovery despite Bitcoin and Ethereum both marking a green candlestick.

- Investors seem to be losing their faith in recovery as DOGE holders' pessimism is at a two-month high.

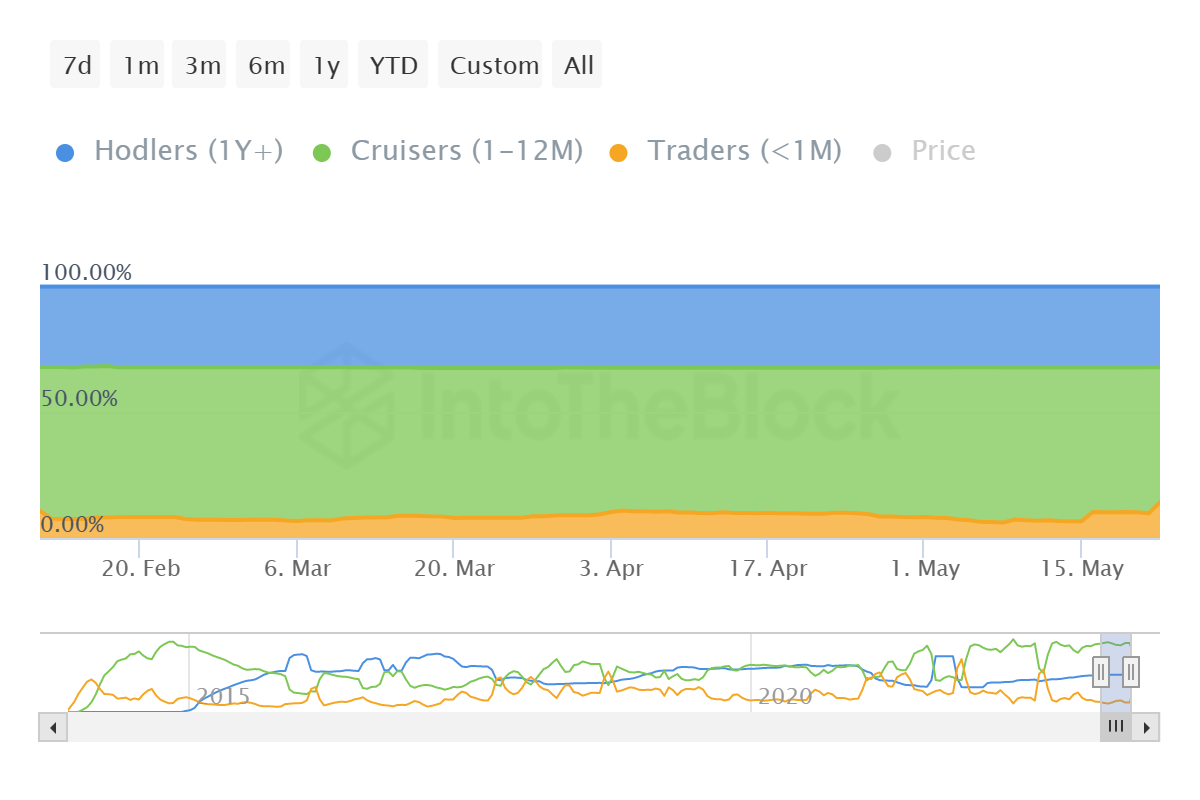

- Consequently, in the last week, mid-term holders have dumped nearly 8% of their supply, which was picked up by short-term holders.

Dogecoin price has stood its ground over the last 24 hours while the cryptocurrency leaders Bitcoin and Ethereum made gains. The overall lackluster performance of the meme coin has pushed DOGE holders to the brink of losing their confidence in an asset that was once hailed as "the next big thing".

Dogecoin price remains unchanged

Dogecoin price has made virtually no attempt whatsoever to initiate a recovery over the last two weeks. Trading at $0.078, the meme coin has been moving under the 50-day Exponential Moving Average (EMA) since the 17% crash of mid-April, which now acts as the next key barrier. The weak macroeconomic conditions are certainly impacting, but DOGE holders' pessimism has been growing since the last month.

DOGE/USD 1-day chart

Investors are rapidly losing their confidence in the meme coin. The lack of green candlesticks has resulted in Dogecoin holders' weighted sentiment slipping below the neutral mark, suggesting a bearish outlook toward the digital asset.

Although Dogecoin investors have exhibited such pessimism in the past, this particular instance is the longest stretch of growing bearishness in their behavior. This has led to the investors offloading their holdings in order to minimize their losses. The biggest chunk of this selling came from one of the most influential cohorts at that.

Dogecoin sentiment

The mid-term holders or "Cruisers" are the group of investors that have held onto their supply for a period longer than a month and less than a year. Their actions, in a way, impact the price since these 1.2 million addresses collectively own over 53% of the entire circulating supply.

Their holdings used to be much larger, around 61%, up until a week ago, but since the Dogecoin price stopped showing signs of recovery, these investors decided to offset their losses. As a result, 7% of their supply was dumped, which was then picked up by short-term holders who represent supply younger than a month.

Dogecoin supply distribution by time held

Thus, loss of conviction from such holders does leave a bearish impact on not just the price but the investors' outlook as well. And if Dogecoin price fails to recover soon and instead continues to trail around $0.078, this selling could go up a notch.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

%20[22.18.24,%2023%20May,%202023]-638204584237018881.png)