- Dogecoin price is grappling with the trading range’s midpoint at $0.178, eyeing further gains.

- Investors can expect DOGE to shatter the $0.197 barrier and make a run at the $0.22 hurdle.

- On-chain metrics hint bullish as they display the entry of high networth individuals at the current levels.

Dogecoin price is trying to move past its recent swing high to set up higher highs. While a minor and brief downswing might be possible, the overall short-term outlook for DOGE is bullish.

Dogecoin price eyes higher highs

Dogecoin price is grappling with the trading range’s midpoint at $0.178 and shows its intention to move higher. There is a minor possibility that DOGE might take a brief dip before it heads higher. Regardless of this outcome, Dogecoin price is ready to move higher.

The first hurdle that the buyers will encounter is the $0.197 resistance barrier after a 10% climb. Beyond this level, DOGE will revisit the $0.22 ceiling and make a run at the liquidity resting above it.

In total, this leg-up would constitute a 25% ascent.

DOGE/USDT 4-hour chart

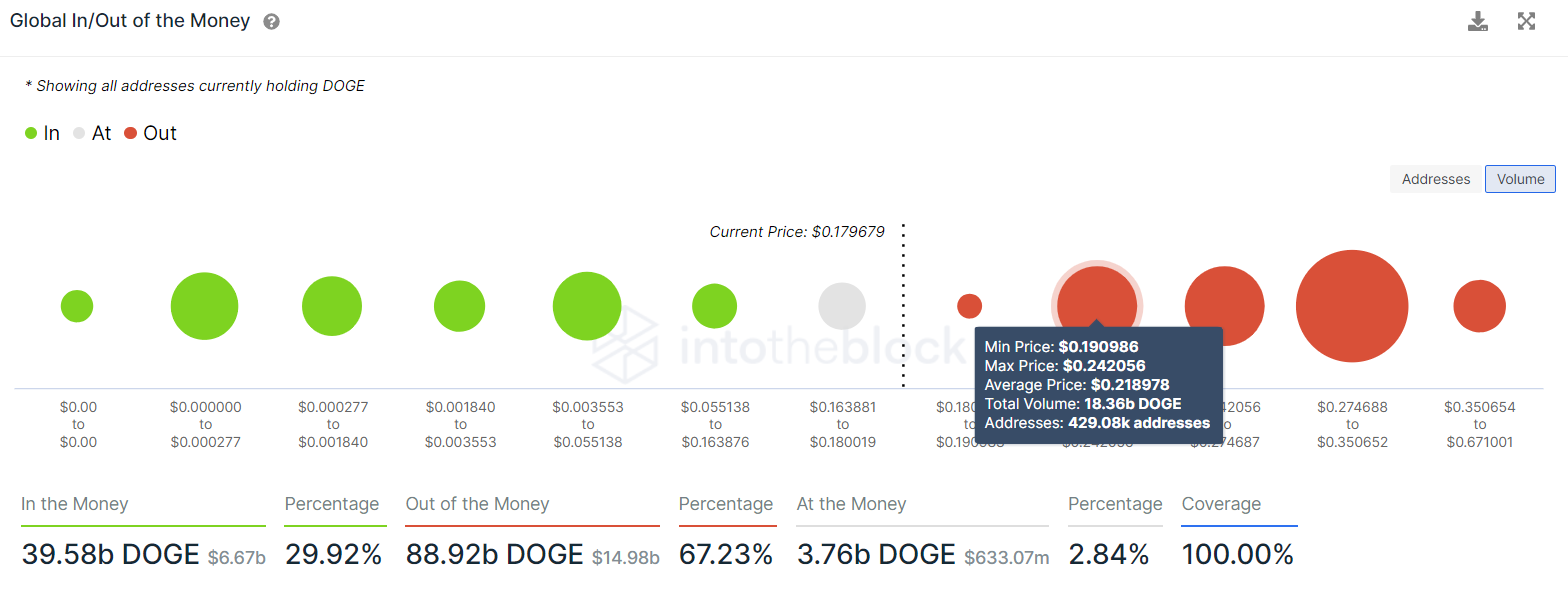

From a technical perspective, tagging the $0.22 level might seem like overreaching, but IntoTheBlock’s Global In/Out of the Money (GIOM) model shows a significant cluster of underwater investors resting around $0.22.

Here, roughly 430,000 addresses that purchased 18.36 billion DOGE are “Out of the Money.” Therefore, any more beyond this level might be a high resistance run as these holders might want to break even.

DOGE GIOM chart

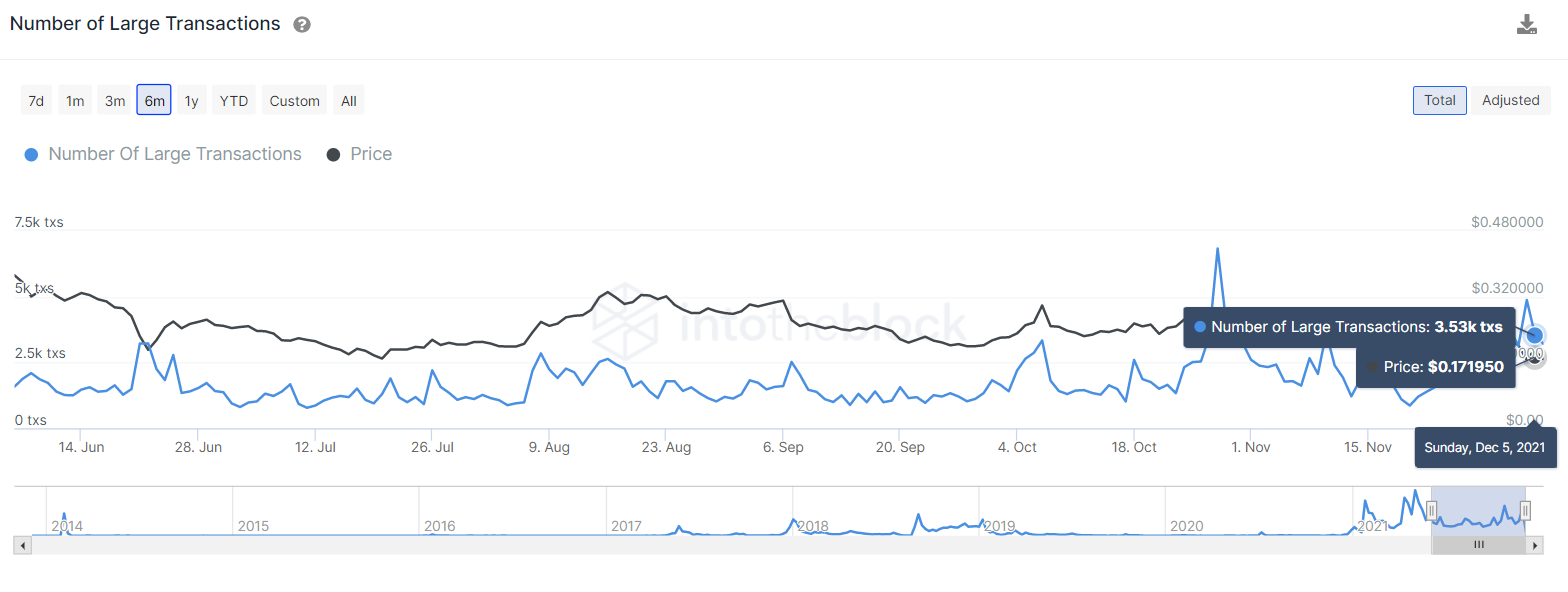

Further supporting the bullish outlook is the 272% uptick in transactions worth $100,000 or more. Since November 20, these transfers have gone from 862 to 3,261.

This trend indicates that high networth investors are interested in DOGE at the current price levels.

DOGE large transactions chart

While things are looking up for Dogecoin price, a failure to maintain the bullish momentum could lead to a retracement. If this correction pushes DOGE to produce a lower low below $0.158, it will invalidate the bullish thesis.

In such a situation, market participants can expect Dogecoin price to venture lower and potentially retest the $0.13 support level.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP futures market signals rising bearish momentum amid large profit levels of long-term holders

Ripple's XRP declined by 1% on Tuesday, as on-chain and futures data reveal the impact of the recent market downturn on its investors.

Tron Price Forecast: TRX founder Justin Sun announces collaboration with Solana Blockchain

Tron (TRX) price edges slightly down, trading at $0.23 on Wednesday after rallying nearly 12% in the last two days.

Bitcoin not yet in a bearish phase despite on-chain and futures liquidity contraction: Glassnode

Bitcoin (BTC) traded above $81,000 on Wednesday as both its on-chain liquidity and futures open interest declined, according to Glassnode's weekly report.

Raydium plans to launch Pumpfun competitor, will this spark a meme coin war?

Solana-based decentralized exchange (DEX) Raydium is allegedly planning to roll out LaunchLab, a new token launchpad that would serve as an alternative to Pump.fun, according to a Blockworks report on Tuesday.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.