Dogecoin price to offer patient investors two opportunities

- Dogecoin price shows signs of weakness after sweeping the liquidity present above equal highs at $0.074.

- A breakdown of the point of control at $0.066 will signal the start of a downtrend to $0.048.

- A daily candlestick close below $0.048 will invalidate the bullish thesis.

Dogecoin price is trying to establish a directional bias as it hovers aimlessly after collecting buy-stop liquidity above equal highs. Investors need to be aware of a potential downswing, especially considering the lack of momentum in Bitcoin price.

Dogecoin price shows no signs of bullish momentum

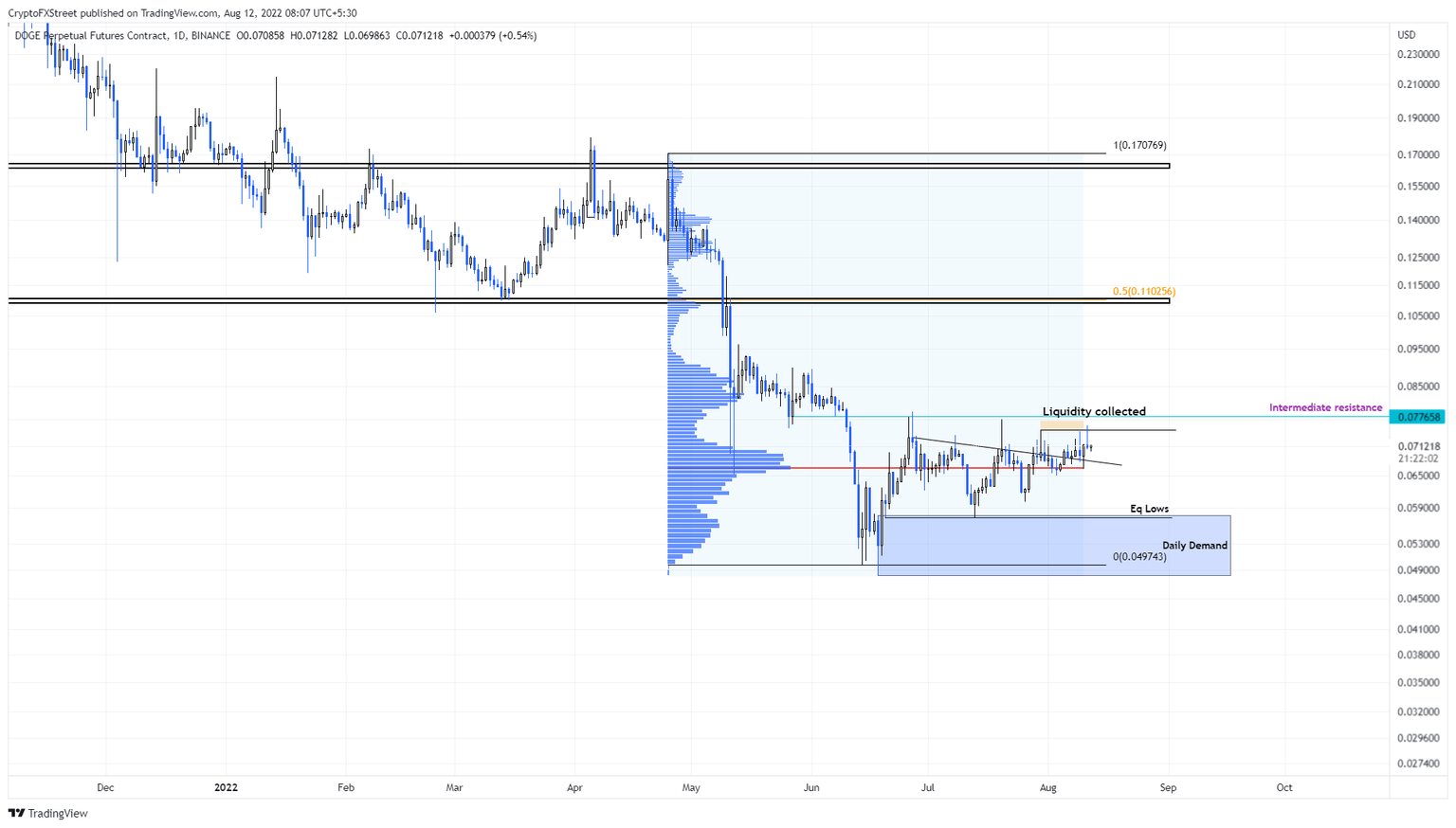

Dogecoin price bounced off the volume point of control (POC) at $0.066 and broke through the declining trend line resistance level to trigger its ascent. However, the bullish momentum fell short after collecting the liquidity resting above the equal highs at $0.074.

While the downtrend is just getting started, investors can expect this to continue as long as Bitcoin price continues to trend downward. A daily candlestick close below the POC at $0.066 will confirm the start of a downtrend.

In such a case, Dogecoin price will most likely revisit the $0.048 to $0.057 demand zone, which is a major support area. A sweep of the equal lows at $0.057 is likely before DOGE triggers an uptrend.

Therefore, market participants can either short this move to $0.057, aka a 19% downswing, or long DOGE after a sweep of the aforementioned level.

The latter scenario will allow a 16% upswing for Dogecoin price that could extend to 35% after a retest of the $0.074 resistance level.

DOGE/USDT 1-day chart

While things are looking up for Dogecoin price, a daily candlestick close below $0.048 will invalidate the bullish thesis for DOGE. In such a case, the meme coin is likely to crash lower, in search of a stable support level at $0.040.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.