Dogecoin price struggles to recover despite fast-paced wallet growth

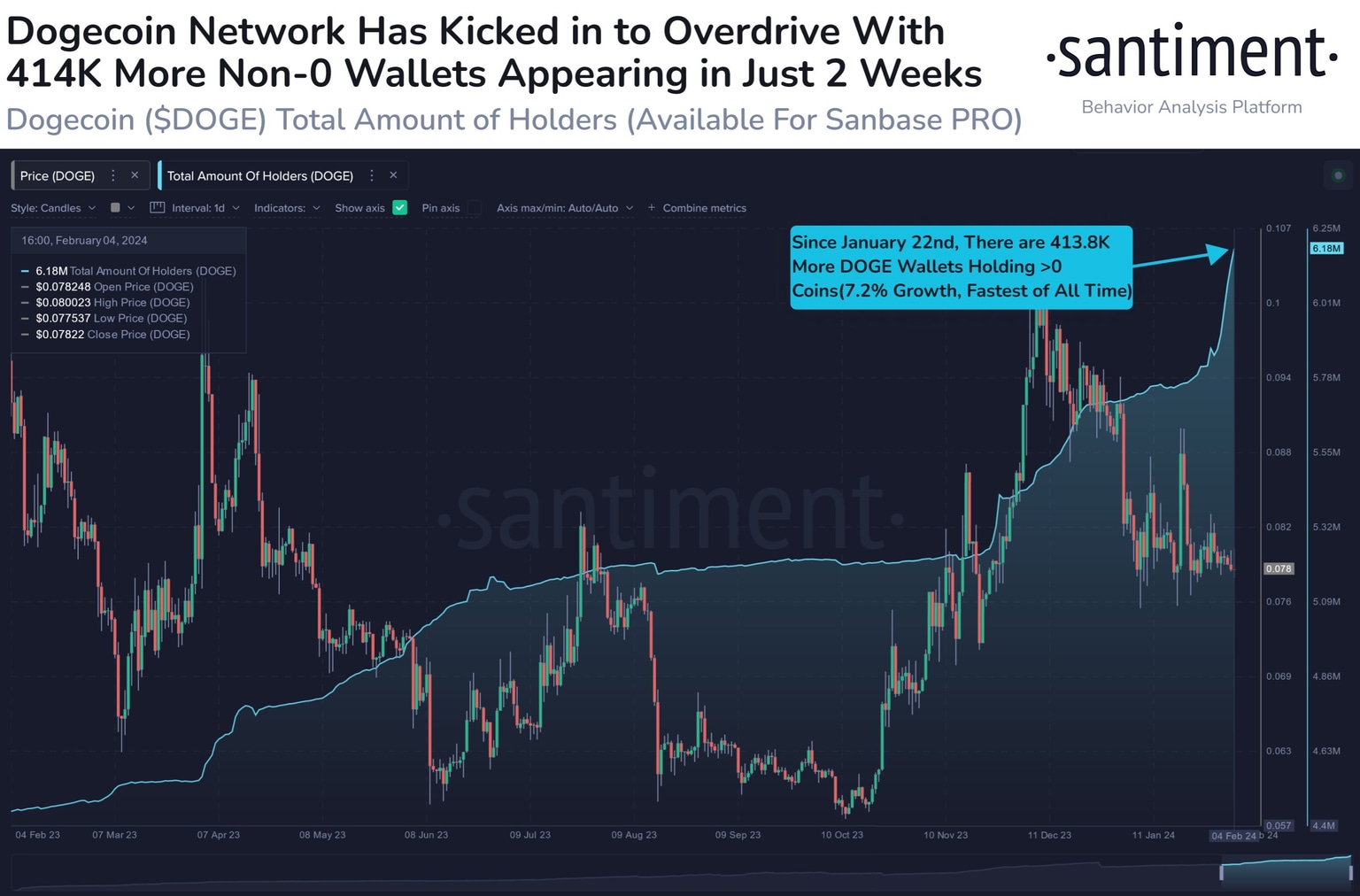

- Dogecoin wallets with non-zero DOGE token holdings are growing at a fast pace.

- Dogecoin added 413,800 new wallets mostly holding 0.0001 to 1 DOGE in the past two weeks.

- DOGE price is at risk of declining to $0.074 before a recovery in Dogecoin.

Dogecoin network’s wallet growth observed a boost in the number of non-zero balance DOGE wallet addresses. DOGE price has struggled to keep up with the pace of Dogecoin’s adoption among market participants.

DOGE price is likely to correct lower to $0.074.

Also read: CYBER Price Forecast: Rally to $8 likely as CyberWallet crosses 900,000 deployments

Dogecoin wallet growth fails to catalyze price recovery

On-chain intelligence tracker Santiment observed that DOGE price declined by nearly 23% between December 9 and February 6. The meme coin’s network added 413,800 new wallets in a two-week timeframe, most of them holding 0.001 to 1 DOGE.

The pace of wallet growth is one of the fastest-recorded rates in Dogecoin’s decade-long existence.

DOGE wallets with non-zero balance. Source: Santiment

DOGE price could suffer further correction

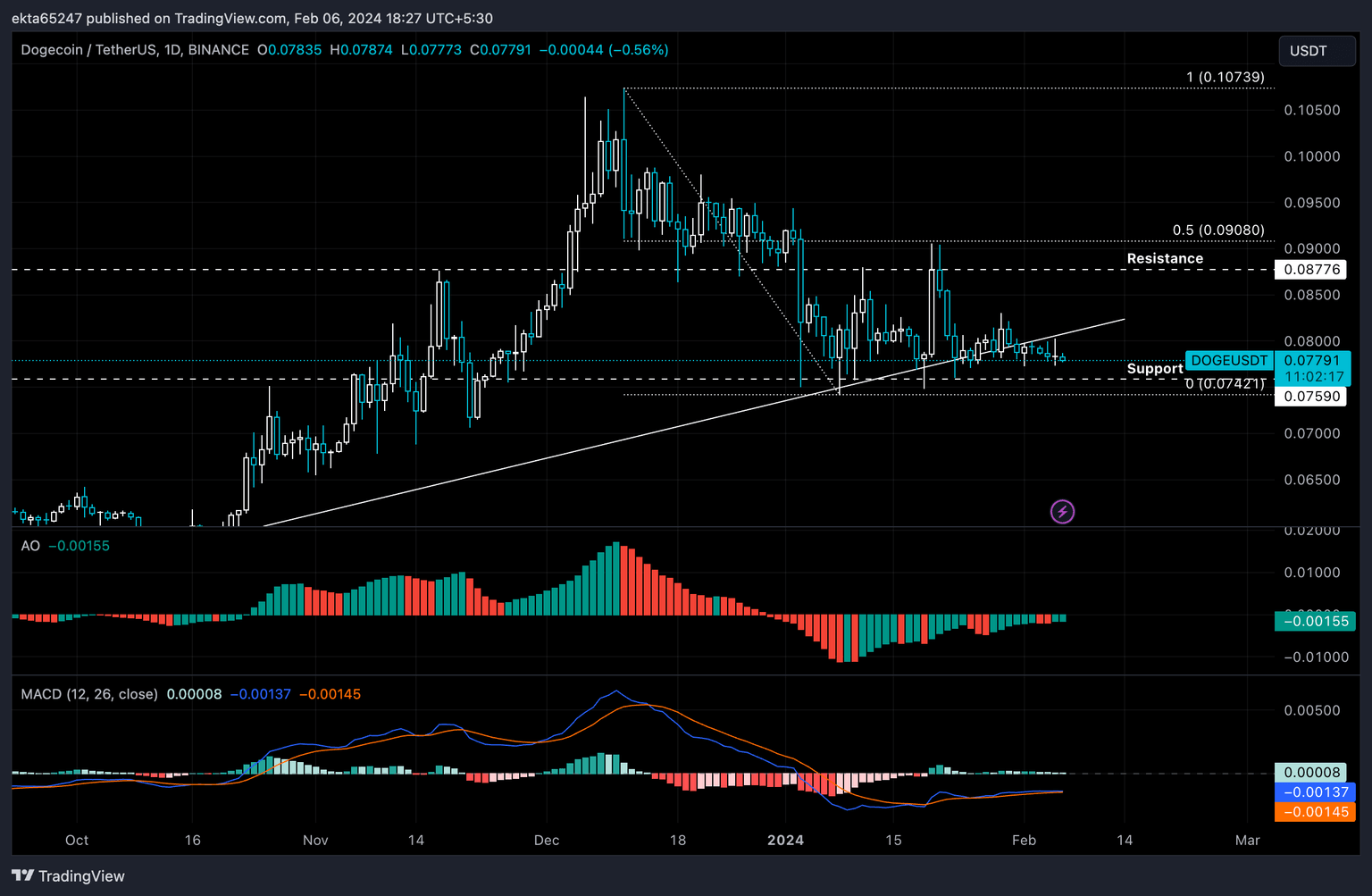

Dogecoin price is likely to correct further as wallet growth fails to catalyze DOGE price recovery. DOGE price has been range bound between its January 29 high of $0.083 and February low of $0.077. At the time of writing, DOGE price is $0.078 on Binance.

DOGE price is likely to correct to support at $0.0759 before a bounce and a rally to its resistance at $0.087. This is likely since the two price levels have acted as support/resistance, consistently, since April 2023.

If bulls succeed in pushing DOGE price past its resistance at $0.087, the meme coin could target the 50% Fibonacci Retracement of the decline between December 11 and January 8, at $0.090.

The two green bars on the Awesome Oscillator (AO) and the green bars on the Moving Average Convergence Divergence (MACD) support the thesis of a recovery in DOGE price. Once the meme coin sweeps support at $0.0759 a recovery is likely.

DOGE/USDT 1-day chart

A daily candlestick close below the February low of $0.077 could invalidate the thesis of price recovery and DOGE price could nosedive to $0.074 in its downward trend.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.