- Dogecoin price has a massive spike from $0.053 to $0.071 in just one hour.

- Elon Musk states that SpaceX will put a literal Dogecoin on the literal moon.

- The pump did not last long as the digital asset is down 17% in the last 12 hours.

Dogecoin has done it again, thanks to Elon Musk, who tweeted that SpaceX will put a literal Dogecoin on the actual moon in space. The tweet had a significant impact on DOGE initially, which saw a massive 30% spike within hours.

SpaceX is going to put a literal Dogecoin on the literal moon

— Elon Musk (@elonmusk) April 1, 2021

However, as the tweet was posted on April 1, many investors were worried about a potential April Fools joke by Musk. The digital asset is down 17% from the top of $0.071.

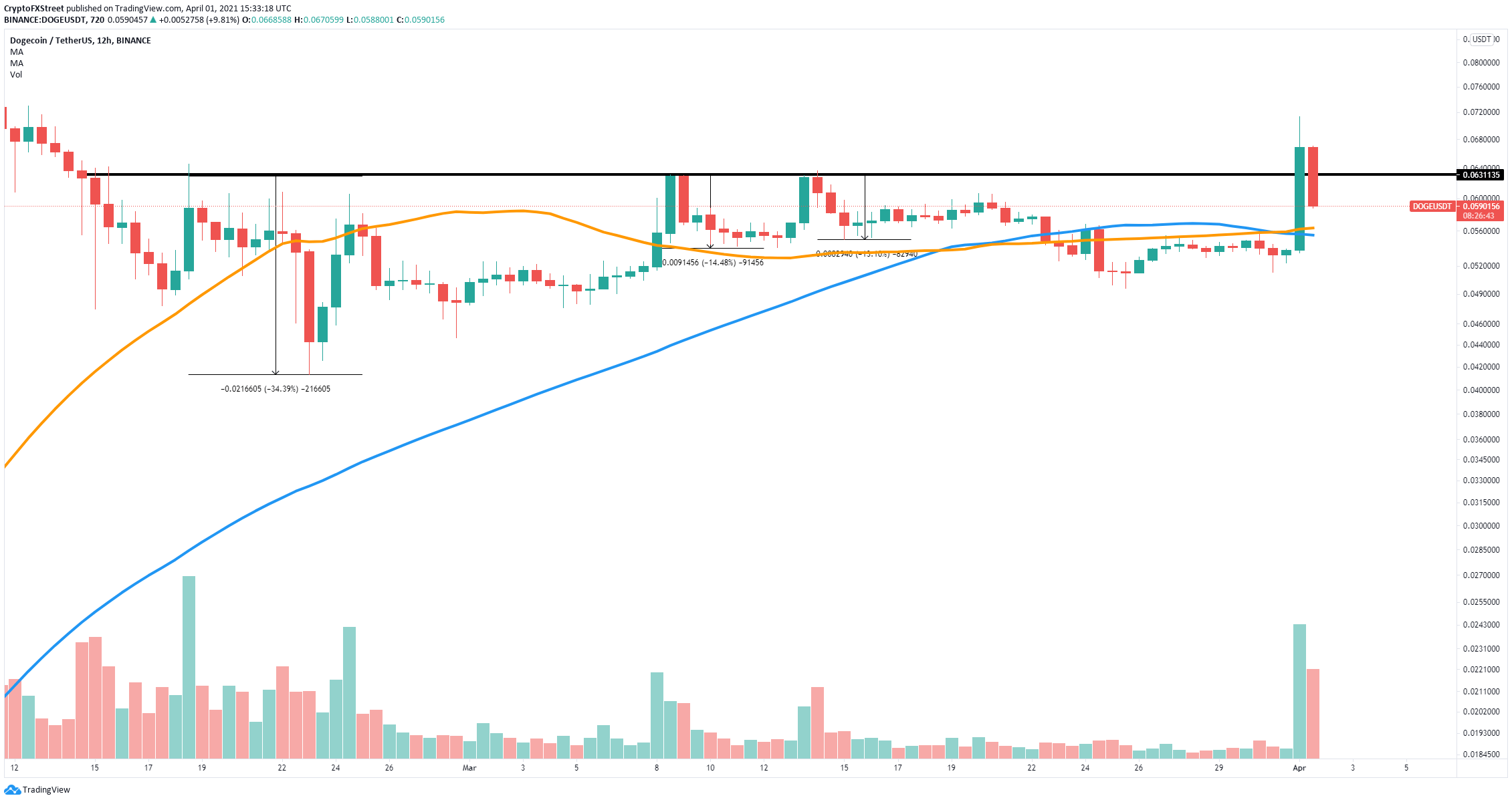

Dogecoin price explodes but can't stay above a critical level

Dogecoin price has struggled to climb above $0.063 since February 15. This massive resistance trendline was broken in the past 12 hours, but DOGE lost it again.

DOGE/USD 12-hour chart

The past three rejections all lead to at least 13% corrections. The most substantial support level is located at $0.056, which coincides with the 50-SMA and the 100-SMA. A move towards this point would represent a 12% correction from the $0.063 trendline resistance.

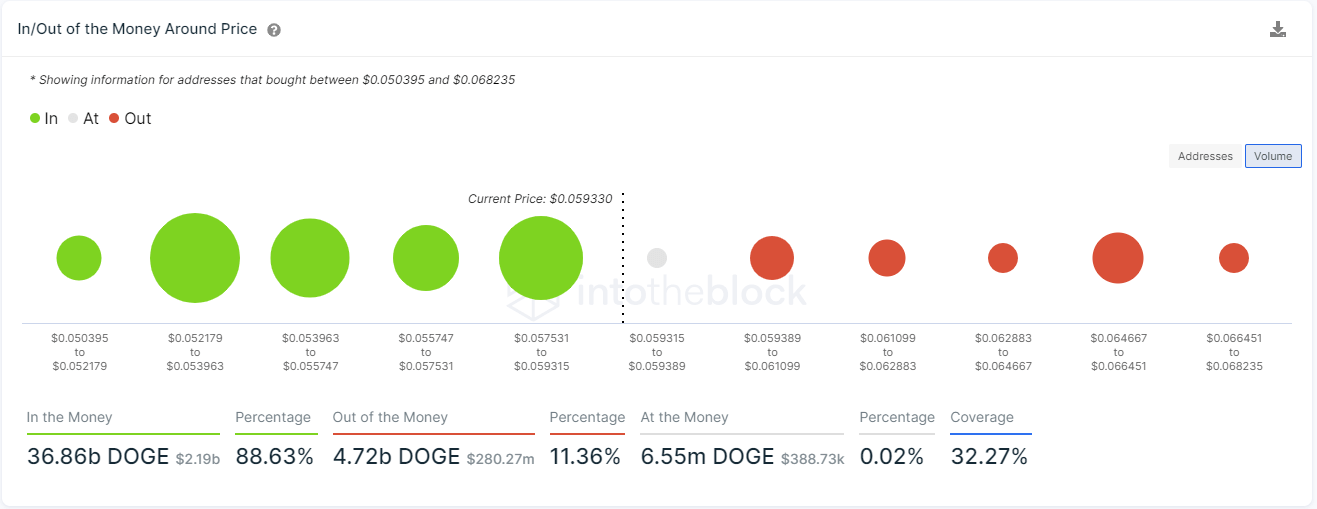

DOGE IOMAP chart

On the other hand, the In/Out of the Money Around Price (IOMAP) chart shows relatively weak resistance ahead in comparison to the support DOGE has. Holding $0.056 could quickly drive Dogecoin price towards the upper trendline at $0.063 again.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin, crypto market remain in uptrend following 25 bps Fed rate cut

Fed Chair Jerome Powell stated that the FOMC lowered the Fed funds rate by 25 basis points. The rate cut comes after Bitcoin reached a new all-time high price upon Donald Trump's election victory. Ethereum and Solana also retained gains of 7% and 4%, respectively, following the rate cut.

XRP sees bullish momentum following $123 million increase in open interest

XRP exchange reserves in Binance and Upbit have declined by nearly $13 million. In the past three days, investors opened over $123 million worth of XRP positions. XRP needs to overcome key descending trendline resistance to stage a rally to $0.6640.

Coinbase launches wrapped Bitcoin token on Solana network

Crypto exchange Coinbase announced on Thursday that it has launched its synthetic Bitcoin token, cbBTC token, on the Solana network, marking its first token issuance on the Layer-1 platform. The new token will allow users to stake Bitcoin on Solana and use it as lending collateral.

Solana Price Forecast: Investors stake $1.3B SOL amid November winning streak

Buoyed by Donald Trump's victory at the polls, the global crypto market entered its third consecutive day on an uptrend on November 7, 2024. Amid the ongoing rally, Solana emerged one of the biggest gainers on Thursday, as demand for native memecoins further propelled market demand for SOL.

Bitcoin: New all-time high at $78,900 looks feasible

Bitcoin price declines over 2% this week, but the bounce from a key technical level on the weekly chart signals chances of hitting a new all-time high in the short term. US spot Bitcoin ETFs posted $596 million in inflows until Thursday despite the increased profit-taking activity.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.