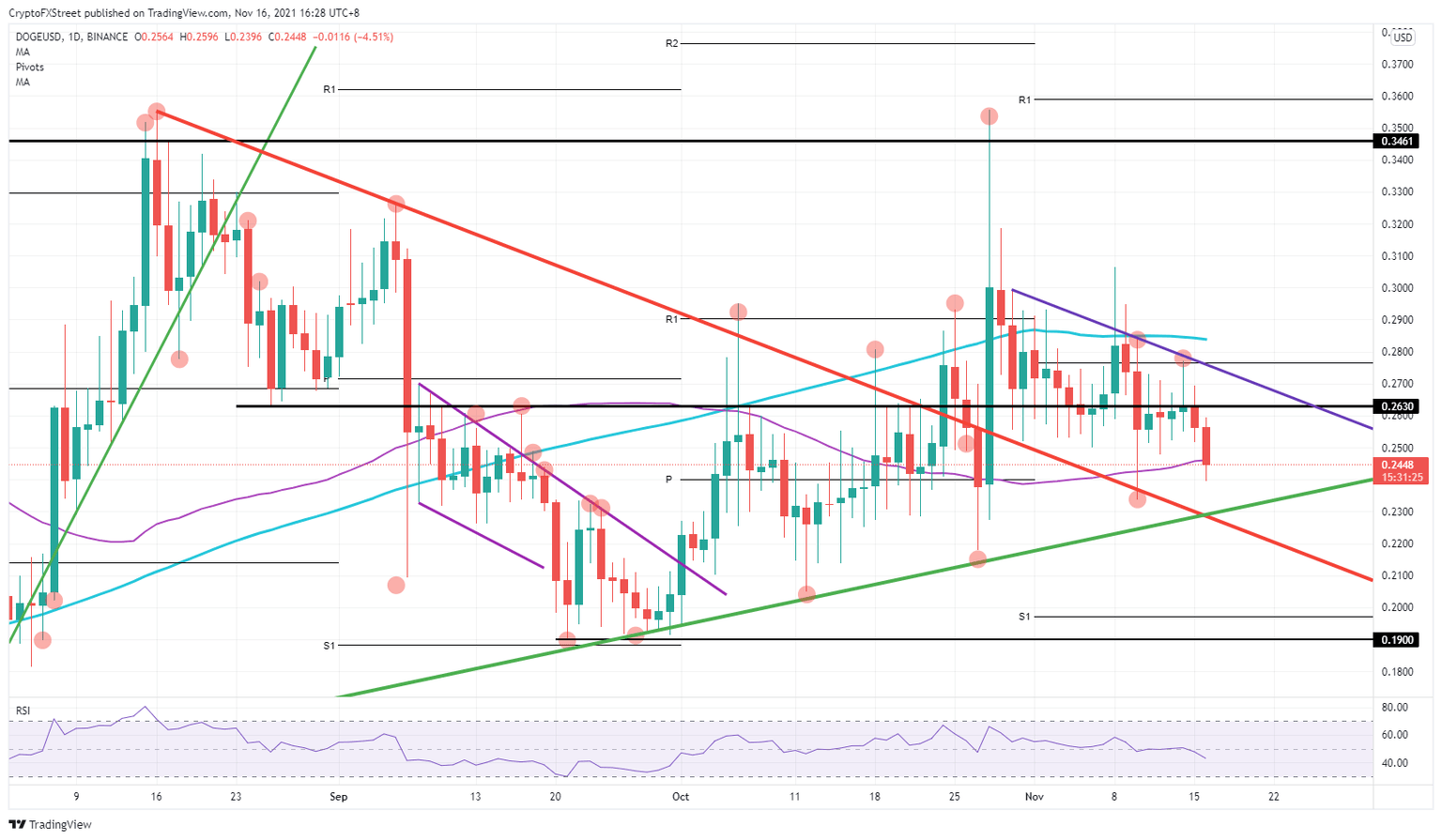

Dogecoin price shifts to the downside and forms a bearish channel

- Dogecoin price is on the back foot as DOGE price slips below $0.26.

- DOGE price accelerated further to the downside, bears have broken the first initial support.

- This correction could hold another 20% of losses.

Dogecoin (DOGE) is under pressure from bears taking over. Price is fading further to the downside leaving the $0.27 monthly pivot behind as it extends its decline.. DOGE price is drifting lower as no solid support levels are there to slow its descent, except for one moving average. Another break would accelerate the correction by another 20% towards $0.20.

Dogecoin price correction could hold another 20% of losses

Dogecoin price is on the back foot as its November fade continues and accelerates. Bulls tried their last attempt to break above the monthly pivot at $0.28, but failed and with the start of this week, DOGE price already corrected 10%. The 55-day Simple Moving Average (SMA) at $0.25 looks to be trying to halt the selling pressure, but as it stands alone with no other support of any kind, it is not expected to slow the sell-off, which means there is no real entry point for bulls to reverse course.

DOGE price sees bears starting their sell-off from an upper channel line, marked in purple on the chart, that looks to be symmetrical with the red descending trend line. A bearish trend channel looks to be forming, which could start to accelerate further downward moves. On the downside, the green and red trend lines are forming an intersection around $0.23, which is, for now, the only fundamental supporting element in the near vicinity.

DOGE/USD daily chart

Should that intersection point break and see bears pushing DOGE price below the red descending trend line, expect an acceleration of the losses with another 20% towards $0.20-$0.19. This area holds the monthly S1 support level and the low of September, which should give bulls an excellent incentive to pick up some DOGE coins as the price will be trading at a good discount. With that, the RSI will trade in an oversold area and see sellers booking profits as sell-side volume dries up.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.