Dogecoin price set for 20% rally

- Dogecoin price finds support near 200-day Exponential Moving Average.

- On-chain data suggests DOGE’s development activity is rising.

- A daily candlestick close below $0.128 would invalidate the bullish thesis.

Dogecoin (DOGE) price could experience a 20% rally in the short to medium term, according to technical indicators and on-chain metrics, as the dog-based meme coin finds support on key levels amid a rise in development activity.

Dogecoin price shows potential

Dogecoin price finds support around its 200-day Exponential Moving Average (EMA) at $0.132.

This level roughly coincides with the 61.8% Fibonacci retracement level at $0.133, drawn from the swing low of $0.074 on January 8 to a swing high of $0.229 on March 28.

If this support level of $0.132 holds, DOGE could rally 20% from its current trading price of $0.141 to tag the $0.175 daily high from May 26.

If the bulls are aggressive and the overall crypto market outlook is positive, then DOGE could extend an additional rally of 14% to the bearish order block area, which extends between $0.198 and $0.202. A bearish order block refers to specific price areas where large market participants, such as institutional traders, have previously placed significant sell orders.

DOGE/USDT 1-day chart

Santiment’s Development Activity metric tracks the frequency of project development events recorded in the public GitHub repository over time.

A rise in this metric usually suggests continuous endeavors to uphold, innovate and improve the protocol, which is generally seen as favorable by investors and stakeholders. Conversely, a decline in the metric might raise apprehensions about the project's endurance, capacity for innovation, and engagement with the community in the foreseeable future.

As in DOGE’s case, the index rose from 0.166 on June 11 to 0.452 on June 13. This rise in DOGE's Developing Activity adds further credence to the bullish outlook.

%2520%5B20.31.49%2C%252013%2520Jun%2C%25202024%5D-638538931460209609.png&w=1536&q=95)

DOGE Development Activity chart

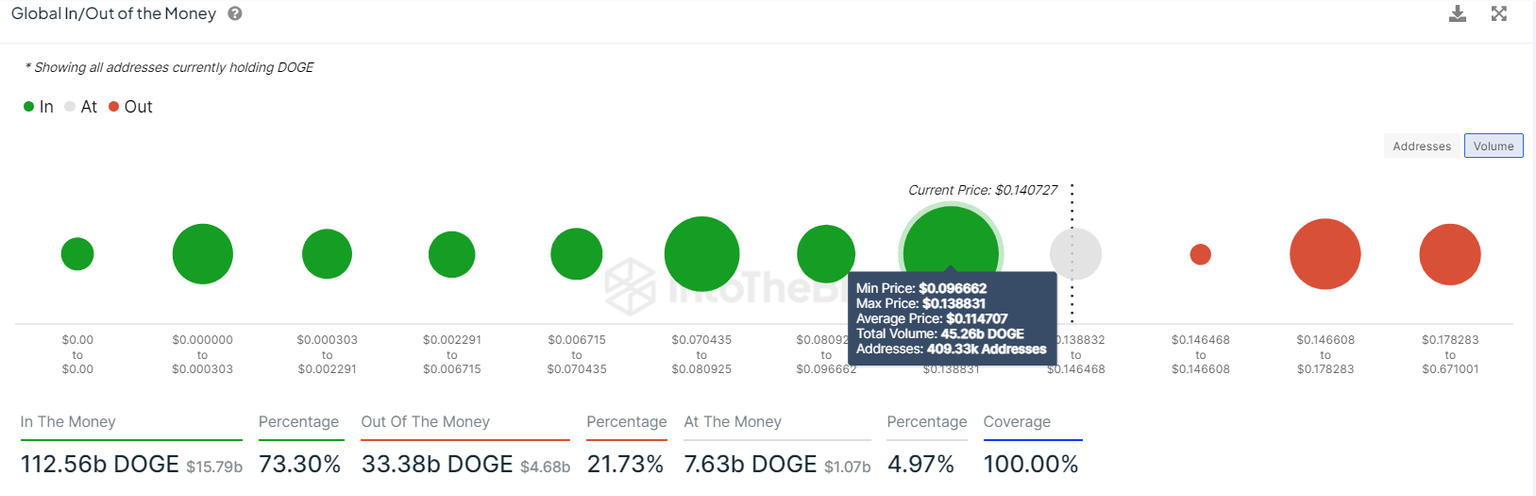

Based on IntoTheBlock's Global In/Out of the Money (GIOM), nearly 409,330 addresses accumulated 45.26 billion DOGE tokens at an average price of $0.114 These addresses bought the dog-based meme token between $0.096 and $0.138, which makes it a key support zone. These investors will likely add more to their holdings if the price retraces.

Interestingly, the $0.096 to $0.138 zone mentioned from a technical analysis perspective coincides with the GIOM findings, making this zone a key reversal zone to watch.

DOGE GIOM chart

Even though the on-chain metric and technical analysis point to a bullish outlook, if DOGE’s daily candlestick closes below $0.128, the daily support level, this move would invalidate the bullish thesis by producing a lower low on a daily timeframe. This development could see Dogecoin's price fall 8% to the weekly support level of $0.118.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.