- Dogecoin price on a knife’s edge, significant drop forecasted if buyers dry up.

- Bullish fundamental data regarding the Dogecoin-funded DOGE-1 satellite fails to entice buying.

- The threshold to keep Dogecoin from falling becomes increasingly difficult to overcome.

Dogecoin price has, like the majority of the cryptocurrency market, faced strong selling over the past few days. But unlike most altcoins, Dogecoin is positioned against an imminent price collapse.

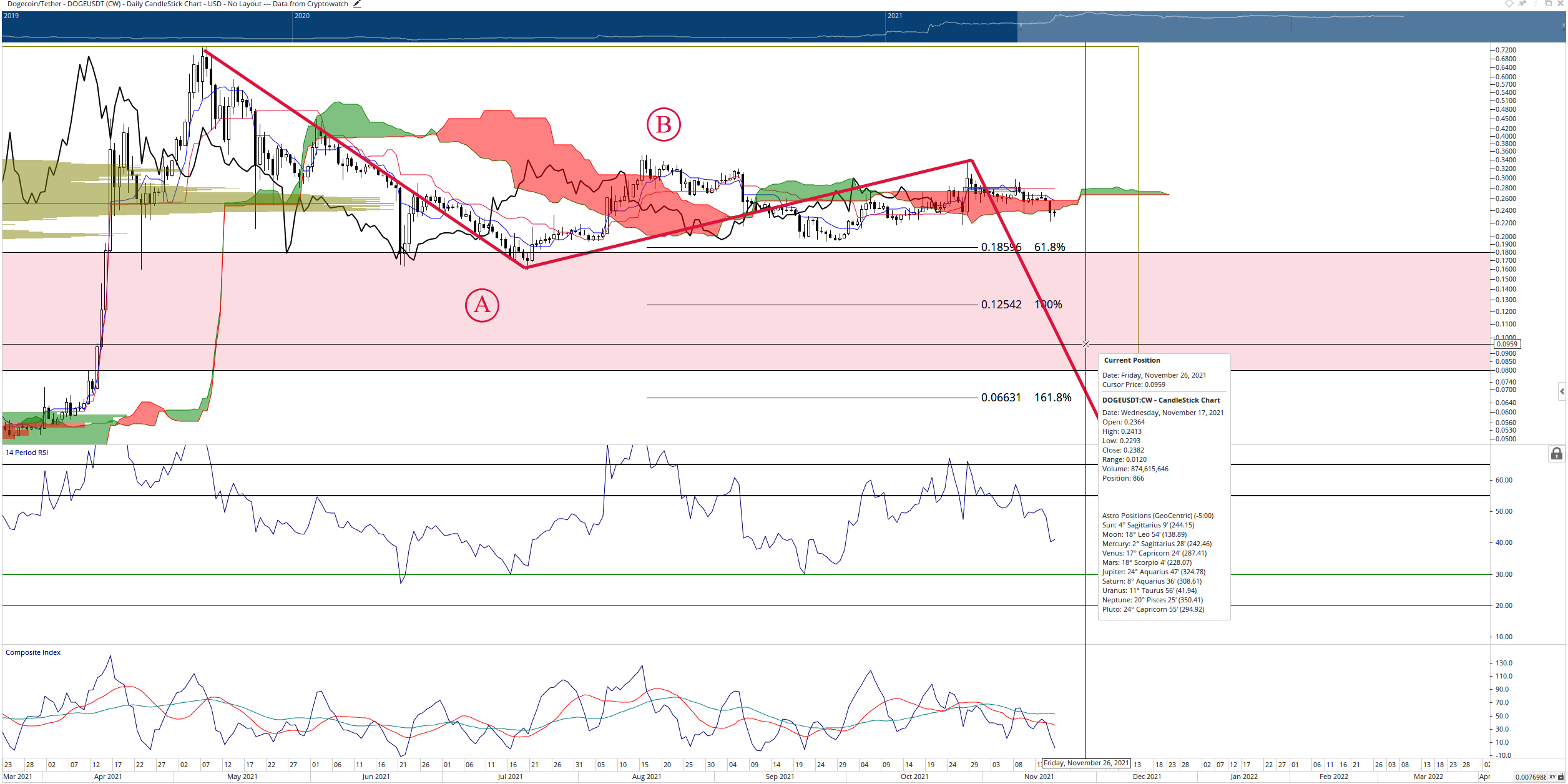

Dogecoin price at risk of dropping to $0.18, could drop over 75% to $0.08

Dogecoin price is at a tipping point. A close at or below the $0.23 value area would likely create a fast move to the $0.18 level. From there, Dogecoin is at its greatest risk of a downside move.

A look at the 2021 Volume Profile shows an extremely thin traded range between $0.18 and $0.08 – almost no trading has occurred between those price levels. This is concerning because price treats those low volume levels like a vacuum. In other words, if Dogecoin price were to drop below $0.18, then it is likely to get ‘sucked’ into a vacuum of vacant volume to the next high volume node. The following high-volume node doesn’t appear until $0.08 - $0.09.

Despite the bullish news about an upcoming moon satellite entirely funded by Dogecoin and christened DOGE-1, there has been little interest to support Dogecoin price. This can be observed by looking at the oscillators. The Composite Index is at an angle where it will cross below its moving averages very soon. Additionally, the Relative Strength Index is rejected against the first overbought level in a bear market at 55.

DOGE/USDT Daily Ichimoku Chart

Dogecoin price has a difficult path to invalidate any near-term bearish outlook. Because of the Volume Profile, it is easier for Dogecoin to move lower than it is to move higher. Dogecoin also needs to close above all of its Ichimoku levels on the weekly chart to return to a clear bull market. That will only happen if Dogecoin can rally and close to at least $0.38.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Chainlink looks at $14 resistance as outflows from exchanges signal continued demand

Chainlink exchange outflows exceed $120 million in the last 30 days, hinting at increasing accumulation. The breakout from a falling wedge technical pattern and an uptrending RSI indicator signal stronger bullish momentum.

Bitcoin extends gains toward $90,000 as ETFs inflows exceed $381 million

Bitcoin is extending its gains, trading above $88,000 at the time of writing on Tuesday after rising nearly 3% the previous day. Institutional demand seems to be supporting BTC’s recent price rally, with US spot ETFs recording an inflow of $381.40 million on Monday.

Top 3 gainers Fartcoin, POL, DeepBook: Altcoins surge as Bitcoin nears $90,000

Investors in select altcoins like Fartcoin, POL and DeepBook welcome double-digit gains. Bitcoin inches closer to $90,000, potentially waking up as digital Gold amid uncertainty in the macro environment.

Hyperliquid updates validator to 21 permissionless nodes, HYPE price breaks out

Hyperliquid’s validator update allows anyone to register, with the 21 largest stakes forming the active set. Validators must lock up 10,000 HYPE for one year, whether in the active set or not.

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.