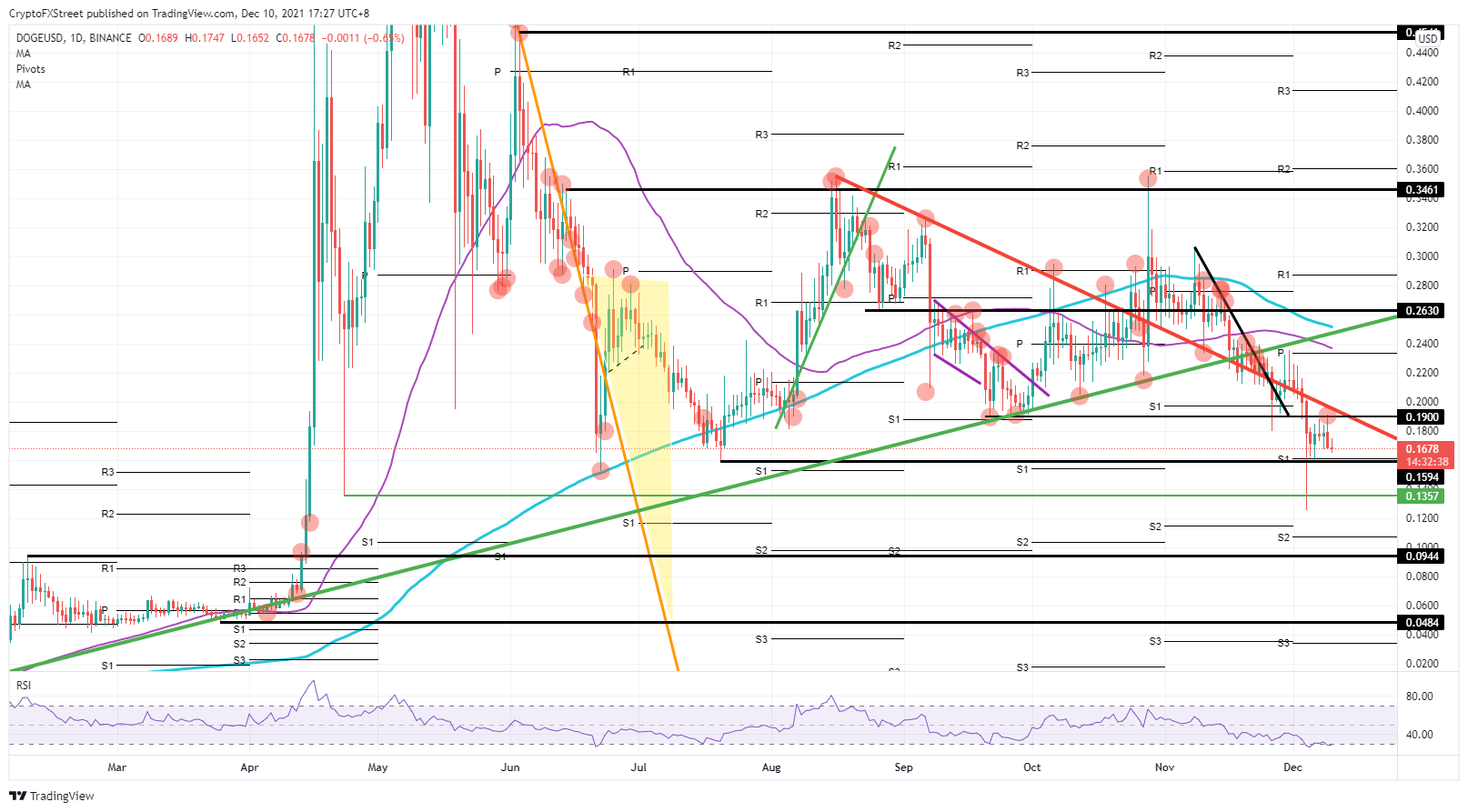

- Dogecoin price rejected by top of the $0.19 double bottom.

- DOGE now sees bulls trying to defend $0.16 – a historical and monthly S1 support level.

- A break below could trigger an aggressive sell-off, resulting in a 40% devaluation for Dogecoin.

Dogecoin (DOGE) price is continuing its downtrend which has strengthened after bears seized the opportunity to add even more short positions, following the rejection at the $0.19 ceiling. Currently, tailwinds look to be fading for cryptocurrencies and bulls are unlikely to find much external support to try and defend the $0.16 floor. A break below there could spiral into a price correction to under $0.1, holding a 40% possible devaluation for DOGE.

Dogecoin price sees bears targeting $0.09 to the downside

Dogecoin price took another leg lower in its downtrend this week, below $0.19. The DOGE price started to normalize after a turbulent weekend, with bulls trying to reclaim $0.19 but they got rejected as bears seized the momentum, squeezing them out of their positions. As price action in DOGE now looks to test $0.16, bulls are scrambling to defend both the historical level and the monthly S1 support level, but without any tailwinds behind them to help.

DOGE looks ripe for the break to the downside below $0.16, as not many elements seem to be standing in the way. Bears will likely have a smooth run to the downside with only the monthly S2 support around $0.10 and the historical support level at $0.09 standing in the way. The Relative Strength Index (RSI) will by then likely be trading highly in the oversold zone, indicating the correction will probably halt at these levels as buyers renter the market seeing an opportunity to pick up DOGE at a discount.

DOGE/USD daily chart

If bulls can defend and hold $0.16, a return to $0.19 is likely – but again with the risk of another rejection. If market sentiment turns more positive for crypto this could act as a catalyst to push DOGE price above $0.19 and see a return to possibly $0.26, depending on the strength and number of factors. The issue is that both the 55-day and the 200-day Simple Moving Averages are hovering just above the monthly pivot around $0.24, making it quite a challenge to reach $0.26 in one rally.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto Today: Traders discuss Solana futures and Ethereum Hoodi update as Bitcoin price stalls at $83,000

Amid a 2% decrease in market capitalization, crypto trading volume surges 42% to $87.2 billion in the last 24 hours, signalling active capital rotation. Bitcoin price stagnates below $85,000 as Gold enters a record rally to $3,000 ahead of the US Fed rate decision.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH, XRP gain as MicroStrategy buys $10.7 million BTC

Bitcoin (BTC) daily price chart shows signs of recovery in the largest cryptocurrency. Strategy, one of the largest corporate holders of Bitcoin, acquired another 130 BTC last week, according to an announcement on Monday.

Top Formula 1 crypto sponsors rally, racing fans gain from Binance Coin, OKB, ApeCoin and Crypto.com

The 2025 Formula 1 season kicked off in Australia last week with a lineup of crypto sponsors for half of the teams. Racing giants are powered by sponsors like crypto exchanges Binance, OKX, ApeCoin, and Crypto.com, among other NFT and trading platforms.

SEC pumps brakes on altcoin ETFs, institutional interest remains

The US SEC postponed its decisions on several spot altcoin ETF applications this week, including those for Litecoin, XRP and Solana. A K33 Research report shows there is consensus but the agency is waiting the confirmation of Trump’s nominee for SEC Chair.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.