Dogecoin Price Prediction: DOGE to rebound to $0.21

- Dogecoin price made new 2022 lows.

- Downtrend officially exceeds one year in length.

- Strong corrective move incoming.

Dogecoin price action tanked on Monday, following the rest of the cryptocurrency market's massive collapse. DOGE closed Monday with an 18% loss, just slightly above the daily low that constituted 20% decline overall. But a change in direction may be coming soon.

Dogecoin price bounces off of new 2022 and YTD lows

Dogecoin price hit a major milestone in time and price. DOGE is now in a downtrend that exceeds 365 days. Today's new YTD and 2022 low represents an 87% loss from the all-time high made on May 8, 2021. However, the extremity of the current down drive has created an aggressive long setup for DOGE.

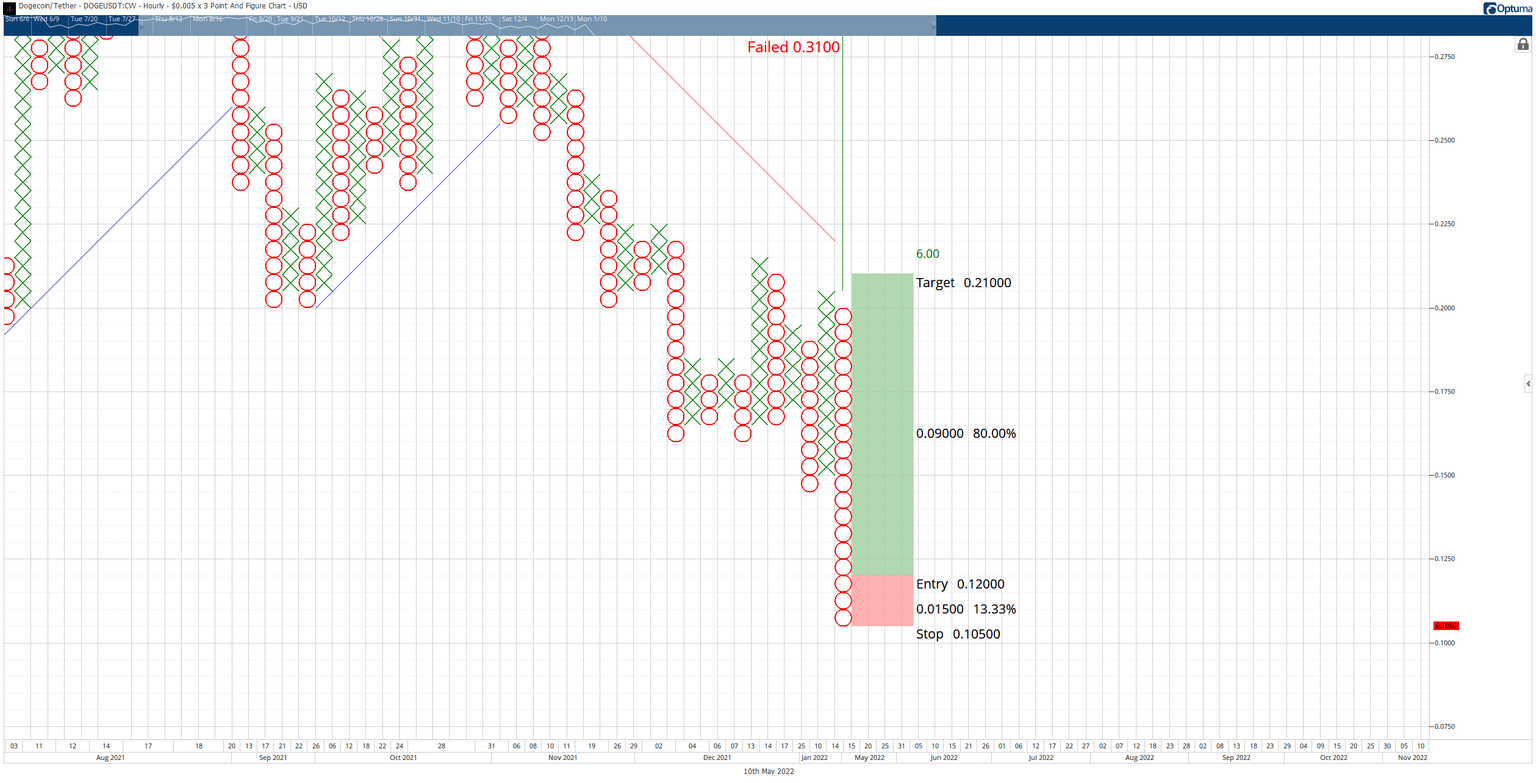

A hypothetical long entry for Dogecoin price now exists on its $0.005/3-box reversal Point and Figure chart. The setup is a buy stop order at $0.12, a stop loss at $0.105, and a profit target at $0.22. In addition, a trailing stop of two to three-box is an option and would help protect against any implied profit made post entry.

The long setup for Dogecoin price is based on a Spike Pattern. The Spike Pattern in Point and Figure is a column with fifteen or more Xs or Os. It is considered a move that has hit an extreme and is due for a strong corrective move that can often convert into a broader trend change.

The projected profit target is below the dominant bear market angle (red diagonal line). It is also the 50% Fibonacci retracement on the weekly Ichimoku chart. The hypothetical long setup represents a 6:1 reward for the risk.

$0.005/3-box Reversal Point and Figure Chart

There is no invalidation point on a Spike Pattern because the entry is always on the 3-box reversal. If the current O-column moves lower, then the entry and stop loss for Dogecoin price moves in tandem with the new low. The profit target remains the same.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.