Dogecoin Price Prediction: DOGE stands in a no-trade zone awaiting a potential 33% move

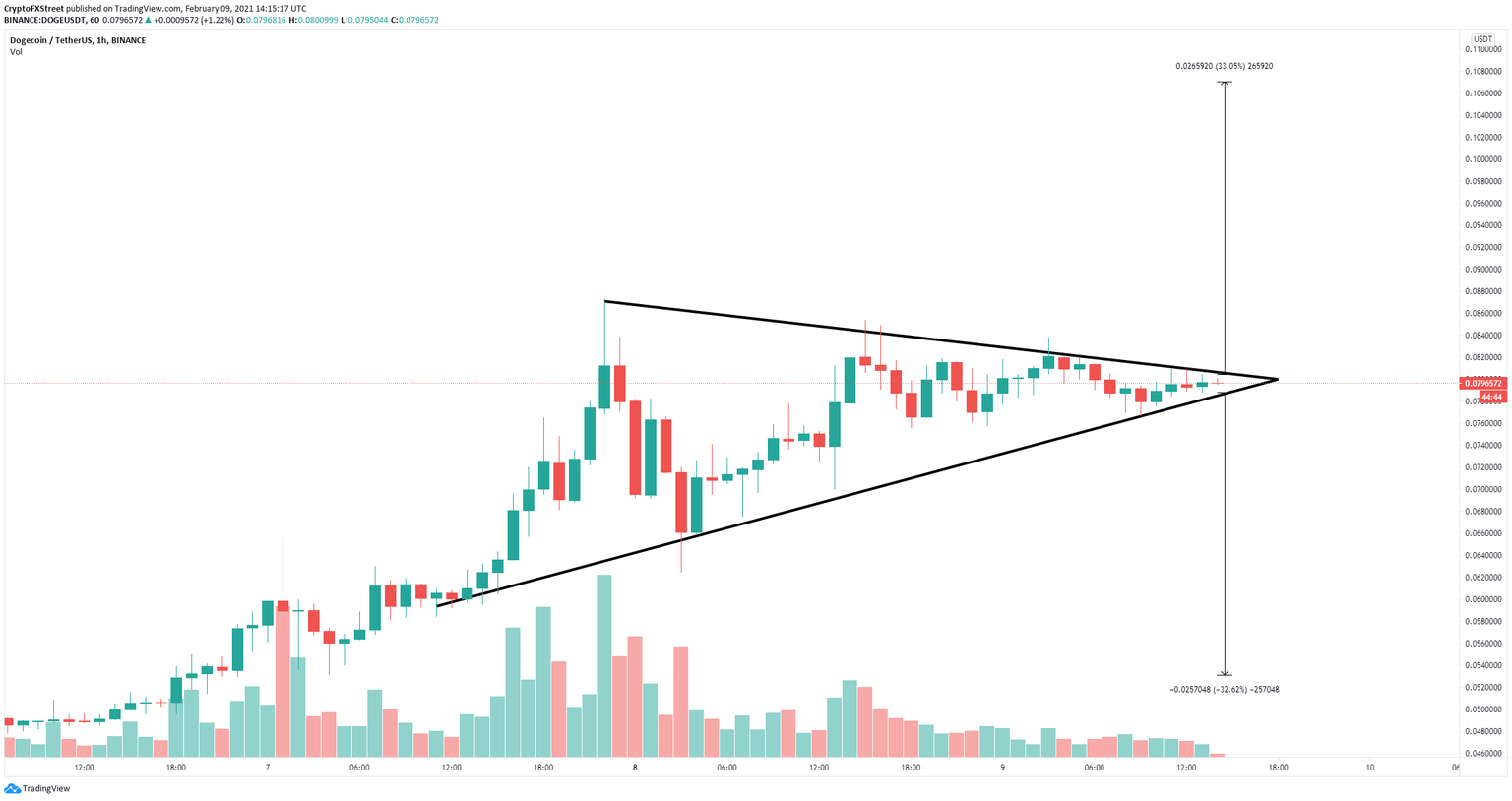

- Dogecoin price is contained inside a symmetrical triangle pattern on the 1-hour chart.

- The pattern is on the verge of bursting and can push DOGE by up to 33%.

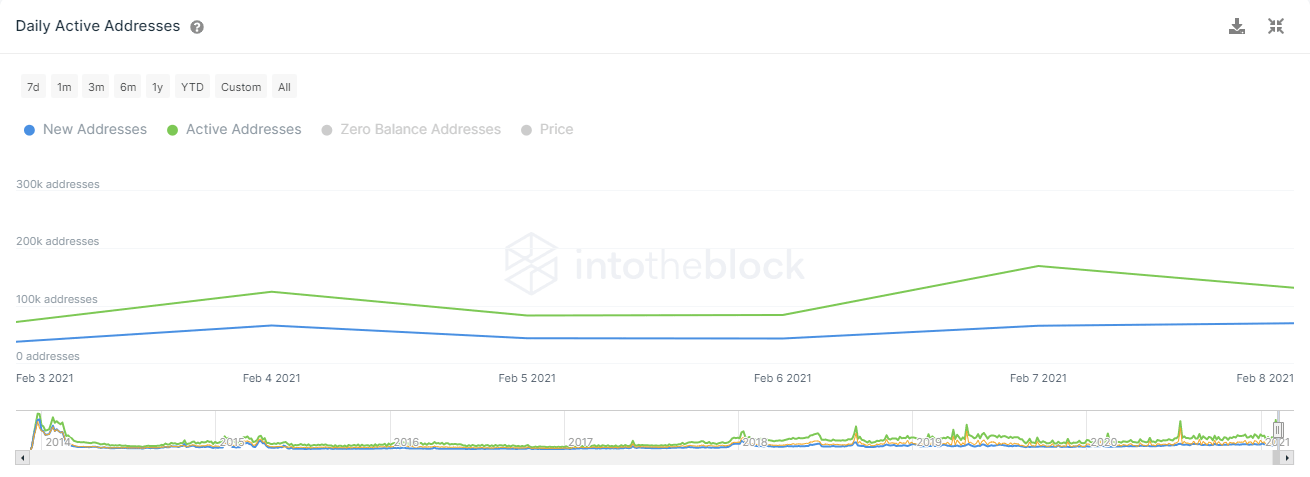

- Another increase in network growth shows bulls might have the upper hand.

After several massive moves thanks to Elon Musk, Dogecoin has finally calmed down in the past 24 hours. The digital asset is currently inside a symmetrical triangle pattern and it’s on the verge of a massive price move.

Dogecoin price awaits a massive explosion as volatility fades away

On the 1-hour chart, Dogecoin has established a symmetrical triangle pattern which is on the verge of bursting. The resistance level is located at $0.0806, a breakout above this point would drive Dogecoin price towards $0.106, a 33% move.

DOGE/USD 1-hour chart

It seems that DOGE bulls have the upper hand as the network growth of the digital asset has continued to rise. The number of new addresses joining Dogecoin’s blockchain has increased by 33% in the past week. Similarly, the amount of active addresses on the network also grew by 28%.

DOGE Network Growth chart

Nonetheless, a breakdown is also entirely possible as both support and resistance levels are extremely close to each other. Losing $0.078 would quickly drive Dogecoin price down to $0.053.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.