- Dogecoin price looks ready for a 64% climb as it moves higher toward the upper boundary of the symmetrical triangle pattern.

- A break above $0.269 could put the bullish target of $0.435 on the radar.

- DOGE may discover a strong foothold at $0.242 if selling pressure spikes.

Dogecoin price is preparing for a 64% rally, but the dog-themed token has one last hurdle to overcome before the bullish target is in the offing. DOGE must climb above the descending resistance trend line that has acted as a headwind for the token since June 3.

Dogecoin price to clear one last barrier

Dogecoin price has formed a symmetrical triangle pattern on the daily chart as the bulls catch their breath. While DOGE consolidates, the token is supported by a few significant technical indicators, suggesting that the token is poised to aim higher.

The prevailing chart pattern suggests a 64% climb for Dogecoin price if the token manages to slice above the upper boundary of the technical pattern at $0.269. Before the bulls can anticipate a bull run toward the optimistic target, DOGE would also need to conquer the nearest resistance at 50% Fibonacci retracement level at $0.255.

If a spike in buying pressure occurs, and Dogecoin breaks above $0.27, DOGE would be met with another obstacle at the 61.8% Fibonacci retracement level, coinciding with the 200-day Simple Moving Average (SMA) at $0.277.

Additional hurdles may emerge at the 78.6% Fibonacci retracement level at $0.310, then at the August 16 high at $0.351 before eventually reaching the aforementioned bullish target at $0.435.

DOGE/USDT daily chart

Given that Dogecoin price is still trapped in a consolidation pattern, DOGE could still oscillate within the governing technical pattern until a decisive move toward the upside, accompanied by a surge in buy orders. Until then, the dog-themed token may be exposed to minor sell-offs, in which case the nearest foothold at the 100-day SMA at $0.242 will act as substantial support.

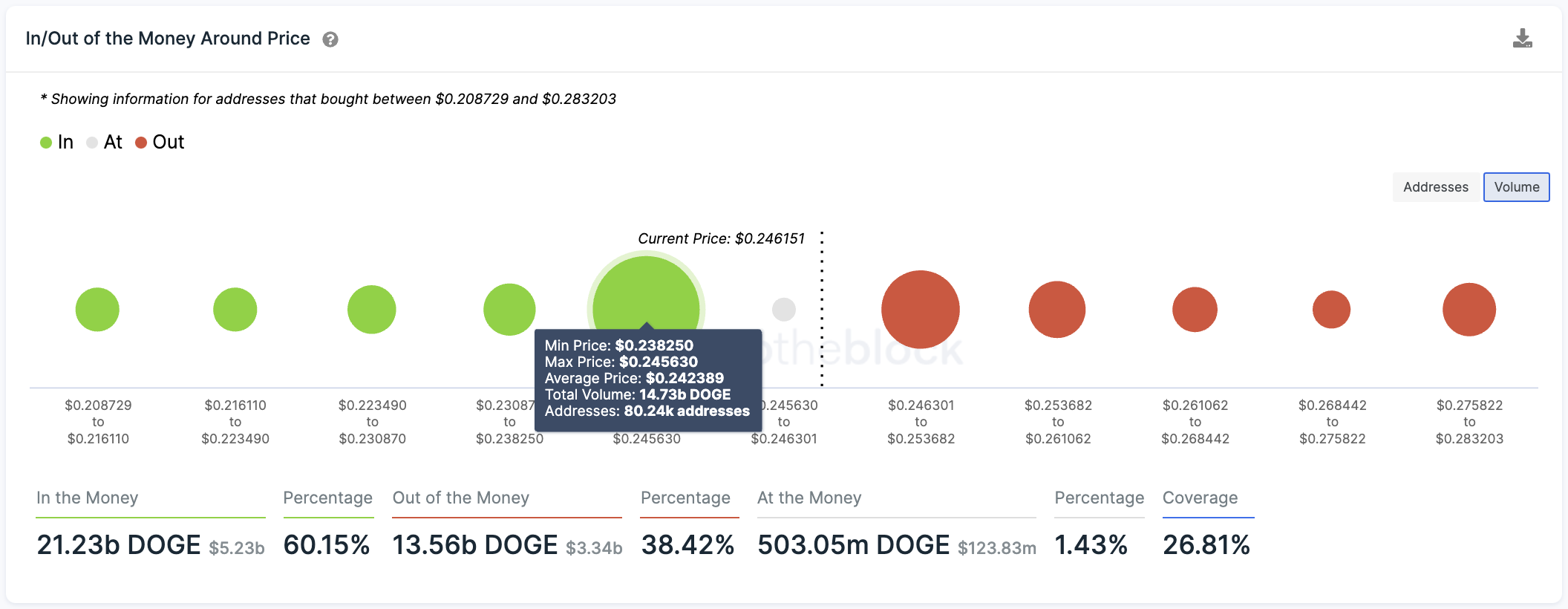

Adding credence to the strength of this support level is IntotheBlock’s In/Out of Money Around Price (IOMAP), indicating that 80,240 addresses purchased 14.73 billion DOGE at an average price of $0.242.

DOGE IOMAP

Additional lines of defense will appear at the 20-day and 50-day SMAs, which sit at $0.238 before dropping lower toward the 38.2% Fibonacci retracement level at $0.233. Only a rise in selling pressure would see Dogecoin price tag the lower boundary of the triangle at $0.213.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Top 3 gainers Supra, Cosmos Hub, EOS: Supra leads recovery after Trump’s tariffs announcement

Supra’s 25% surge on Friday calls attention to lesser-known cryptocurrencies as Bitcoin, Ethereum and XRP struggle. Cosmos Hub remains range-bound while bulls focus on a potential inverse head-and-shoulders pattern breakout.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin price remains under selling pressure around $82,000 on Friday after failing to close above key resistance earlier this week. Donald Trump’s tariff announcement on Wednesday swept $200 billion from total crypto market capitalization and triggered a wave of liquidations.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker is back above $1,300 on Friday after extending its lower leg to $1,231 the previous day. MKR’s rebound has erased the drawdown that followed United States President Donald Trump’s ‘Liberaton Day’ tariffs on Wednesday, which targeted 100 countries.

Gold shines in Q1 while Bitcoin stumbles

Gold gains nearly 20%, reaching a peak of $3,167, while Bitcoin nosedives nearly 12%, reaching a low of $76,606, in Q1 2025. In Q1, the World Gold ETF's net inflows totalled 155 tonnes, while the Bitcoin spot ETF showed a net inflow of near $1 billion.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.