- Dogecoin gets ready for a massive upswing to $0.09 despite the barrier at $0.05.

- The increased social buzz around Dogecoin could see investor sentiment grow.

- The IOMAP reveals that robust seller congestion may hinder the expected upsurge.

Dogecoin continues to stir interest across the cryptocurrency market. Speculation shoot up after a tweet by Elon Musk, the founder of Tesla. At the time of writing, DOGE is trading at $0.046 after hitting a barrier at $0.055. Support is needed to place the ‘Meme Coin’ back on the recovery trajectory eyeing $0.09.

Dogecoin must flip crucial resistance into support to sustain the uptrend

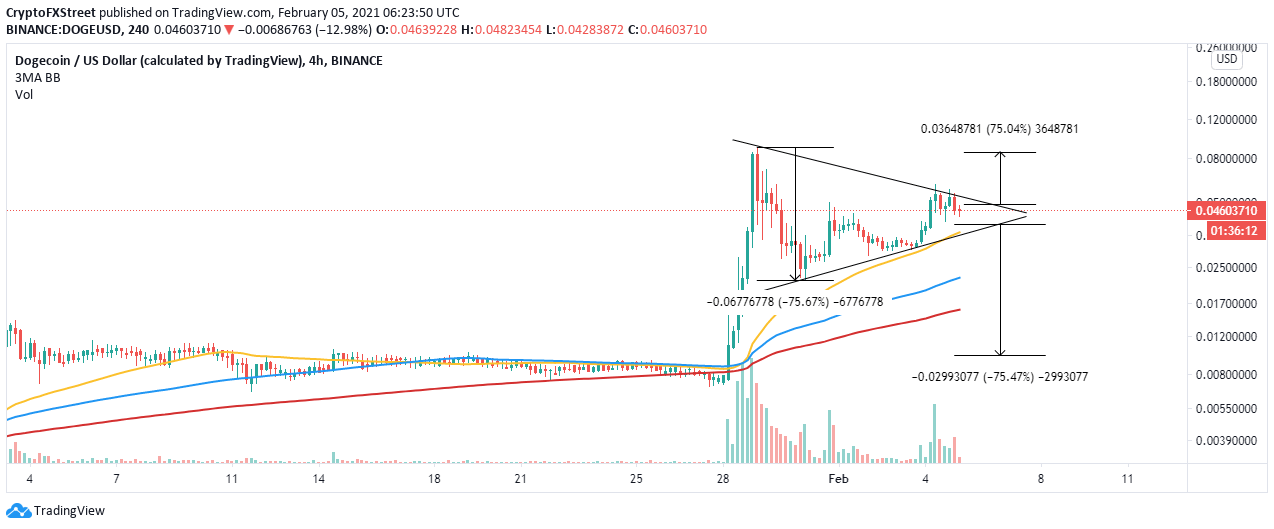

DOGE is dancing at the apex of a symmetrical triangle. The pattern is created by connecting a series of lower highs with a trendline. Similarly, the asset’s higher lows are linked using another trendline.

Traders usually lookout for breakouts or breakdowns from the triangle. A breakout occurs after the price slices through the upper trendline. In the case of Dogecoin, a 75% upswing may come into action if the price rises above the pattern. Triangles are essential in trend prediction because they have exact price targets measured from the highest to lowest points.

DOGE/USD 4-hour chart

According to the Santiment, Dogecoin’s social media-related mentions have started to increase consistently after falling massively early this week. An increase in social volume is a bullish signal and foresees a price rise. However, it is essential to watch out for the peak as it quickly turns bearish.

Dogecoin social volume

Looking at the other side of the fence

The IOMAP model by IntoTheBlock brings to light a strong resistance that could derail the upswing. This seller congestion zone runs from $0.046 to $0.048. Here, roughly 49,000 addresses had previously purchased nearly 9.4 billion DOGE. The investors in this range will be trying to come out of their positions, adding to the selling pressure.

Dogecoin IOMAP chart

On the downside, support exists but not as strong as the above resistance. Therefore, bulls must push for gains above $0.05 to avert potentially massive losses. Besides, the symmetrical triangle pattern suggests that a breakdown may extend to $0.0096.

The 50 Simple Moving Average, the 100 SMA, and the 200 SMA are in line to absorb the selling, thus preventing a sharp price drop.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

%20[09.28.03,%2005%20Feb,%202021]-637481049176604851.png)

-637481077047197338.png)