Dogecoin Price Prediction: DOGE gets a harsh lesson on ‘No means No!’

- Dogecoin price faced another firm rejection after a rejection last week.

- DOGE is set to dip lower in search of support from the next technical element.

- The decline could mount up to 22% of losses this week, making it a 33% decline in fourteen days.

Dogecoin (DOGE) price receives yet again a firm rejection, this time from a technical moving average. The rejection and fade to the downside is almost a play and repeat from last week when a similar event occurred against a monthly pivot level. With no support nearby, DOGE will need to dip further in search of buyers that are willing to halt the descent in the current bearish market environment;

Dogecoin price looks for daredevils

Dogecoin price is, as the subtitle mentions, having vacancies for daredevil traders that venture to build long positions in DOGE while the current macroeconomics backdrop is becoming even more bearish than before. With several big central banks issuing warnings and projection dire prospects for 2023, any risk-on appetite looks far away. Support is not yet near, so DOGE is set to continue declining until the first support level is met.

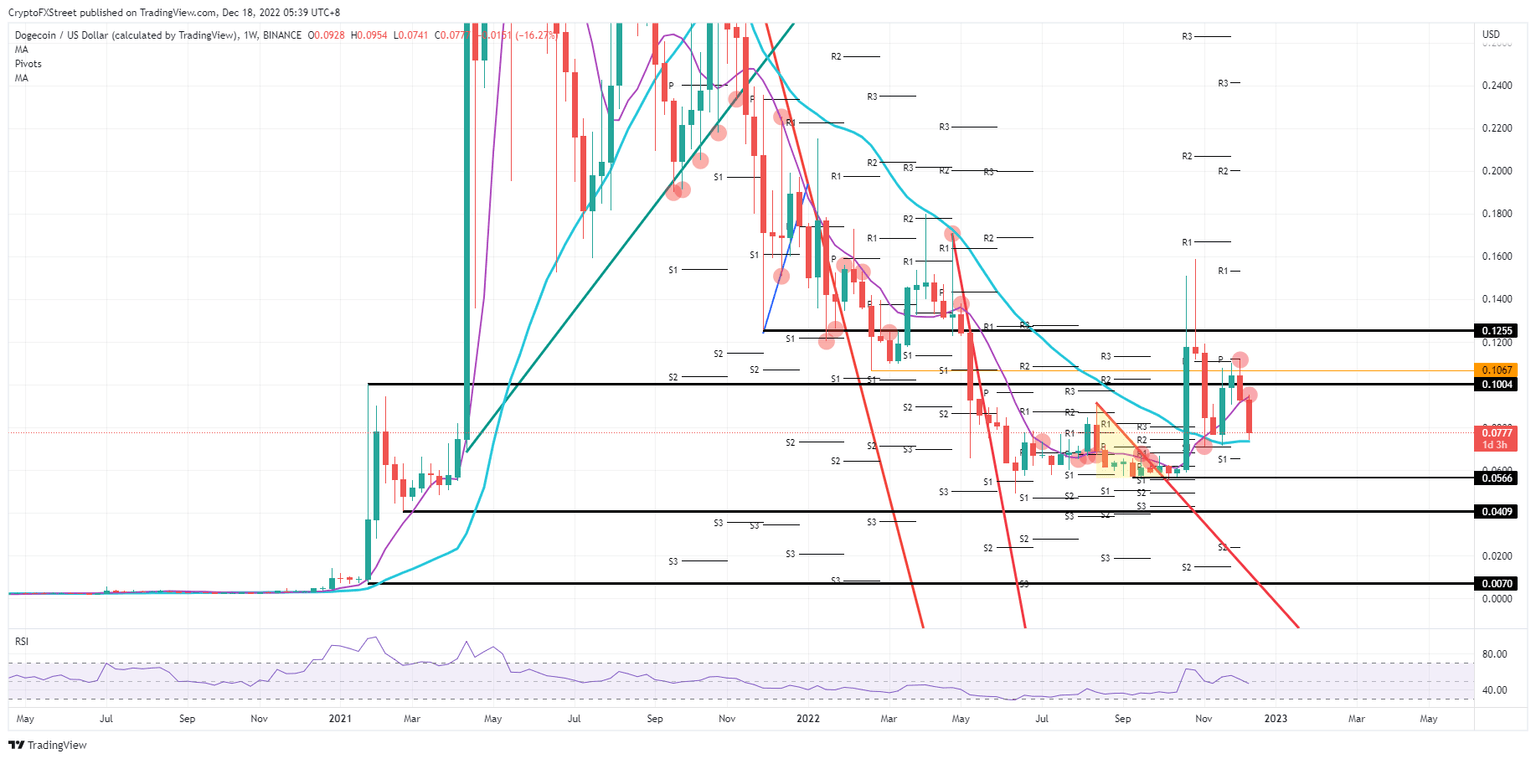

DOGE sees its first level coming into play near $0.0739 in the form of the 200-day Simple Moving Average (SMA). That level already supported the price action and triggered a 28% fortunate bounce for the week at the end of November. Still, that means for the week a 20% decline from the topside against the 55-day SMA to the support from the 200-day SMA.

DOGE/USD weekly chart

If that 200-day SMA gets tested before Sunday night near the weekly close, that bounce could come much quicker than expected. Bulls could be more than happy to jump on it and increase price action. Do not expect a massive full-blown rally, but paring back some losses towards $0.1004 could be granted with some follow-through towards $0.1255.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.