- Dogecoin’s search engine volume spikes on Baidu as the world discovers the ‘Meme Coin.’

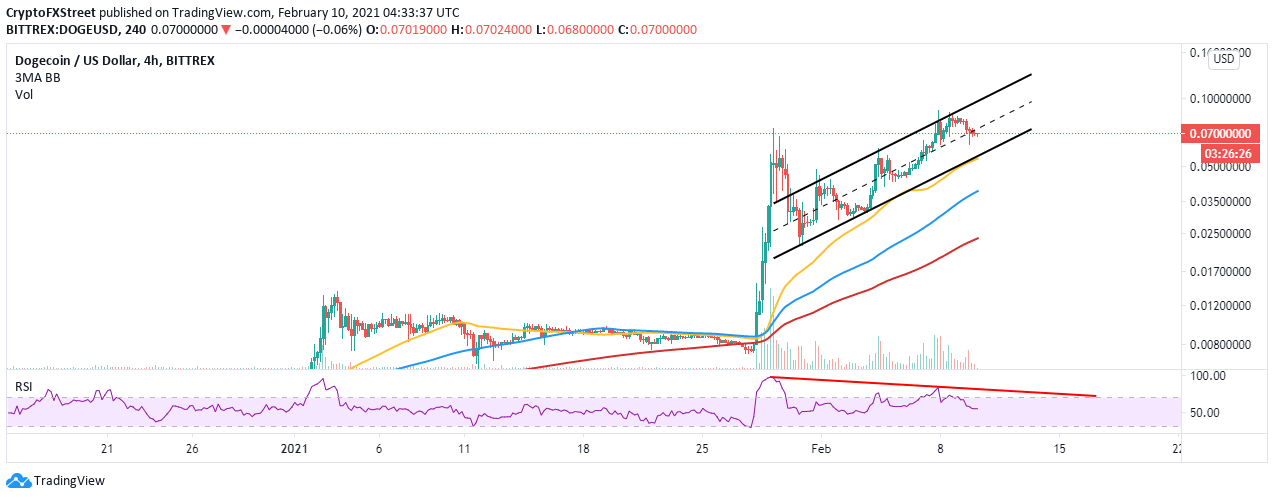

- DOGE is correcting toward the 50 SMA on the 4-hour chart after rejection at $0.089.

- The uptrend will be sustained if the ascending parallel channel’s middle support is reclaimed.

Dogecoin has been the most significant contributor to the crypto-related chatter on various social media channels. The ‘Meme Coin’ rallied again, surpassing the previous record high, and achieved a new all-time high of $0.089. Meanwhile, a retreat seems underway, with Dogecoin likely to retest levels toward $0.045.

Elon Musk tweets send Dogecoin to the moon

Elon Musk is among the most influential people in the world. He is the founder of Tesla, the world’s leading producer of electric vehicles, and the space exploration company, SpaceX. Recently Dogecoin found itself in the billionaire favor, whose tweets have sparked discussions amid DOGE’s rally to new highs.

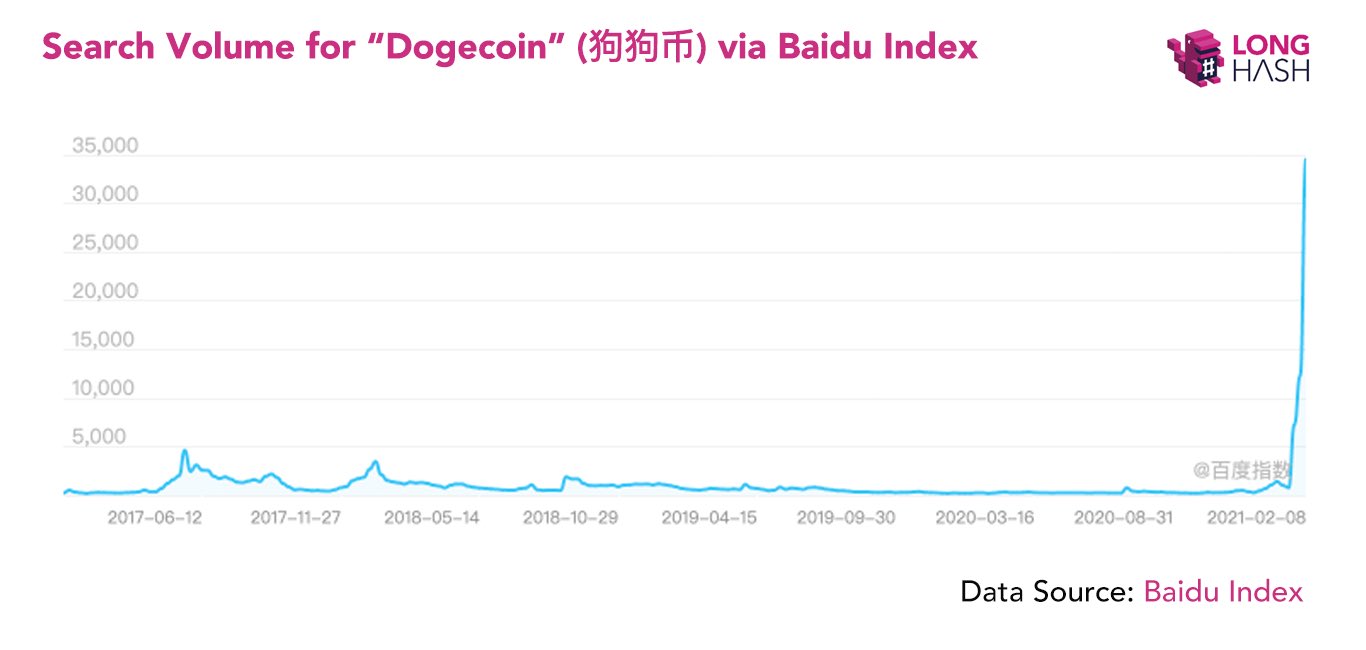

The Dogecoin fever appears to have spread its wings to China. Dogecoin search volume hit an all-time high on Baidu. According to LongHash, a gateway to China’s blockchain, the current volume was ten times that of the bull run in 2017.

Dogecoin search volume on Baidu

Dogecoin engages reverse gear

It is usual for a cryptoasset’s price to correct following a surge in its social media volume. For example, Dogecoin is in the middle of a retreat after being rejected at $0.089. An ascending parallel channel’s middle boundary support has given way to the declines, which are likely to linger to the lower edge. The 50 Simple Moving Average (SMA) is coincidently at this same level and is expected to halt the losses.

The pessimistic outlook has been validated the Relative Strength Index negative (RSI) divergence on the 4-hour chart. This divergence forms when the price makes a series of higher lows while the RSI creates lower highs. The deviation indicates that trading volume is reducing, and a reversal is likely to take place.

DOGE/USD 4-hour chart

Looking at the other side of the fence

It is worth mentioning that Dogecoin will continue with the uptrend eyeing $1 if the price recovers above the ascending channel’s middle boundary. Closing the day above this zone may recall more buyers into the market. Besides, the gap made by the 50 SMA from the 100 SMA and 200 SMA suggests that bulls influence the price.

On the other hand, the Dogecoin search volume has rallied in China, which may impact the buying pressure behind Dogecoin—thus placing DOGE on the trajectory to new record highs.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Litecoin Price Prediction: LTC tries to retake $100 resistance as miners halt sell-off

Litecoin price grazed 105 mark on Monday, rebounding 22% from the one-month low of $87 recorded during last week’s market crash. On-chain data shows sell pressure among LTC miners has subsided. Is the bottom in?

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin price struggles around $95,000 after erasing gains from Friday’s relief rally over the weekend. Bitcoin’s weekly price chart posts the first major decline since President-elect Donald Trump’s win in November.

SEC Commissioner Hester Pierce sheds light on Ethereum ETF staking under new administration

In a Friday interview with Coinage, SEC Commissioner Hester Peirce discussed her optimism about upcoming regulatory changes as the agency transitions to new leadership under President Trump’s pick for new Chair, Paul Atkins.

Bitcoin dives 3% from its recent all-time high, is this the cycle top?

Bitcoin investors panicked after the Fed's hawkish rate cut decision, hitting the market with high selling pressure. Bitcoin's four-year market cycle pattern indicates that the recent correction could be temporary.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.