Dogecoin Price Prediction: DOGE explodes again thanks to Elon Musk and remains stronger

- Dogecoin price is contained inside an ascending parallel channel on the hourly chart.

- The digital asset seems poised for a massive breakout towards $0.086.

- On-chain metrics suggest there is a lot of support building below current prices.

Dogecoin had another massive 50% price explosion in the past 24 hours thanks to several tweets from Elon Musk. Yet again, the richest man in the world endorses Dogecoin and the market reacts positively. Of course, shortly after DOGE plummeted 21% but managed to keep some of the gains.

Dogecoin price could be poised for another breakout without Elon’s help

On the 1-hour chart, it seems that Dogecoin has formed an ascending parallel channel and bulls have just defended the 18-SMA support level and the middle trendline of the pattern. A rebound from this point can quickly push Dogecoin price towards the upper boundary at $0.056.

DOGE/USD 1-hour chart

A breakout above the critical resistance point at $0.056 will drive Dogecoin price by 55% towards $0.086. This price target is calculated using the height of the pattern as a reference point.

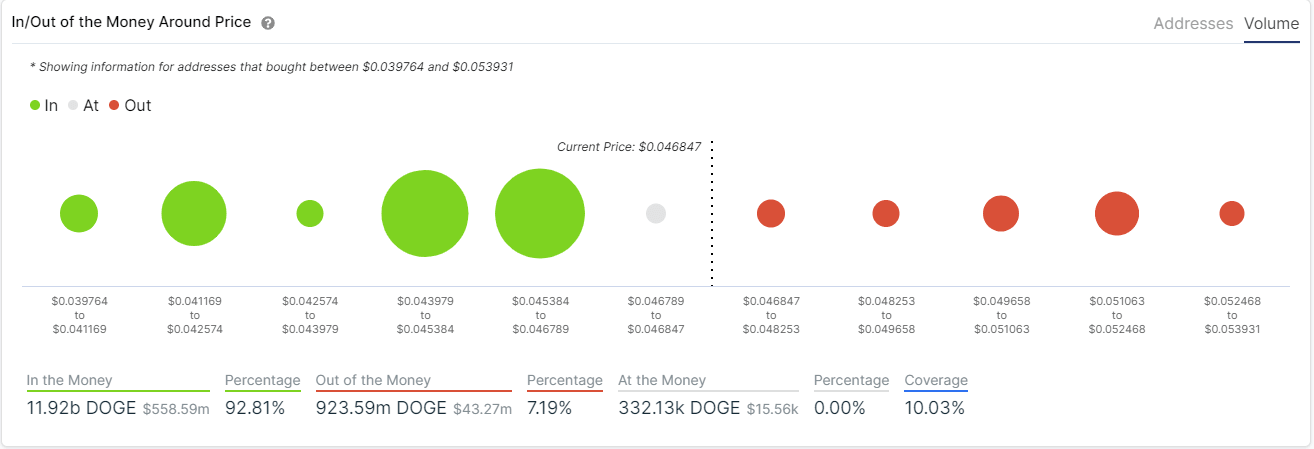

DOGE IOMAP chart

The In/Out of the Money Around Price (IOMAP) chart shows robust support below $0.0467 which indicates that bulls are building many strong points despite the high volatility. In comparison, there are practically no barriers above $0.048 according to the IOMAP model.

DOGE/USD 1-hour chart

However, investors must be extra careful as the digital asset is highly volatile. Losing the 18-SMA on the 1-hour chart can push Dogecoin price towards $0.036 at a lightning-fast speed.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.