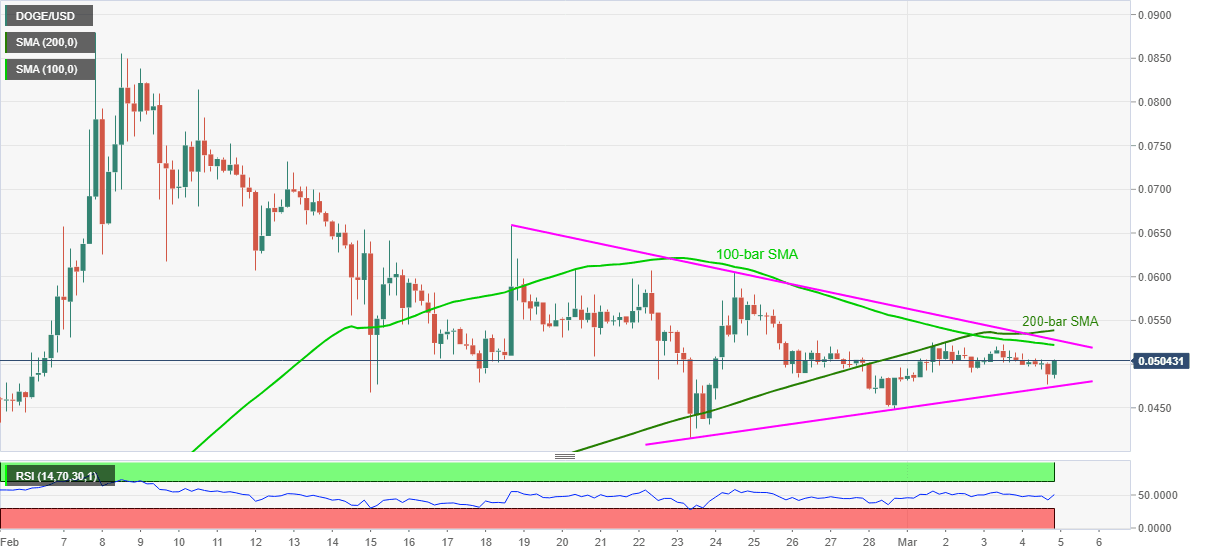

Dogecoin Price Prediction: DOGE bulls embrace for a long trip towards 0.0880

- Dogecoin picks up bids inside a two-week-old symmetrical triangle.

- 100-bar, 200-bar SMAs add to the upside filters.

- Normal RSI, repeated bounces off weekly low favor bulls.

DOGE/USD rises to 0.0504 in its latest run-up during early Friday. In doing so, the meme-coin bounces off the lowest since Sunday while funneling down the breakout of a short-term symmetrical triangle.

Considering the normal RSI conditions and multiple u-turns from weekly lows, Dogecoin is up for a fresh rise. However, a clear break above the stated triangle’s resistance line, at 0.0530 now, becomes necessary.

Also acting as an upside filter are 100-bar and 200-bar SMAs, respectively around 0.0522 and 0.0540.

In a case where the quote successfully crosses 0.0540, February 18 top near 0.0658 can offer an intermediate halt to the rally targeting the record top of 0.0880.

Alternatively, pullback moves need to break the triangle support, at 0.0474, to call the DOGE/USD bears targeting February lows of 0.0288.

If at all, the sellers keep reins past-0.0288, January-end low close to 0.0220 holds the key to the pair’s south-run eyeing the early 2021 levels around 0.0050.

DOGE/USD four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.