- Dogecoin price is prepared for a sell-off after a bearish chart pattern was revealed.

- However, DOGE may find abundant support should the correction take place.

- A technical indicator adds credence to the fact that Dogecoin may have recorded a local top.

Dogecoin price could be primed for a 19% collapse after a bearish chart pattern emerged, along with a top signal by a technical indicator. DOGE is also met with stiff resistance, not allowing higher targets to be approached.

Dogecoin price sets local top

Dogecoin price has printed a rising wedge pattern on the daily chart, suggesting a bearish forecast for DOGE.

Although the canine-themed token has gained nearly 80% since its swing low on July 20, hinting that Dogecoin price may be awaiting a trend reversal.

The governing technical pattern indicates that Dogecoin price would drop by 19%, reaching a downside target at $0.221, corresponding with the 50-day Simple Moving Average (SMA).

The Momentum Reversal Indicator (MRI) flashed a top signal, further adding credence to the bearish thesis. The Relative Strength Index (RSI) also suggests that DOGE may be slightly overbought.

DOGE/USDT daily chart

However, DOGE may see ample support before the bearish aim materializes. The first line of defense for Dogecoin price is at the lower boundary of the rising wedge, coinciding with the 27.2% Fibonacci retracement level at $0.259.

The next support level is at the 38.2% Fibonacci retracement level at $0.244, then the 50% Fibonacci retracement level, joining the 20-day SMA at $0.228.

Should Dogecoin price continues to fail to galvanize investors' enthusiasm, DOGE may test the 61.8% Fibonacci retracement level at $0.212 before sliding further down to the 200-day SMA.

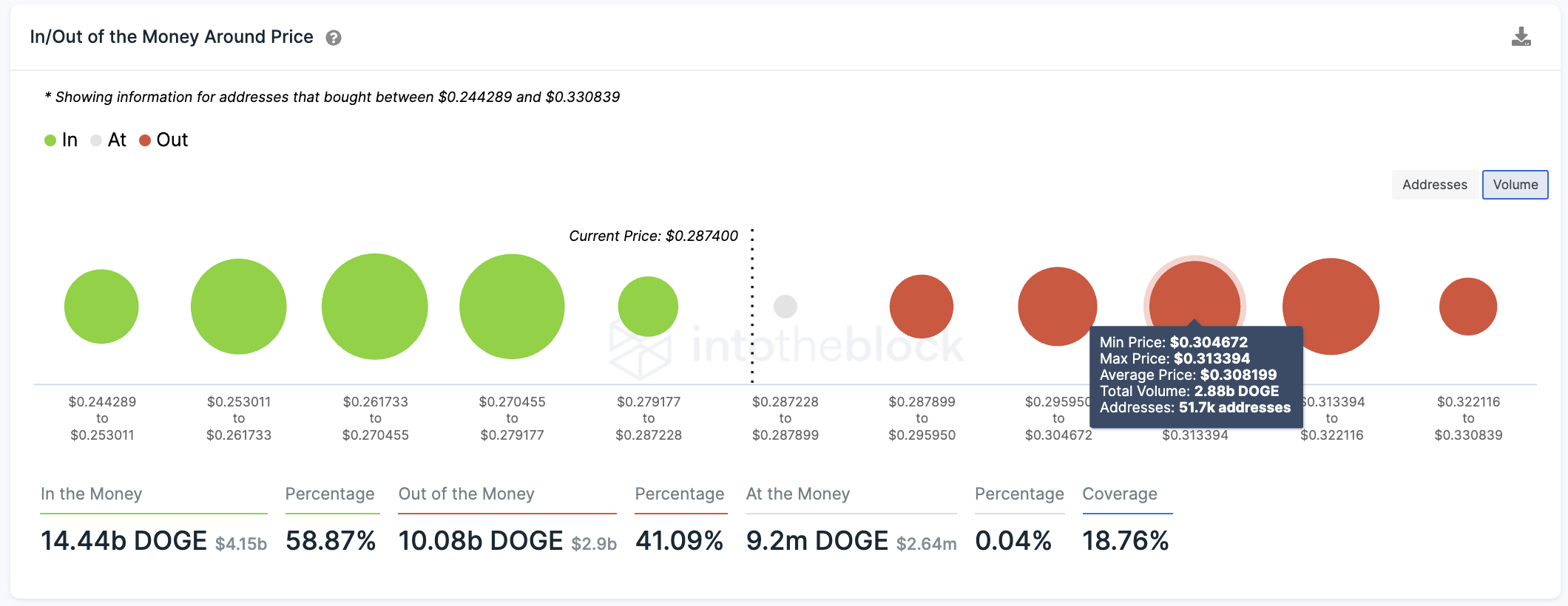

On the flip side, if Dogecoin price is able to slice and close above the 100-day SMA at $0.296 and the upper boundary of the rising wedge pattern at $0.302, the IntoTheBlock’s In/Out of the Money Around Price (IOMAP) metric reveals large clusters of resistances ahead.

Dogecoin IOMAP

The next obstacle for Dogecoin price is at $0.308, with 51,700 addresses holding 2.88 billion DOGE.

Overall, the IOMAP suggests that Dogecoin price is would see major challenges ahead if it attempts to record a higher high for August.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin holds $84,000 despite Fed’s hawkish remarks and spot ETFs outflows

Bitcoin is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Fed on Wednesday, BTC remains relatively stable.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Top meme coin gainers FARTCOIN, AIDOGE, and MEW as Trump coins litmus test US SEC ethics

Cryptocurrencies have been moving in lockstep since Monday, largely reflecting sentiment across global markets as United States (US) President Donald Trump's tariffs and trade wars take on new shapes and forms each passing day.

XRP buoyant above $2 as court grants Ripple breathing space in SEC lawsuit

A US appellate court temporarily paused the SEC-Ripple case for 60 days, holding the appeal in abeyance. The SEC is expected to file a status report by June 15, signaling a potential end to the four-year legal battle.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.