Dogecoin Price Prediction: DOGE at risk of a 60% downswing if vital support fails to hold

- Dogecoin bulls are tasked with defending $0.03 support to avert a potentially massive breakdown.

- DOGE is dealing with massive seller congestion zones ahead that could delay recovery.

- The downtrend could be sabotaged if Dogecoin sustains an hourly candlestick above the 100 SMA.

Dogecoin recovery has become an uphill task after plunging from $0.088. The bearish outlook has also remained unchallenged over the last couple of days, as reported. Meanwhile, the 'Meme Coin' is exchanging hands at $0.032 amid the bulls' intensive fight to hold above $0.030.

Dogecoin critical support in jeopardy as technicals flip bearish

Slightly above the prevailing market value, Dogecoin is facing acute resistance under the 100 Simple Moving Average. It is essential to note that the token is also trading below the 50 SMA on the 1-hour chart, significantly increasing overhead pressure.

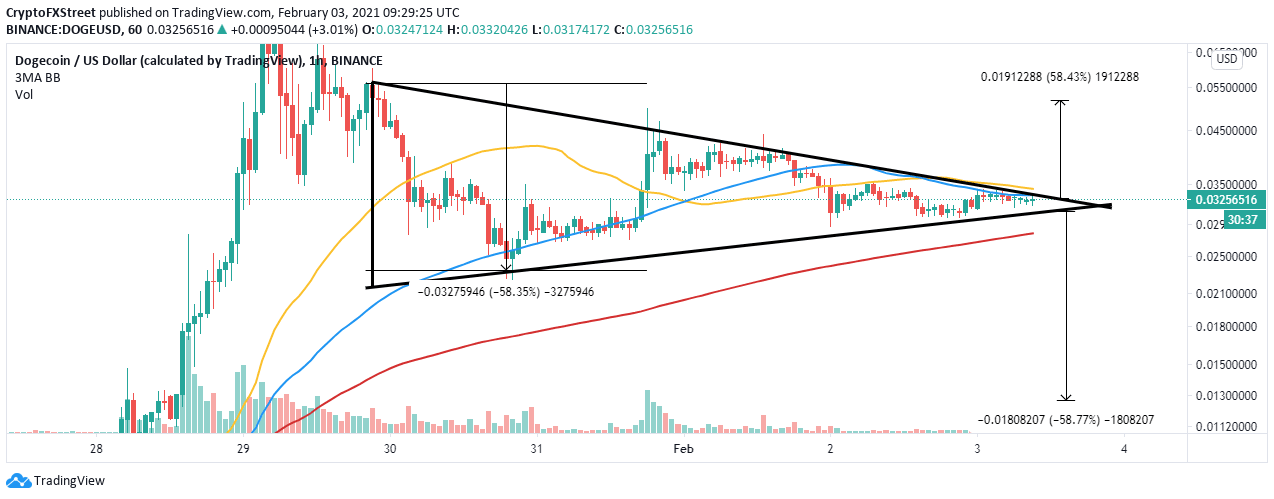

The most significant technical development is the formation of a symmetrical triangle pattern. This type of triangle can be described as a volatility-contraction pattern. In other words, it marks a decrease in an asset's volatility. The triangle also signifies a potential breakout or breakdown.

A breakout occurs after the price hits levels above the upper trendline. Similarly, a breakdown takes place when the price crosses below the lower trendline. Note that the triangle has an exact target that can be used as a stop loss, measured from the highest to the lowest point of the pattern.

If DOGE loses the support at $0.030, a 60% breakdown could come into play, forcing Dogecoin to explore lower price levels toward $0.0138. Investors still holding Dogecoin are probably worried that the bottom yet to be found. Therefore, declines under $0.030 could trigger panic-selling.

DOGE/USD 1-hour chart

The IOMAP model by IntoTheBlock confirms that recovery will not come easy based on the robust seller congestion zones ahead. The largest hurdle runs from $0.036 to $0.037. Here, nearly 29,000 addresses had previously bought about 2.8 billion DOGE.

Dogecoin IOMAP model

The same IOMAP model highlights the key support, $0.0315 to $0.0324. Roughly 23,000 addresses are currently profiting from the approximately 7.6 billion DOGE formerly purchased in the range. Buyers must hold above this critical zone; otherwise, Dogecoin could dive downstream.

Looking at the other side of the picture

As mentioned above, the symmetrical triangle can result in an upswing if Dogecoin breaks above the upper trendline. However, DOGE must jump above the 100 SMA to sustain an uptrend. Besides, crossing beyond the 50 SMA would call out to buyers to join the market, in turn, pushing Dogecoin toward $0.055.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637479430297836637.png&w=1536&q=95)