Dogecoin price on track to hit new highs, rallying 16% with Tesla payments going live

- Tesla announced that it accepts Dogecoin and cannot receive or detect any other cryptocurrency.

- Dogecoin price has posted 16% gains within minutes of Tesla’s DOGE payments going live.

- Analysts have predicted an explosive rally in Dogecoin price, continuing the memecoin’s uptrend.

Elon Musk announced that Tesla merchandise can now be purchased using Dogecoin. The Shiba-Inu-themed cryptocurrency’s price is on track for a new high.

Dogecoin price explodes, analysts predict continuation of uptrend

An electric car giant, Tesla started accepting Dogecoin payments for its merchandise. The memecoin posted double-digit gains within minutes to Elon Musk’s announcement.

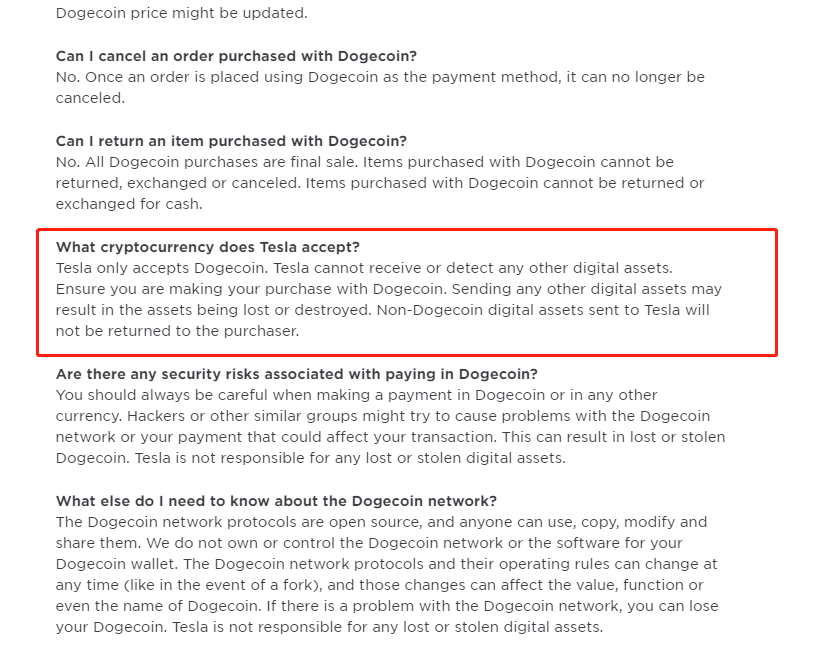

The Tesla website states that Dogecoin is the only cryptocurrency that is accepted as payment for its merchandise.

Tesla accepts Dogecoin as payment

Tesla is yet to accept Dogecoin for its electric vehicles. The Tesla merchandise that can be bought using Dogecoin can drive the utility of the cryptocurrency. Dogecoin price received a major boost and posted over 16% gains within minutes.

Tesla had started accepting Bitcoin payments in May 2021; however, the electronic vehicles giant stopped soon after, citing environmental concerns. Musk has repeatedly stated that Dogecoin is a better alternative for payments than Bitcoin.

Dogecoin core’s new release reduces fees for all memecoin’s network participants.

@CryptoKaleo, a crypto analyst and trader, has predicted that Dogecoin price could hit the target of $0.24. The analyst believes that the memecoin has bullish potential.

*Assuming* $DOGE doesn't retrace here and this isn't just some sick twisted fake, next point of resistance will probably be HTF log diagonal, around 24 cents. pic.twitter.com/olidZrzaAd

— K A L E O (@CryptoKaleo) January 13, 2022

FXStreet analysts believe Dogecoin could form a dead-cat bounce before a fatal crash to $0.09.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.