Dogecoin price needs to reclaim this level to prevent a 14% crash

- Dogecoin price noted an 8% increase in value, bouncing off of the $0.0724 support floor.

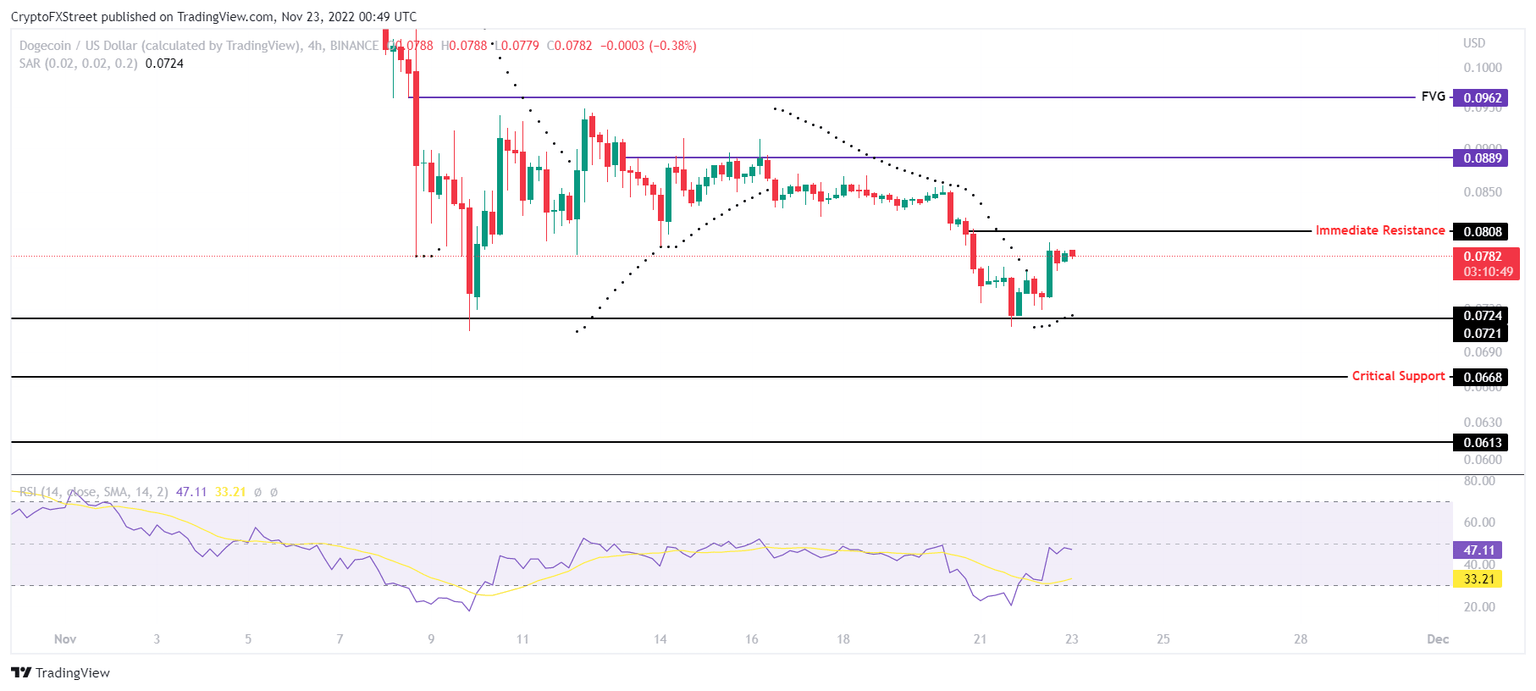

- Should the meme coin fail to close above $0.0808, it could slip down to tag $0.0668.

- A breach of the immediate resistance at $0.0808 would invalidate the bearish thesis, providing support for a rise to $0.0889.

Dogecoin price followed the broader market bearish cues, declining to new monthly lows on November 21. The recovery for the meme coin continues to be questionable since there are no clear signs of bullishness visible yet. If the consistent declines continue, DOGE could note a significant crash.

Dogecoin price needs its bulls

Dogecoin price fell to tag the support level at $0.0724 after a week of bearish pressure. Bouncing off of this support floor, DOGE observed an 8.65% increase in value in the last 48 hours to trade at the current price of $0.0728.

However, given the persisting bearishness in the market, the odds of a positive move from meme coin seem rather unlikely.

At the moment, Dogecoin price faces immediate resistance at $0.0808, breaching which is necessary for the cryptocurrency to engage in recovery. However, failure to do so could kick DOGE back down toward the current support level at $0.0724. If the bears continue to call the shots, the altcoin could fall through this level and crash by 14.43% to tag the critical support level at $0.0668.

However, the Parabolic Stop and Reverse (SAR) indicator is currently highlighting an uptrend. The presence of the indicator’s black dots below the candlestick is an indication of an uptrend that came almost two weeks after DOGE suffered a downtrend.

The Relative Strength Index (RSI) is also in the bearish, neutral zone around the 50.0 neutral mark. From here on, if the indicator rises above this mark, Dogecoin will note an increase in buying pressure finding support from the bulls.

DOGE/USD 4-hour chart

This would enable Dogecoin price to flip the immediate hurdle at $0.0808 into a support floor and kick start a recovery toward $0.0889. If DOGE produces a daily candlestick close above $0.0889, it will invalidate the bearish thesis. This would set the meme coin up for an upswing toward the inefficiency at $0.0962, labeled as the Fair Value Gap (FVG).

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.