Dogecoin price likely to rally 27% if DOGE shatters this barrier

- Dogecoin price shows bullish signs as it recently breached a month-old resistance barrier.

- Transaction data shows that a minor uptrend to $0.150 seems plausible.

- A four-hour candlestick close below $0.106 will create a lower low and invalidate the bullish thesis for DOGE.

Dogecoin price has shattered the downtrend in a recent run-up and shows signs that more of these gains are around the corner. Although DOGE is facing temporary slowdowns, investors can expect bulls to make a strong comeback soon.

Dogecoin price breaks out for more gains

Dogecoin price formed a string of lower highs as it shed roughly 40% in the last 40 days. These swing points can be connected using trend lines; this downward-facing trend line has prevented DOGE from rising.

However, on March 18, DOGE saw a massive surge in buying pressure resulting in a breakout. Since then Dogecoin price has retraced but still maintains its bullishness. Therefore, investors can expect the meme coin to continue its uptrend.

The dog-themed crypto will face the $0.140 hurdle first but clearing it will allow Dogecoin price to retest the $0.150 barrier. In total, this move would constitute a 27% ascent from the current position - $0.120.

DOGE/USDT 4-hour chart

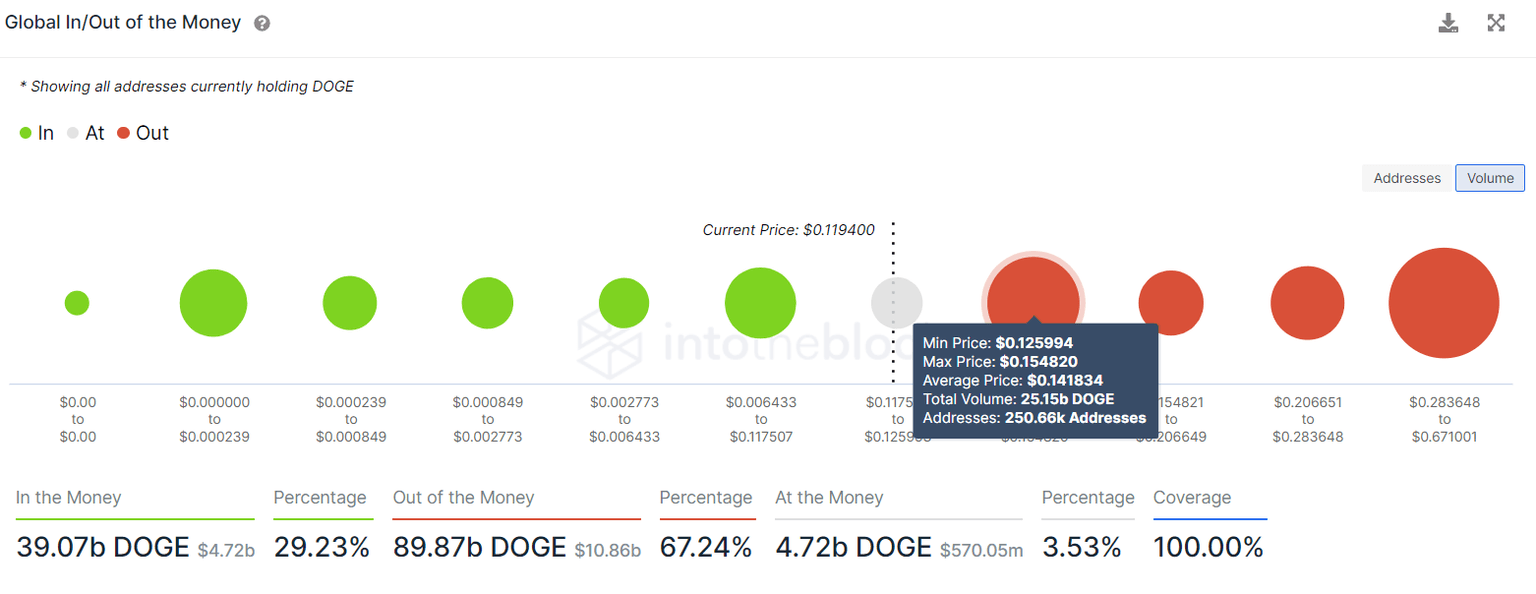

Supporting the bullish outlook for Dogecoin price is IntoTheBlock’s Global In/Out of the Money (GIOM) model. This index shows that the next resistance cluster is relatively strong and extends from $0.126 to $0.155.

Here, roughly 250,000 addresses that purchased roughly 25.15 billion DOGE tokens are “Out of the Money.“ Therefore, a move into this cluster will likely result in selling pressure from these underwater investors.

Hence, market participants can expect DOGE to pierce this area and set a local top in the range mentioned above.

DOGE GIOM

While the bullish outlook makes sense from a transaction data standpoint, the whales do not seem to be interested in Dogecoin price. Large transactions worth $100,000 or more, which serve as a proxy to high networth investors’ investment interest, have dropped from 1,800 to 688 in the past three months.

This 30% reduction indicates that these buyers are not excited to purchase DOGE, suggesting that an uptrend might face problems due to a lack of momentum.

DOGE large transaction

Regardless of the optimism around DOGE, a four-hour candlestick close below $0.106 will create a lower low and invalidate the bullish thesis for Dogecoin price. In such a case, DOGE could crash 30% and revisit the $0.074 support level, allowing buyers to make another comeback.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.