- Dogecoin price tries to keep the ground above the crucial technical area.

- DOGE could go either way, depending on the market sentiment for the coming weeks.

- Expect to see price action underpinned around $0.0700.

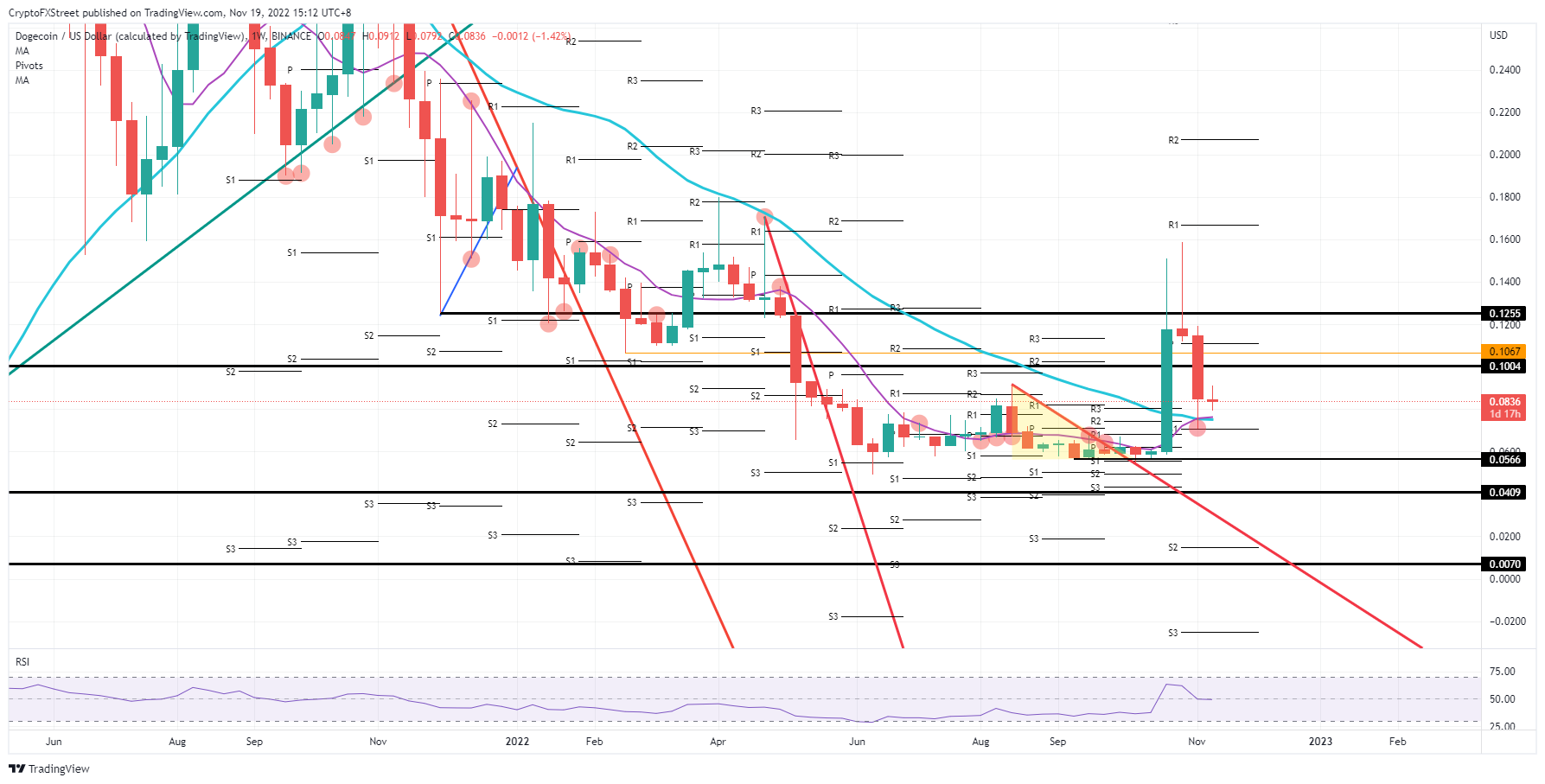

Dogecoin (DOGE) price is recovering and consolidating after a brutal performance for the first part of November. DOGE saw a 35% profit erased and turned into a negative print in the first week of November and a 26% meltdown between the open on Monday and the close on Sunday night last week. With traders grappling to see any silver lining, a calm week is more than welcome and could see some confidence returning with small upticks.

DOGE price welcomes this consolidation after its poor performance

Traders have seen Dogecoin price thrown in the bin as FTX broke the fragile confidence traders had regained in cryptocurrencies over the summer after the wounds incurred from the LUNA stablecoin meltdown. Unfortunately, that confidence got broken as FTX triggered another wave of sell-offs and victims in cryptocurrencies with a lot of traders and, within the industry, stakeholders being misgiving to one another. This was translated by the sharp decline in two weeks that erased almost all the profits from the past summer.

DOGE luckily gets underpinned around $0.0700 with three high weekly levels in the same area, just a few pips or ticks away from each other. The first element is the monthly S1 support level at $0.0700. The two other elements, the 55-day Simple Moving Average (SMA) and the 200-day SMA are present at around $0.0760 and are the first line of defence to catch any falling knives before price action is pushed back to $0.1004.

DOGE/USD weekly chart

Although that underpinning is there, it could simply not be enough to support price action if a few external elements chose to create some headwinds. A combination of elements like another missile hitting Poland, US dollar strength that kicks back in, and equities that sell-off would be a toxic cocktail that would see DOGE price hit $0.0566 or even $0.0409, depending on the severity of the catalyst that triggered the move. That would mean that another 30% to 50% of losses could still unfold after another FTX casualty or geopolitics erupting again.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.