Dogecoin price is positioned for a charge back to $0.11

- DOGE price displays evidence to support more uptrend price action.

- Dogecoin price volume pattern shows interesting negotiations.

- Invalidation of the bullish thesis is a close below $0.069.

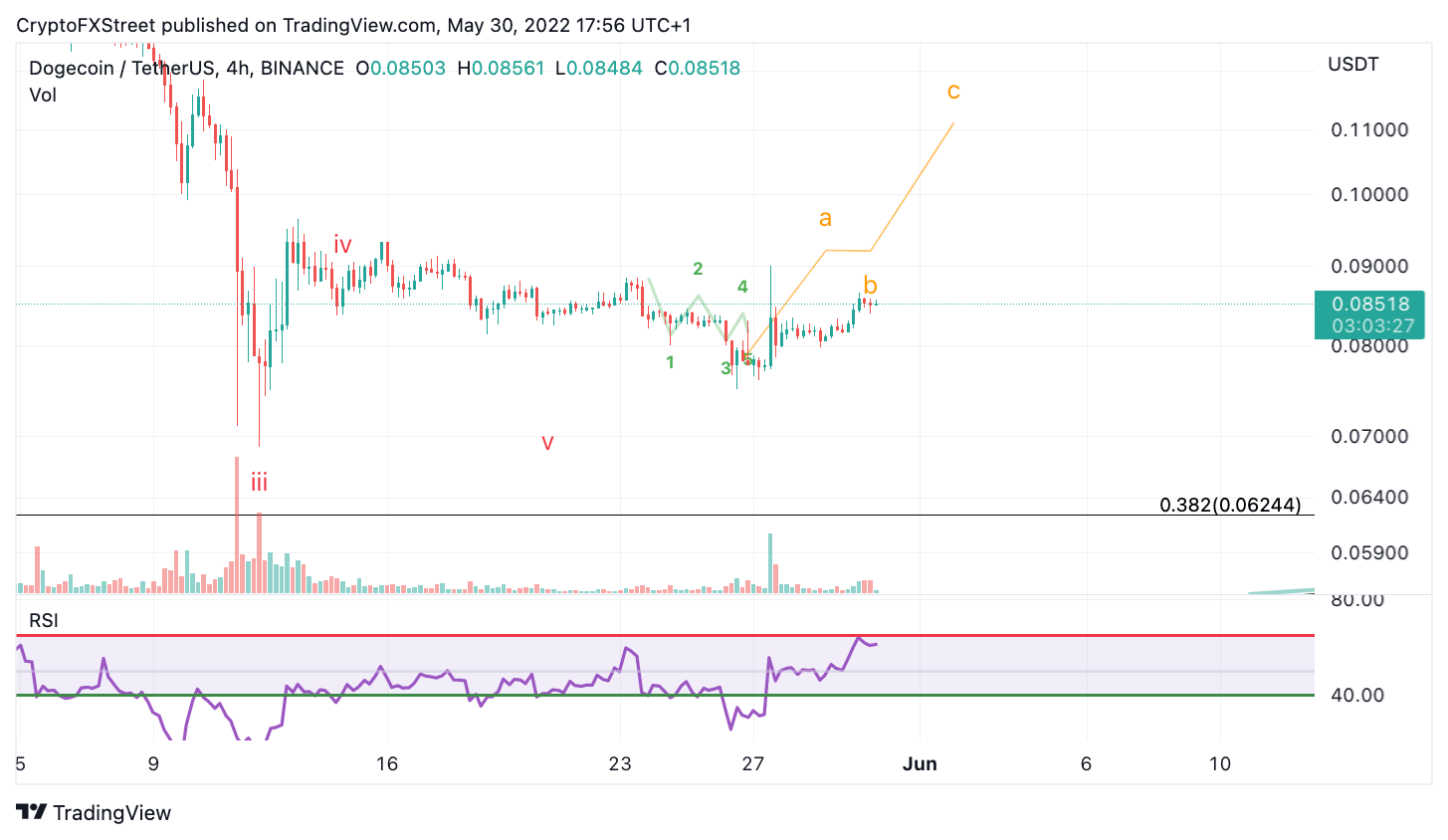

Dogecoin price has begun an uptrend move mentioned in last week’s thesis. The next target of $0.11 has newer investors allocating some of their portfolios to the notorious dog coin.

Dogecoin price is following the technicals

Dogecoin price shows bulls are re-entering the market. The bulls have finally shown substantial retaliative effort since the massive decline that has taken place since May 12th. The DOGE price saw an erratic bullish spike into a high at $0.089 over the weekend. One more wave up is likely to occur if the technicals are correct. Traders should keep Dogecoin on their radars to participate in the next bull run.

Dogecoin price could continue with bullish momentum in the coming days and the Relative Strength Index provides confluence for this idea. The Relative Strength Index continues to climb higher while also maintaining support on the buyers’ 40 level after each profit-taking decline. The volume indicator also looks questionable in its own right and warrants the idea that there may have been a “changing of hands” from retail money to the institutional investors.

DOGE/USDT 4-Hour chart

Invalidation of the bullish scenario is still a breach and close below $0.069.

If the bears can conquer this level, they could continue the decline to $0.05, resulting in a 40% decrease from the current DOGE price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.