Dogecoin price is on the verge of a 70% downturn

- Dogecoin price risks invalidating the falling wedge pattern after six weeks of failed attempts to break out.

- A breakdown of the lower trend line of the wedge at $0.087 will trigger a bearish descent.

- A weekly candlestick close above $0.159 will invalidate the bearish outlook.

Dogecoin price is grappling with the lower trend line of a bullish pattern. This development comes after a wildly bullish narrative over the last few weeks. Therefore, investors need to pay attention to Bitcoin’s directional bias.

Dogecoin price pulls a ‘180 degree’

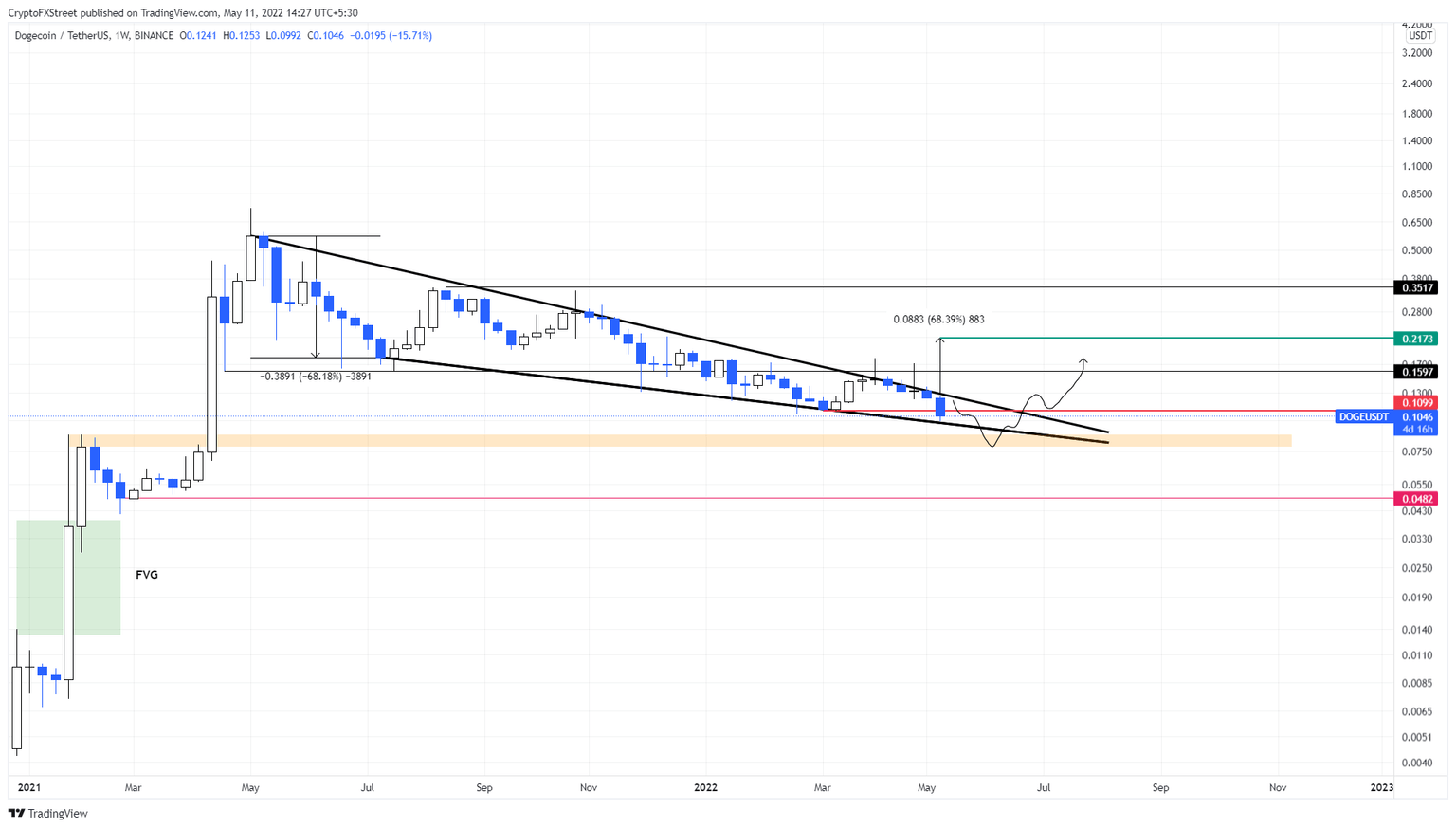

Dogecoin price action set up a falling wedge as it crashed a massive 85% from its all-time high of $0.740. This move set up three lower highs and lower lows on the weekly time frame, which when connected using trend lines reveals a falling wedge.

This technical formation forecasts a 68% upswing to $0.217, obtained by adding the distance between the first swing high and swing low to the breakout point.

Over the last five to six weeks, DOGE was hugging the upper trend line closely and even broke above it temporarily. However, the last week caused a lot of pain for holders as it pushed the Dogecoin price down to retest the lower trend line of the falling wedge.

If the crypto markets continue to crash, the resulting downswing could knock the dog-themed crypto to retest the support area, extending from $0.078 to $0.087, at which level, investors can hope for a slowdown.

A failure to sustain above this range will ultimately crash DOGE to its last line of defense at $0.048. If buyers fail to defend this barrier, the Dogecoin price could crash 70% to $0.014. This move would fill the fair value gap or the price inefficiency satiating sellers.

DOGE/USDT 1-week chart

While things are looking bearish for Dogecoin price, a weekly candlestick close above $0.159 will not only trigger a bullish breakout but will also flip the said barrier into a support floor. Such a development could further propel DOGE to its forecasted target at $0.217.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.