- Dogecoin price continues its ten-month downtrend as it slices through the $0.127 support level.

- DOGE is likely to crash by 35% to $0.075 if the selling pressure continues to build up.

- A daily candlestick close above $0.163 will invalidate the bearish thesis and promote the possibility of an uptrend.

Dogecoin price shows no signs of stalling the downswing that has been ongoing since its all-time high in May 2021. The resulting crash seems to be reaching for a fair value gap (FVG), adding credence to this incoming downswing.

Dogecoin price faces the threat of a crash

Dogecoin price set up an all-time high at $0.744 on May 7, 2021, and has been on a downtrend ever since. This ten-month bear rally has knocked the market value of DOGE by 84% to where it currently trades - $0.118.

The recent crash, pushed the meme coin to shatter the immediate support level at $0.127, pushing the odds in the bears’ favor. Going forward, investors can expect the Dogecoin price to continue its descent to $0.074 due to the presence of the FVG, ranging from $0.0075 to $0.119.

The total move would constitute a 35% crash and is likely where a local bottom will form for DOGE.

DOGE/USDT 3-day chart

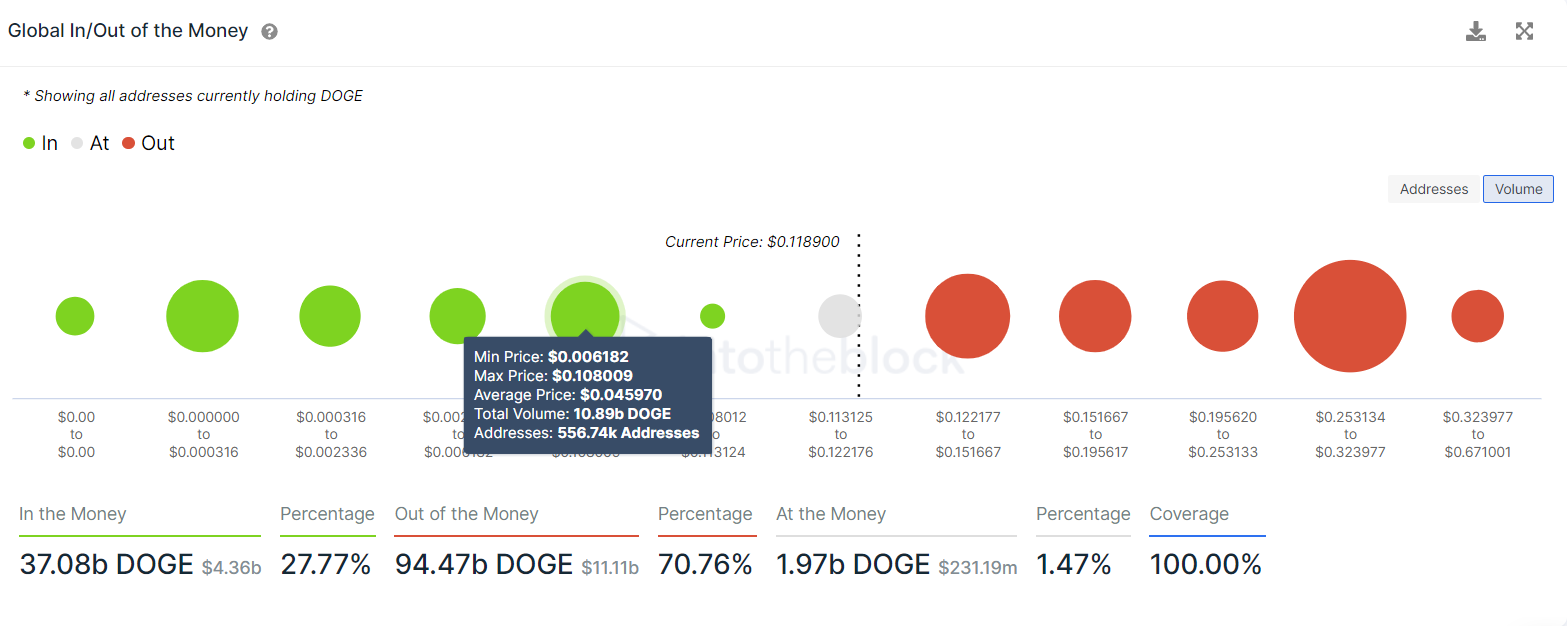

Supporting this downswing is IntoTheBlock’s Global In/Out of the Money (GIOM) model. This index shows that the immediate support floor at $0.111 is non-existent and will likely be breached easily by a short-term spike in selling pressure.

Therefore, the Dogecoin price is likely to head lower to $0.045, where roughly 556,740 addresses purchased roughly 10.89 billion DOGE tokens. This barrier coincides closely with the target obtained from a technical perspective and is the only stable support that should be able to absorb the incoming selling pressure.

DOGE GIOM

Further signaling the bearish nature of Dogecoin price is the decline in the number of large transactions worth $100,000 or more from 1,710 to 1,190. This 30% drop in transfers that serve as a proxy of whales’ investment thesis indicates that these investors are not interested in DOGE at the current price levels.

DOGE large transactions

While things are looking bleak for Dogecoin price, a quick surge in buying pressure that pushes DOGE to produce a daily candlestick close above $0.163 will create a higher high, hinting at an uptrend. Such a move will invalidate the bearish thesis for Dogecoin price.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP chart signals 27% jump after SEC-Ripple appeals pause and $50 million settlement

Ripple (XRP) stabilized above $2.00 exemplifying a similar pattern to the largest cryptocurrency by market capitalization, Bitcoin (BTC), which holds firmly above $84,000 at the time of writing on Thursday.

Bitwise lists four crypto ETPs on London Stock Exchange

Bitwise announced on Wednesday that it had listed four of its Germany-issued crypto Exchange-Traded products (ETPs) on the London Stock Exchange. It aims to expand access to its products for Bitcoin (BTC) and Ethereum (ETH) investors and widen its footprint across European markets.

RAY sees double-digit gains as Raydium unveils new Pumpfun competitor

RAY surged 10% on Wednesday as Raydium revealed its new meme coin launchpad, LaunchLab, a potential competitor to Pump.fun — which also recently unveiled its decentralized exchange (DEX) PumpSwap.

Ethereum Price Forecast: ETH face value- accrual risks due to data availability roadmap

Ethereum (ETH) declined 1%, trading just below $1,600 in the early Asian session on Thursday, as Binance Research's latest report suggests that the data availability roadmap has been hampering its value accrual.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.