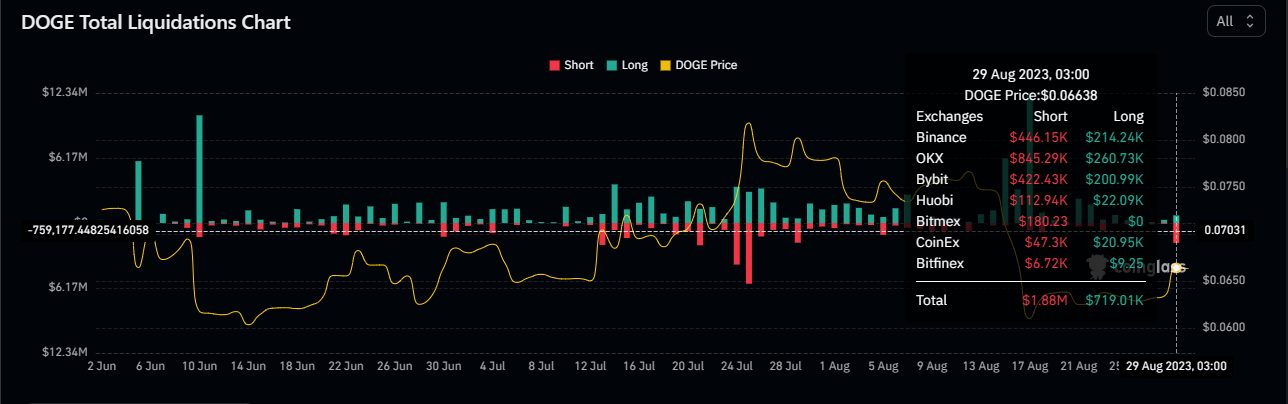

Dogecoin price forecast with $1.88 million in short positions liquidated

- Dogecoin price is up 5% in the last 24 hours, liquidating up to $1.88 million in short positions.

- The uptick follows a positive development in the Grayscale vs. SEC case and news of X adding crypto payments.

- DOGE could rise 10% to $0.0723 or fall 5% to immediate support at $0.0625, with 52% of holders incurring losses.

Dogecoin (DOGE) price rallied alongside the rest of the market, fueled by a positive break in Grayscale asset manager’s litigation against the US Securities and Exchange Commission. Another factor that may have sparked optimism among DOGE holders is news of social media platform X adding crypto payments under the leadership of Elon Musk.

Also Read: Dogecoin price shows short-term bullish momentum after Elon Musk declares X as DOGE friendly.

Dogecoin price rises 5%, liquidates $1.88 million in short positions

Dogecoin (DOGE) price rallying 5% to $0.0664, catalyzed by bullish developments in the crypto market, saw up to $1.88 million in short positions liquidated.

DOGE liquidations

The recent market optimism triggered an uptick, which triggered the stop losses of traders who had taken short positions. With these traders looking to avoid further losses, their positions are either sold for cash or take an equal but opposite position (buy) in the same asset. This is likely to determine the subsequent directional bias for DOGE.

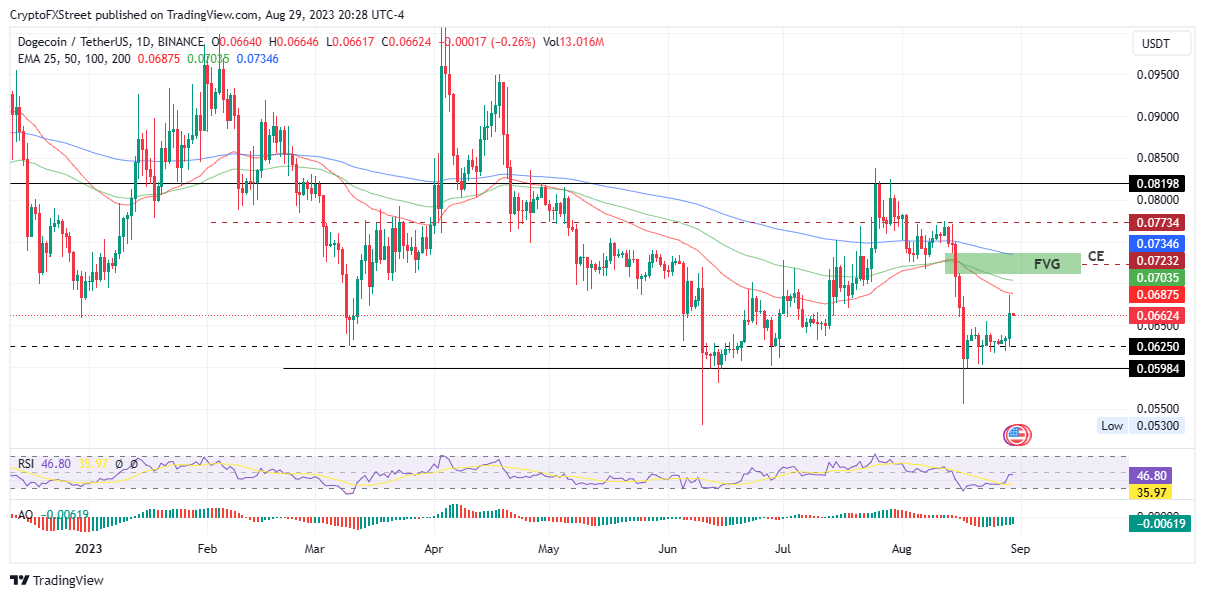

The Relative Strength Indicator (RSI) points to a standoff between the bulls and the bears, moving horizontally but maintaining below 50. The Awesome Oscillator (AO), on the other hand, shows green histogram bars, bolstering the case for the bulls. However, given that the AO is still negative, Dogecoin price could fall.

The meme coin faced rejection from the 50-day Exponential Moving Average (EMA) at $0.6875, with indications of a continued downtrend toward the immediate support at $0.0625. Such a move would constitute a 5% downtrend.

DOGE/USDT 1-day chart

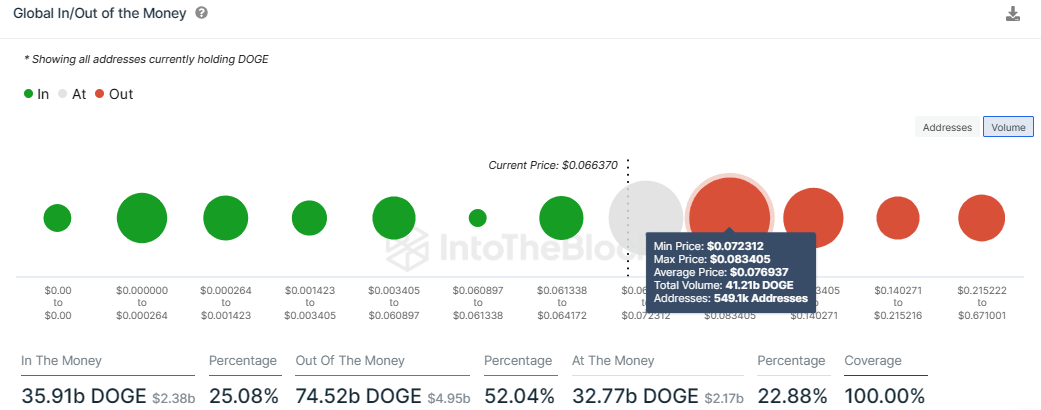

Data from IntoTheBlock’s Global In/Out of the Money (GIOM) shows that 52.04% of DOGE token holders are currently incurring losses (out of the money). This is against the 25.08% that are currently recording profits (in the money), while only 22.88% are breaking even (at the money). With the majority looking to cut their losses, selling pressure may abound for DOGE.

DOGE GIOM

The GIOM metric also shows that the next resistance lies between $0.0723 and $0.0834. Any efforts to send Dogecoin price past this zone would equally be countered by selling pressure from 549.1K addresses that bought approximately 41.21 billion DOGE tokens at an average price of $0.0769.A fair value gap is an inefficiency that has to be filled. It defines the difference between the current value of an asset or currency and its fair value due to inefficiency or imbalance in the market.

More interestingly, the supplier congestion zone has been marked by the fair value gap (FVG) in the price chart above, with the consequential encroachment (CE) at $0.0723. This underscores the significance of this resistance level. A decisive daily candlestick close above the CE would invalidate the bearish thesis.

However, if bullish momentum overpowers selling pressure from the bears, Dogecoin price could flip this order block into a support level, to make it a bullish breaker. In such a case, the next optimistic target for DOGE would be the August 12 high at around $0.0773. This would constitute a 15% climb above current levels.

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rate affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.