Dogecoin price faces selling pressure, but DOGE bulls hope for a breakout rally

- Dogecoin price faces selling pressure as it approaches the $0.0814 critical hurdle.

- A decisive weekly candlestick close above this barrier could make or break DOGE bulls.

- A successful flip could open the path for the meme coin to rally 17% to $0.0814.

Dogecoin (DOGE) price has broken free from its multi-month declining trend line that has defined the dominant bearish trend for nearly a year. The breakout, while pivotal, needs to clear one more critical hurdle before DOGE can take off.

Read more: Dogecoin Price Forecast: DOGE hints at 50% rally as sentiment improves in first-ever Doge Day

Dogecoin price edges closer to breakout

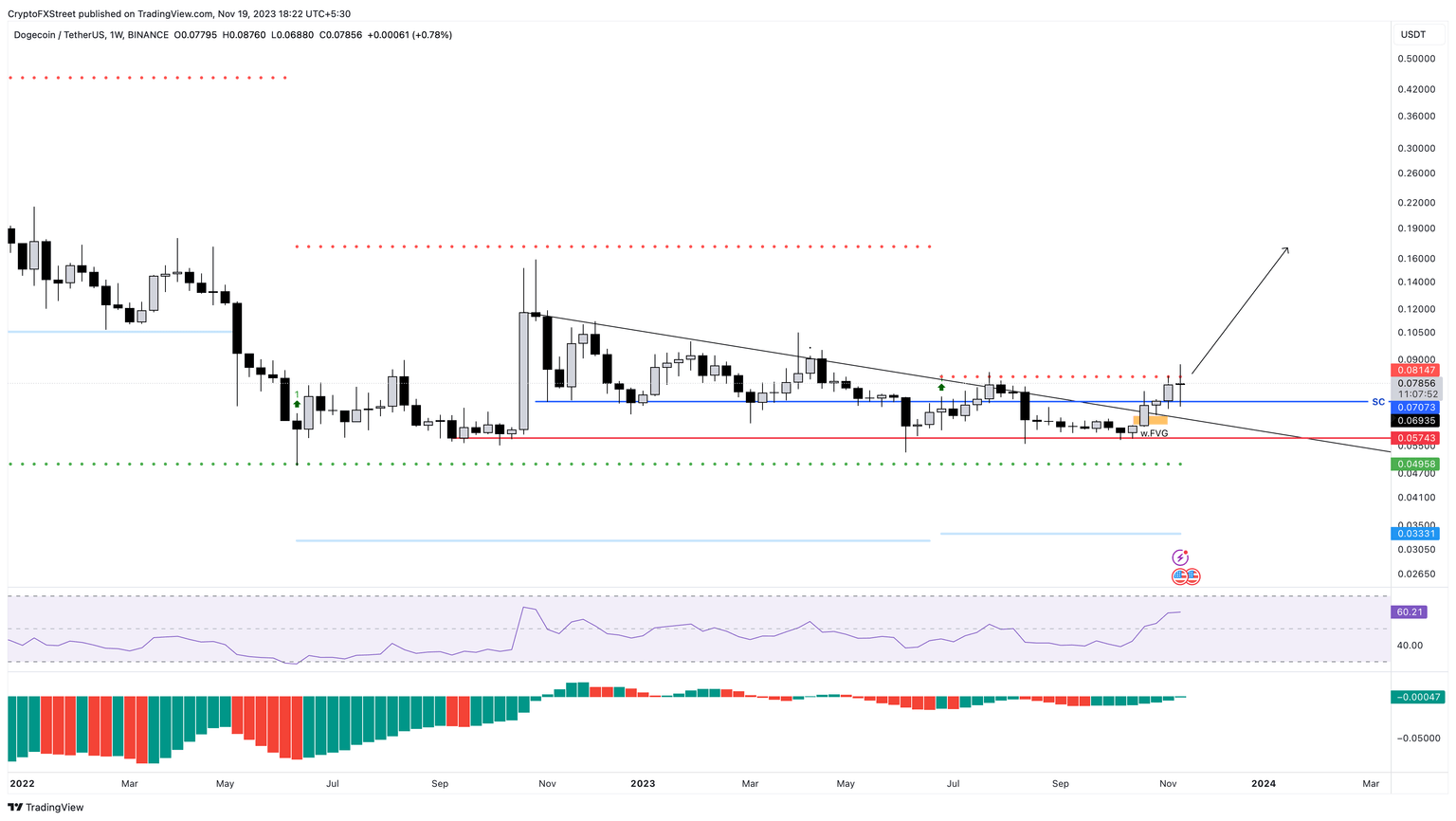

Dogecoin (DOGE) price has produced five lower highs and lower lows since October 31, 2022. Connecting the swing highs using a trend line reveals a declining resistance level. On October 23, DOGE produced a weekly candlestick close above this barrier, signaling a breakout.

This development is key for Dogecoin price as it hints at a potential trend reversal. But, a key hurdle sits at $0.0707, which will decide if DOGE consolidates and kickstarts an uptrend. A weekly candlestick close above this barrier will trigger a 17% rally to $0.0814.

Supporting this uptrend is the weekly Relative Strength Index (RSI), which has recently flipped above the 50 mean levels, suggesting an uptick in bullish momentum. Clearing this barrier will allow Dogecoin price to tag the $0.106 barrier. This move would constitute a 51% gain.

DOGE/USDT 1-week chart

On the other hand, if Dogecoin price gets rejected at $0.0707, it could threaten a steep correction. For a bullish thesis to face invalidation, DOGE needs to produce a weekly candlestick close below $0.0573, which would produce a lower low and signal a continuation of the downtrend. In such a case, Dogecoin price could slip 16% and tag the $0.0495 support level.

Also read: Dogecoin aims for July highs with potential 10% gain amid meme coin revival

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.