Dogecoin Price Forecast: This is what could happen after DOGE’s 30% rally

- Dogecoin price is pulling back after Elon Musk’s Twitter stunt fueled a 30% rally, like several instances before.

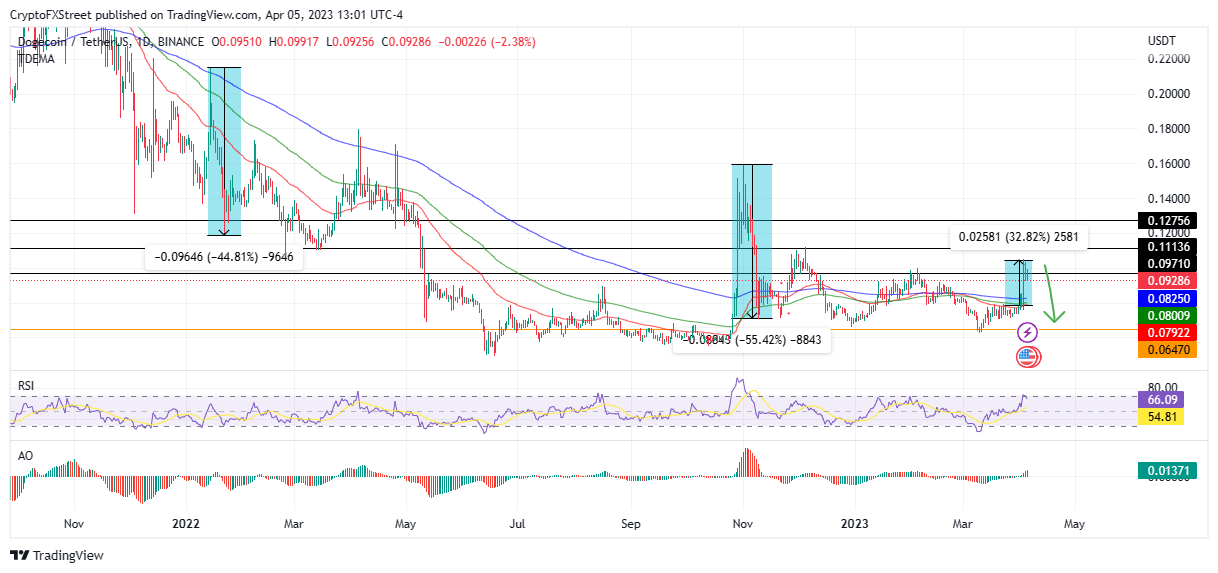

- DOGE could fall catastrophically, akin to the 44% and 55% plunges recorded in early January and around November last year.

- A decisive flip of the $0.097 resistance level into support could invalidate the bearish thesis.

Dogecoin price (DOGE) exploded on April 3 after Twitter CEO Elon Musk updated the company’s logo to a Shiba Inu dog. However, it appears the hype is fading as DOGE is now flashing red on the 1-day timeframe This could be the beginning of a stark retracement similar to what was observed in January and November 2022, when skyrocketing social mentions catapulted the altcoin to unexpected highs.

Dogecoin price could be readying for a price correction

Dogecoin price shows a bearish inclination after recording a high of $0.105 on April 3 when Musk changed the Twitter logo from a bird to a Shiba Inu dog. The change increased chatter around DOGE, triggering a pattern seen in January 2022, when Musk said, “Tesla merch buyable with Dogecoin,” and in November 2022, when he hinted at DOGE becoming the official cryptocurrency of Twitter.

However, Dogecoin price has flashed red for two consecutive days, April 4th and 5th, suggesting the beginning of a downtrend. Presumably, this is the aftermath of exhausted buyer momentum. A glance at the Relative Strength Index (RSI) shows that DOGE was overbought on April 3, explaining the ongoing pullback, evidenced by the RSI tipping downwards after a rejection at 71. Notably, bears tend to take advantage of the laxity whenever buying pressure eases.

If bearish momentum increases, the Dogecoin price could plunge toward the 200-day Exponential Moving Average (EMA) at $0.082. Below this level, DOGE could tag the support confluence between the horizontal line and the 100-day EMA at $0.080. A daily candlestick close below the latter would solidify the downtrend.

If profit-taking continues below $0.080, the Dogecoin price could lose the ground covered in the recent rally by tagging the 50-day EMA at $0.079. In the dire case, the dog-themed coin could plunge lower to reach the $0.064 swing low before a potential bounce. The move would denote a 30% decline from the current price of $0.093.

DOGE/USDT 1-day chart

Conversely, if buying pressure increases, possibly because of the alt season narrative, the Dogecoin price could rise, shattering the immediate resistance level at $0.097. A decisive flip of this roadblock into support would invalidate the bearish thesis, given that this level has been a multi-month barricade to prevent more upside for DOGE investors.

In highly bullish cases, the Dogecoin price could extend higher to confront the $0.111 resistance level, reclaiming the December 5 high.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.