- Dogecoin price could fall even lower as key indicator is about to present a sell signal.

- DOGE bulls face a lot of resistance to the upside while support remains weak.

- The interest in the digital asset has been slowly fading away.

Dogecoin price suffered a major 52% correction from its all-time high of $0.0875. On February 25, the SEC announced that it will open investigations into Tesla’s Chief Executive Elon Musk because of his tweets about DogeCoin. Musk has said in the past that he does not respect the Securities Exchange Commission.

Dogecoin price on the verge of a collapse

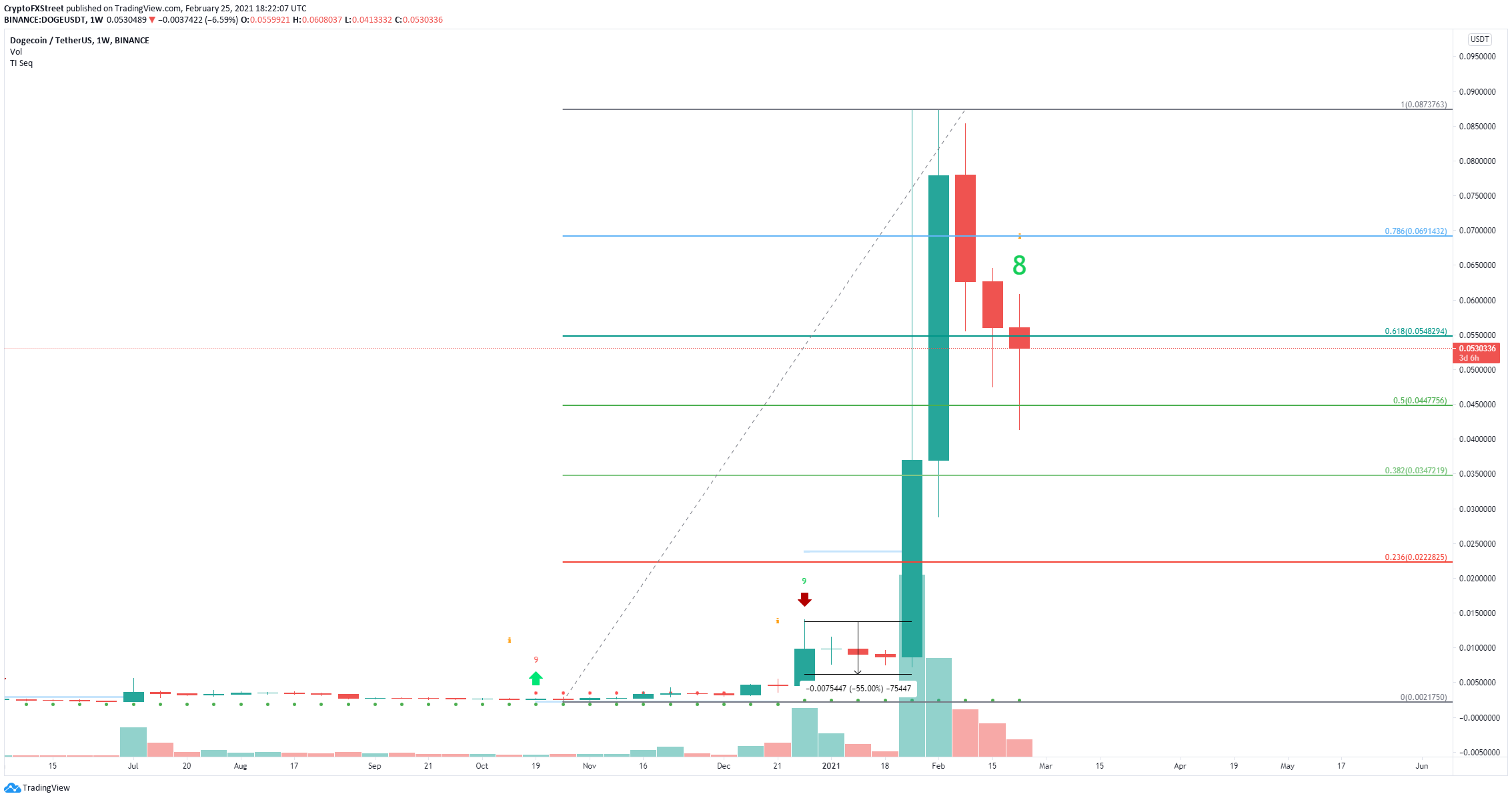

On the weekly chart, the TD Sequential indicator has presented a green ‘8’ candlestick which is usually transformed into a sell signal. The last signal presented on December 2020 had a ton of bearish continuation driving Dogecoin price down by 55%.

DOGE/USD weekly chart

The confirmation of the upcoming sell signal could push Dogecoin price towards $0.044 again, at the 50% Fibonacci Retracement level. Below this point, DOGE has more support at $0.034 which is the 38.2% level, and eventually at $0.022 the 23.6% level.

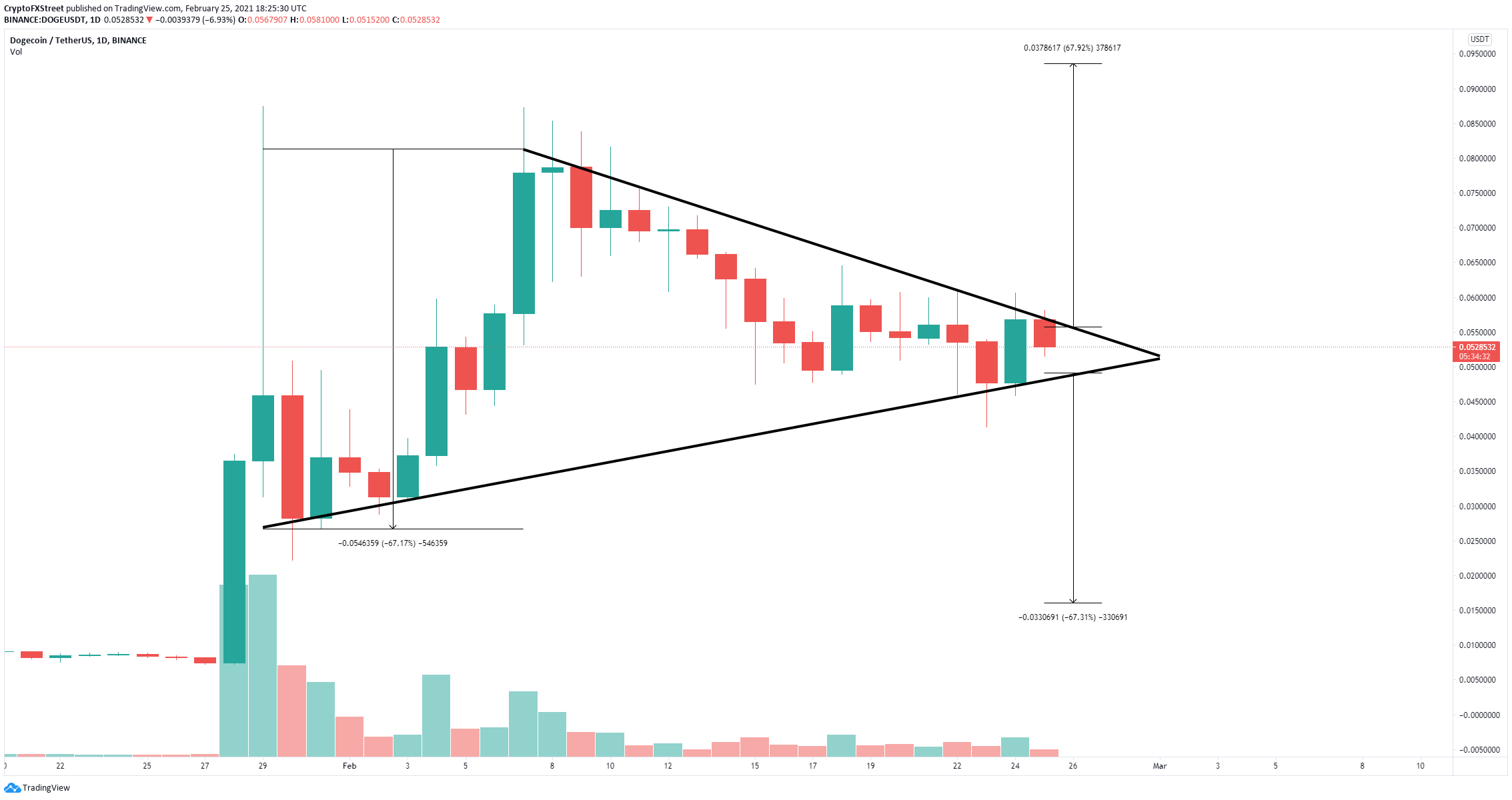

DOGE/USD daily chart

On the daily chart, Dogecoin price has formed a symmetrical triangle pattern. A breakdown below the critical support level at $0.049 will push Dogecoin price towards a low of $0.016 in the long-term.

However, to invalidate the potential bearish outlook, DOGE bulls need to crack the resistance barrier established at $0.057. A breakout above this point should send Dogecoin price to new all-time highs at $0.093.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Crypto trading volume declines further, signaling waning trader enthusiasm and market momentum

The total crypto market capitalization lost $1.01 trillion since January, while Santiment data shows that crypto-wide trading volume has dropped since February’s peak. For a healthier and more sustainable recovery, bulls look for rising prices accompanied by increasing volumes; until trading activity picks up, cautious market sentiment is likely to prevail.

BNB price tops $570 as Binance receives $2 billion investment from Dubai

BNB price rose as high as $574 on Thursday as markets reacted to news that Binance received major investments from an Abu Dhabi based firm. Derivative markets analysis shows how BNB traders are repositioning amid the latest swings in market sentiment.

PEPE price outperforming DOGE and SHIB as US CPI boosts Crypto markets

PEPE price crossed the $0.00007 for the first time this week as markets reacted to positive macro market signals. Early insights show crypto traders are displaying high risk appetite at the onset of the current market rally. Could this sustain PEPE price uptrend along with the rest of the memecoin market.

XRP records slight gains as Ripple's battle with SEC nears end

Ripple's XRP recorded a 2% gain on Wednesday following rumors of the company nearing an agreement with the Securities & Exchange Commission (SEC) to end their four-year legal battle.

Bitcoin: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

Bitcoin price extends its decline on Friday, falling over 5% so far this week. BTC uncertainty and volatility spikes liquidated $1.67 billion as the first-ever White House Crypto Summit takes place on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.