Dogecoin Price Forecast: DOGE squeezes before resuming the uptrend

- Dogecoin price stabilizes after the harsh scourge of May 19.

- DOGE bullish rally has not come to an end and could retest the all-time high at $0.74.

- The Bollinger bands on the 12-hour chart suggest an entry price DOGE at $0.34

Dogecoin price is preparing to continue its bullish rally after the extreme volatility experienced in the last few days.

Dogecoin price to retest all-time highs

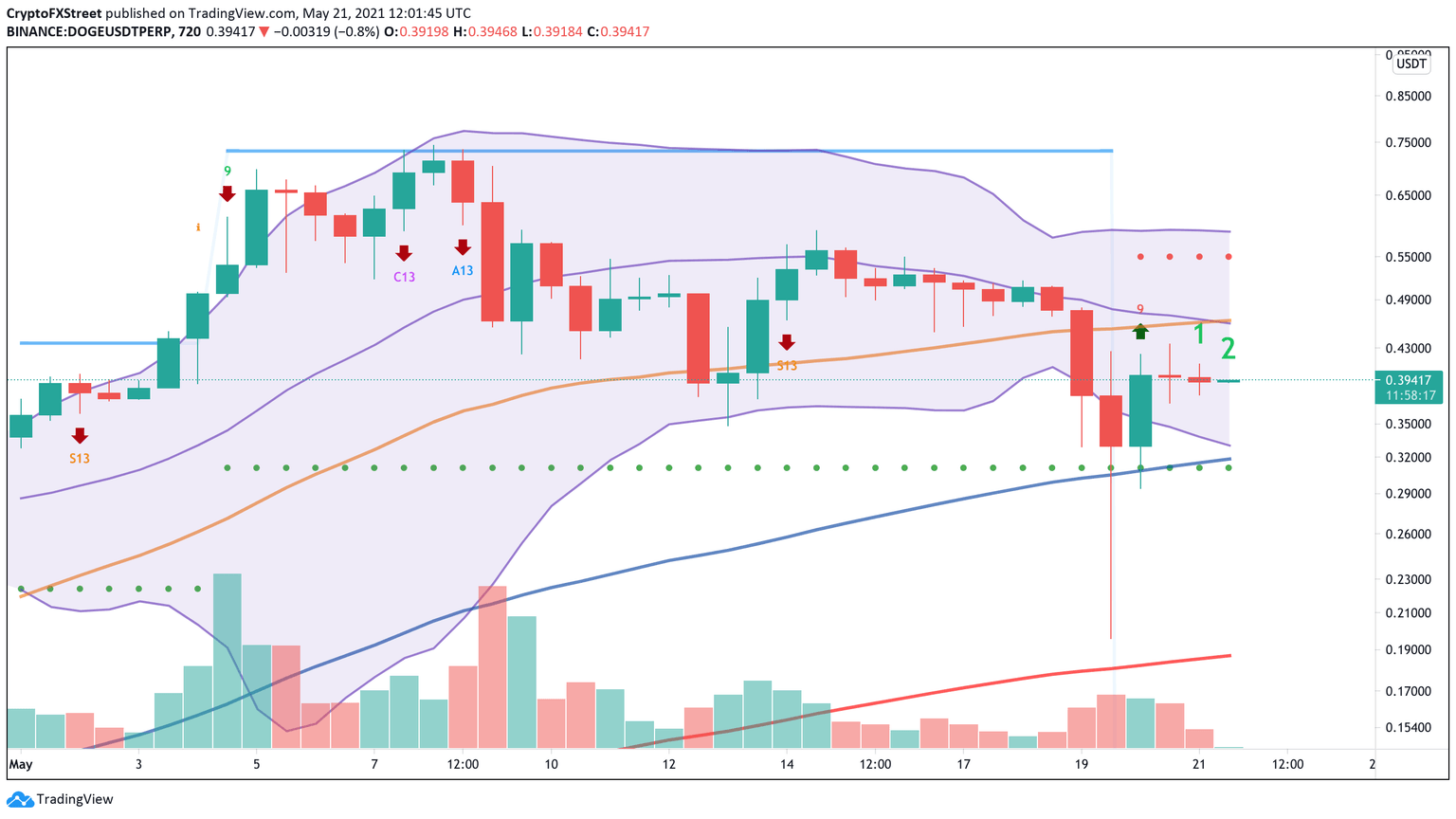

Dogecoin price action forced the Bollinger bands on the 12-hour chart to squeeze for over a week. Such behavior usually occurs when prices endure long stagnation periods that are succeeded by high volatility. Therefore, the downswing on May 19 when DOGE went from $0.50 to $0.21 seems to have been forecasted by this technical indicator.

The Bollinger bands also help identify overbought and oversold market conditions. Dogecoin price recently cut through the lower band and the 100 twelve-hour moving average contained the fall, which suggests a potential buying opportunity.

The bullish scenario is reinforced by the Tom DeMark (TD) Sequential indicator as it presented a buy signal in the form of a red nine candlestick within the same time frame.

A spike in bullish momentum that allows Dogecoin price to break through the middle band and the 50 twelve-hour moving average at $0.46 could be significant enough to push it to the $0.59 resistance level.

Turning this critical barrier as support will then create the condition for DOGE to retest the all-time high of $0.74.

DOGE/USDt 12-hour chart

Regardless of the bullish outlook, Dogecoin price must hold above the 100 twelve-hour moving average at $0.31. Losing this crucial support level could leave the bears in control, sending DOGE to the 200 twelve-hour moving average at $0.18.

Author

FXStreet Team

FXStreet