Dogecoin Price Forecast: DOGE is on the verge of a colossal explosion if any of these two levels break

- After one of the biggest cryptocurrency pumps in history, Dogecoin plummeted down by 70%.

- The digital asset has been trading sideways in a tightening range which is about to burst.

- There are two key levels to watch for a massive breakout or breakdown.

Dogecoin’s volatility has dropped significantly over the past 48 hours and the digital asset has been trading inside a tightening range which is on the verge of a massive explosion within the next 24 hours.

Dogecoin price can jump or die within 24 hours

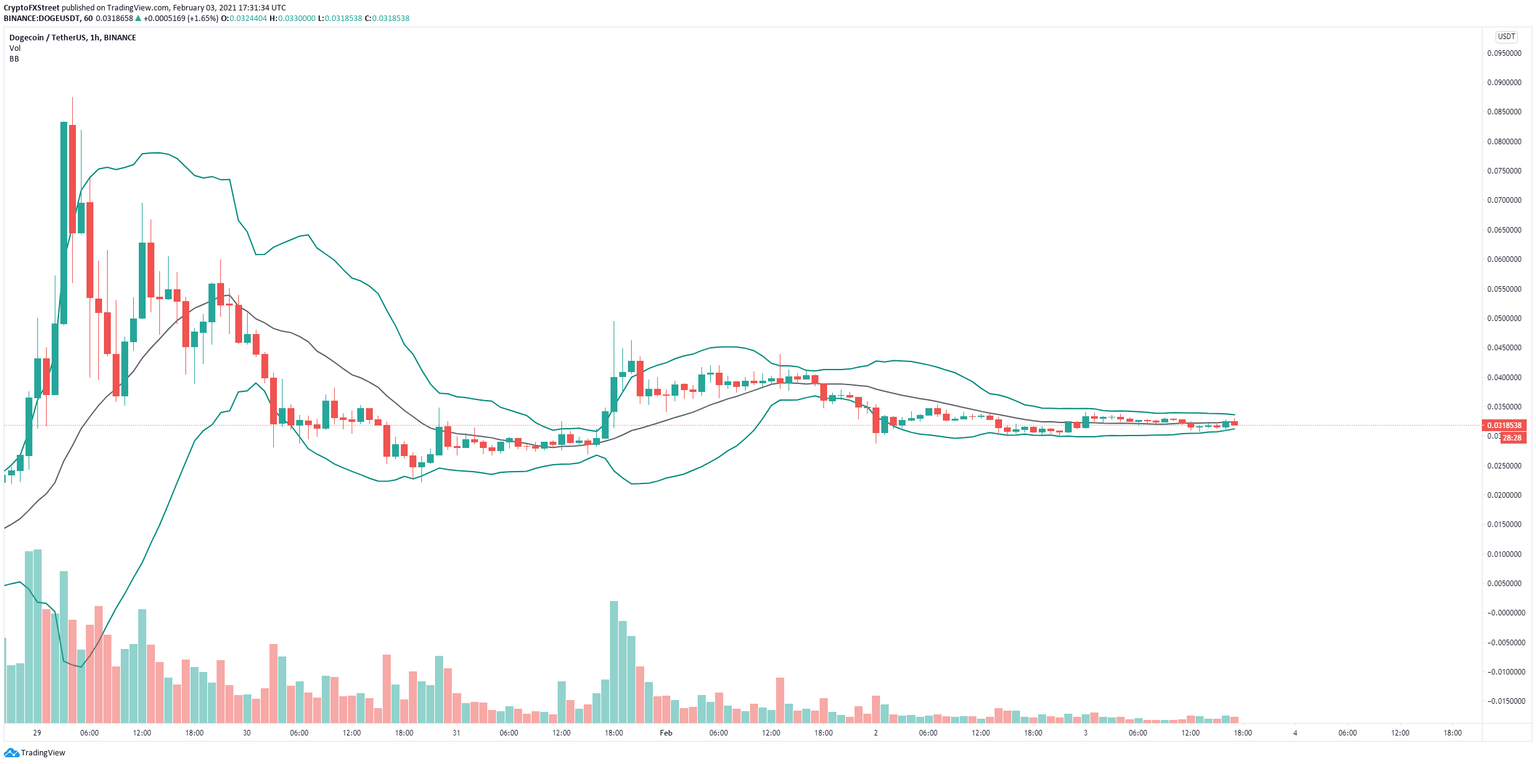

On the 1-hour chart the Bollinger Bands have squeezed significantly and have formed an extremely tight range between $0.0312 and $0.0334. These are the two key levels that investors need to watch out for.

DOGE/USD 1-hour chart

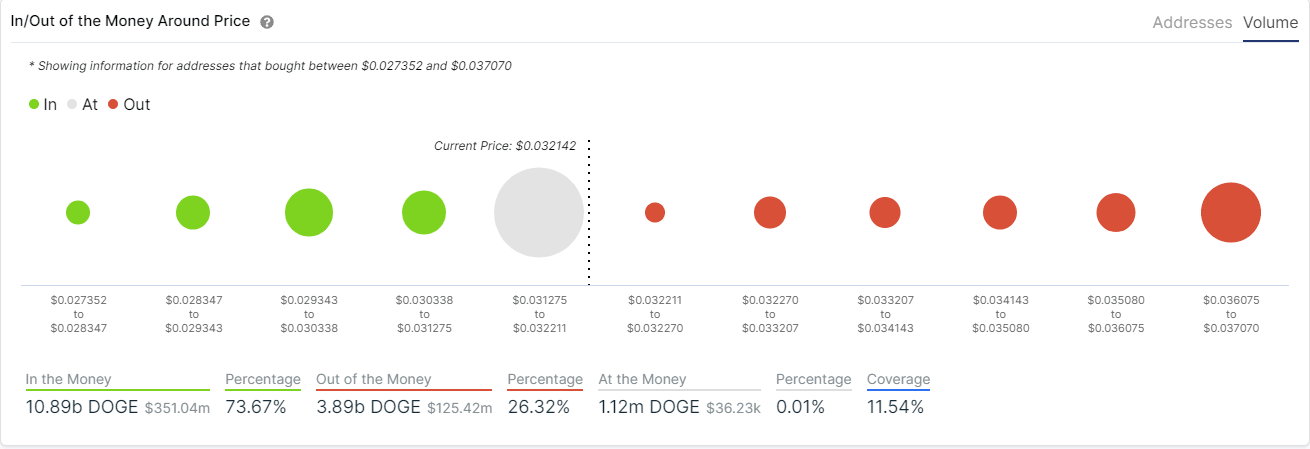

The In/Out of the Money Around Price (IOMAP) chart seems to give the upper hand to the bulls as it shows very weak resistance above $0.032. A breakout above $0.0334 can quickly push Dogecoin price towards $0.037, which is the next most significant resistance level according to the IOMAP model.

DOGE IOMAP chart

However, the IOMAP chart also shows that only one crucial support area is there for the bulls between $0.031 and $0.032 which coincides with the lower Bollinger Band. Losing this massive support point with 8.34 billion DOGE in volume will push the digital asset down to $0.027.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.