Dogecoin Price Forecast: DOGE approaches inflection point

- Dogecoin price recovery is facing a momentary pause as it approaches the resistance level at $0.40.

- A decisive close above this barrier signals the start of an uptrend.

- Transactional data shows that the upward trajectory will face resistance from underwater investors.

Dogecoin price is showing signs of recovery, but the immediate resistance level might momentarily pause the upswing. A swift break above this barrier will allow DOGE a chance to retest a major demand level that was flipped into supply after the recent flash crash on Wednesday.

Dogecoin price tries to surface with bulls’ backing

Dogecoin price has recovered roughly 76% from its lowest point on Wednesday at $0.211. This quick upswing shows that interested buyers are scooping up the dips. However, DOGE is currently having trouble surging past the resistance level at $0.40.

A decisive close above this barrier will allow the buyers to catapult DOGE upward by 15% to the supply zone that ranges from $0.467 to $0.506. If the bullish momentum pushes Dogecoin price above this resistance ceiling, the meme-themed cryptocurrency would have undone its crash and risen to its pre-crash levels.

Moreover, such a move would also convert the said supply area into a firm foothold that would allow the buyers to recuperate and prime DOGE for its upswing to $0.571.

DOGE/USDT 4-hour chart

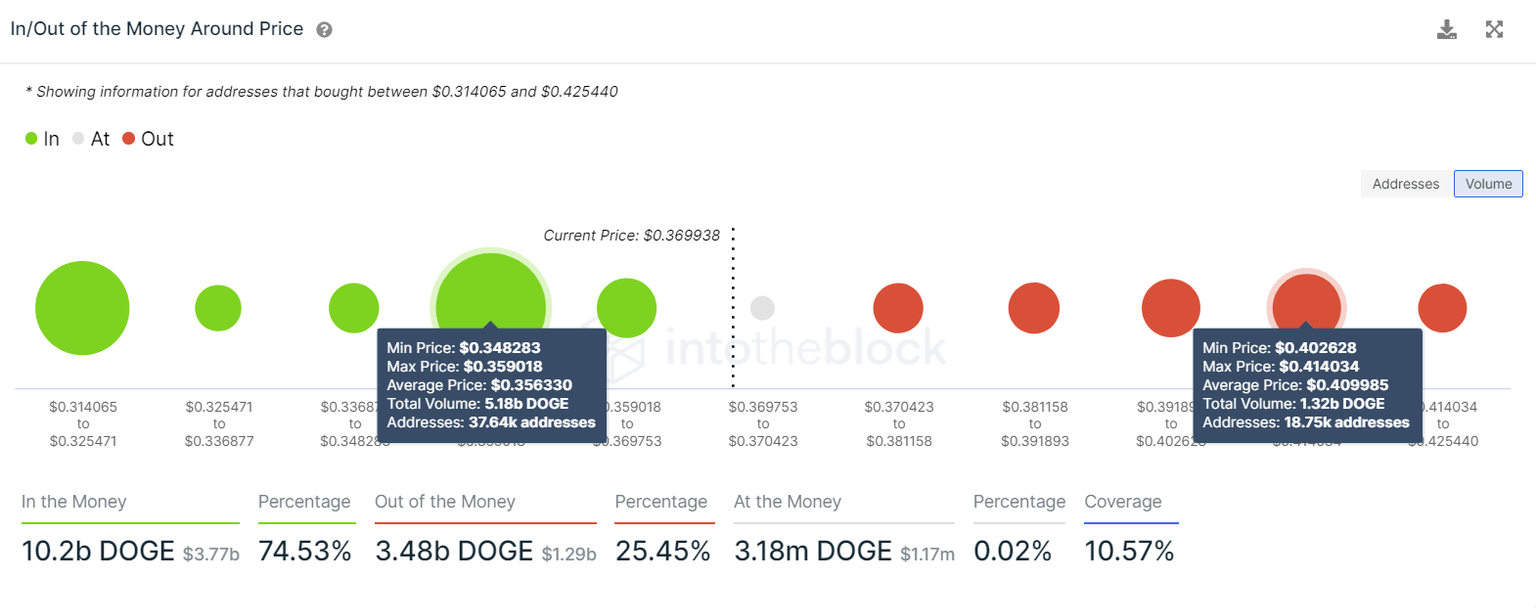

Supporting this upward move for Dogecoin price in the near future is IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, which reveals stable support levels below the current Dogecoin price.

Roughly 37,600 addresses that previously purchased $5.18 billion DOGE at an average price of $0.356 might add to their holdings if Dogecoin price drops due to selling pressure.

DOGE IOMAP chart

While the upswing narrative is straightforward, investors should wait for a confirmation of the upswing, which will arrive after a decisive 4-hour candlestick close above $0.40. However, a failure to slice this level will push DOGE lower.

If the selling pressure manages to shatter the support level at $0.328, it will put the investors that purchased 5.18 billion DOGE at an average price of $0.356 “Out of the Money.” If these newly ‘underwater’ investors begin to sell, it would add more bearish momentum, pushing Dogecoin price lower by 12% to $0.288 support.

A breakdown of this level would invalidate the bullish thesis and kick-start a 15% sell-off to $0.245.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.