- Dogecoin price has been shaping a complex top with support holding for the last several days.

- DOGE trades below the anchored VWAP, reinforcing the bearish turn in the outlook.

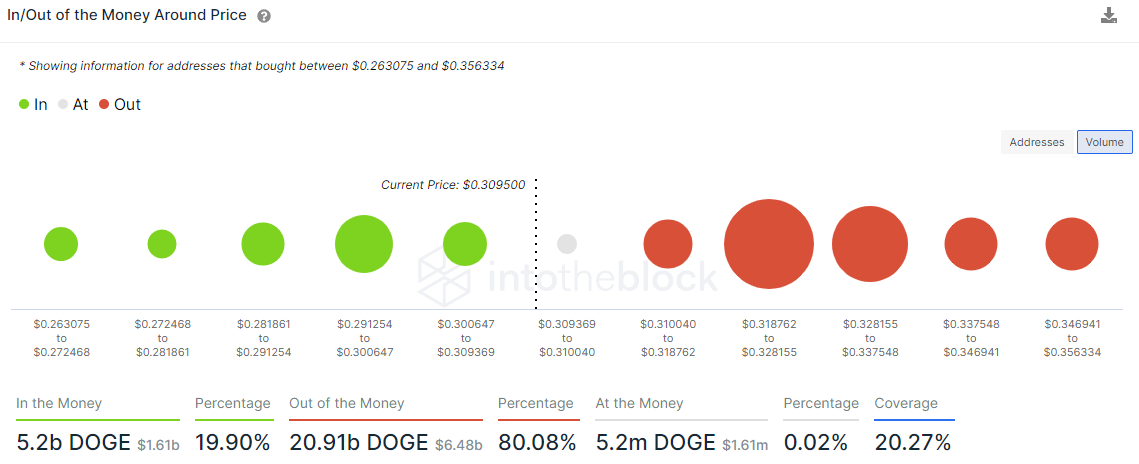

- IntoTheBlock IOMAP data clearly illustrates significant resistance between $0.32 and $0.34.

Dogecoin price was not captivated by the Bitcoin spike of 30% since June 8, opting for consolidation above a short-term support level that will define the future of DOGE. A failure to maintain the support increases the probability that the meme token tests the May 19 low of $0.195.

Dogecoin price has no room for failures

Despite the impressive Bitcoin breach of the psychologically important $40,000, Dogecoin price has not leveraged the BTC rally for a sizeable rally. It is a disappointing response to the most important cryptocurrency event since the May 23 low. Such a withdrawal suggests that DOGE searches for a different catalyst or is more likely swayed by a bearish objective.

Dogecoin price has suggested many potential patterns since the May 19 crash, but none has carried the staying power to reach completion. Today, Dogecoin price illustrates a complex topping formation extending back to May 23, with a clear support line that DOGE is currently holding. The level marks a line in the sand for the altcoin and is the most important barrier to a test of $0.195.

A daily close below the June 13 low of $0.287 will free Dogecoin price to initiate the decline to the May 19 low. The May 23 low of $0.246 will be notable support, but the downside momentum accumulated in the complex topping process should best it.

After the May 19 low, Dogecoin price has a clear path to $0.195, representing a 36% decline from the support level. If the slide is within the context of a breakdown in the cryptocurrency complex, DOGE may target the 200-day simple moving average (SMA) at $0.143.

DOGE/USD daily chart

To shake up the bearish outlook, Dogecoin price will need a daily close above the anchored value-weighted average price (anchored VWAP) at $0.353. DOGE will still have overcome the 50-day SMA at $0.403 and the 2021 rising trend line at $0.426 before a credible bullish outlook can gain traction.

According to the current IntoTheBlock In/Out of the Money Around Price (IOMAP) data, Dogecoin price is suffocated by resistance (out of the money addresses) between $0.318 and $0.337, where 196.42k addresses hold 15.36 billion DOGE.

The range reveals a challenging journey for Dogecoin to defeat the anchored VWAP at $0.353.

DOGE IOMAP - IntoTheBlock

Conversely, the IOMAP shows no support (in the money addresses) down to $0.263, warning of a bearish outlook in the short term.

In the following video, FXStreet's analysts discuss the outlook for DOGE price and how Elon Musk might be the only one who can save DOGE from a crash.

Please follow the link for more timely cryptocurrency market intelligence.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.